American Nvidia – world-leading manufacturer of graphics cards and processors for artificial intelligence (AI) and machine learning – has, with a five-year streak of reports where the company has exceeded expectations, created a situation where the market now expects the company to surpass all forecasts with ease. Moreover, the company is also expected to paint a bright picture of future margins and demand.

Negative reaction in futures trading

This contributes to the initially negative reaction in futures trading after the extremely strong Nvidia report for the third quarter of the year, which came after Wall Street closed trading on Wednesday. The assessment was more positive half a day later.

Nvidia – which during the autumn pushed iPhone manufacturer Apple from the throne as the world's highest-valued listed company – warns in connection with the report of continued challenges regarding Blackwell, the next generation AI chip, which begins delivery before the turn of the year.

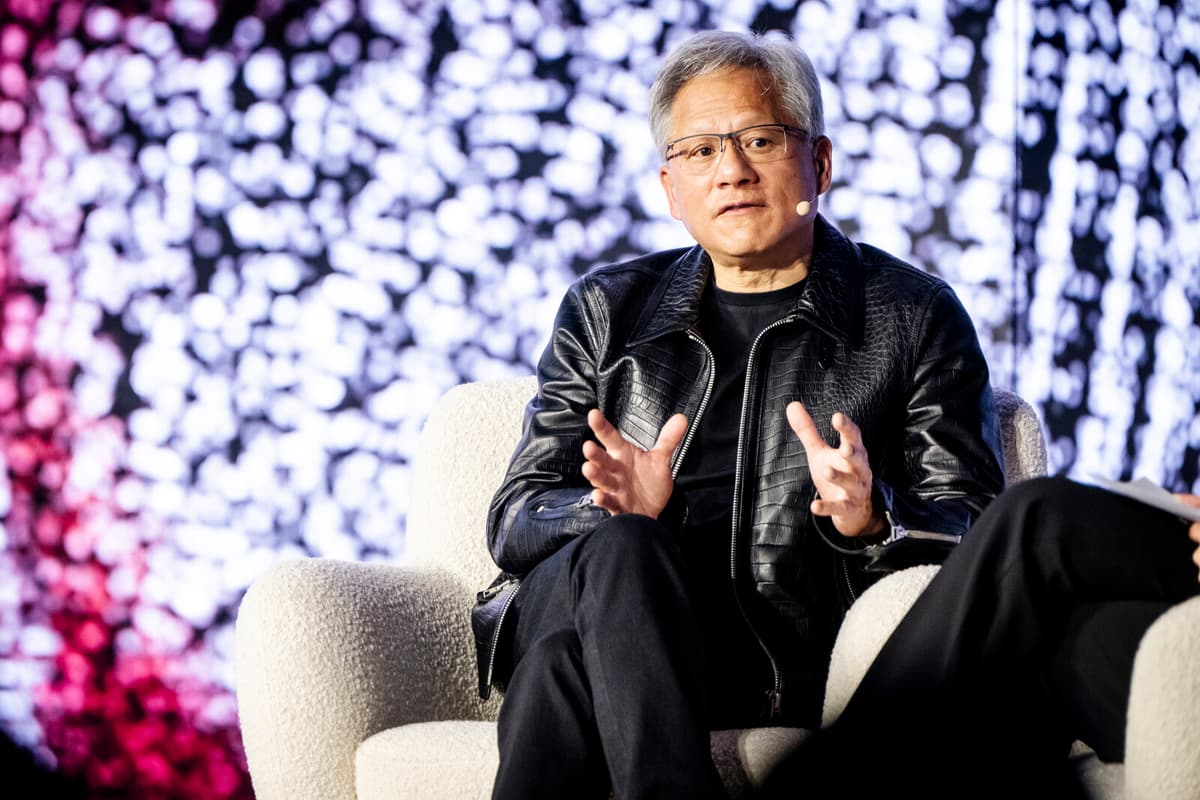

Blackwell production is rolling out as planned, according to founder and CEO Jensen Huang. And he describes demand as "very strong", but adds that high production and technology costs will weigh on Nvidia's margins and that Nvidia, due to bottlenecks in the supply chain, will not be able to produce everything that is demanded for several quarters ahead.

Increased dependence on individual tech giants

Another factor that worries some investors is that the report shows how Nvidia's dependence on sales of technology to data centers and cloud services to a few individual tech giants, primarily Microsoft and Amazon, is increasing. Many are calling for a broadening of the customer base.

The 2 percent increase in Nvidia's share price is on top of a price increase of almost 200 percent for the share so far this year.

Chip manufacturer Nvidia's sales in the third quarter increased 94 percent to 35.1 billion dollars (corresponding to almost 390 billion kronor). And the profit of 74 cents per share in the quarter was better than expected, according to Bloomberg's compilation of forecasts.

The sales forecast for the last quarter of the year, presented in the report, of 37.5 billion dollars, was marginally higher than the average forecast among analysts of 37.1 billion. Some analysts had expected it to reach up to 41 billion.