The Swedish Central Bank has, with another lowering of the interest rate, begun to ease the austerity measures significantly. As a consequence, several banks have lowered their interest rates on mortgages.

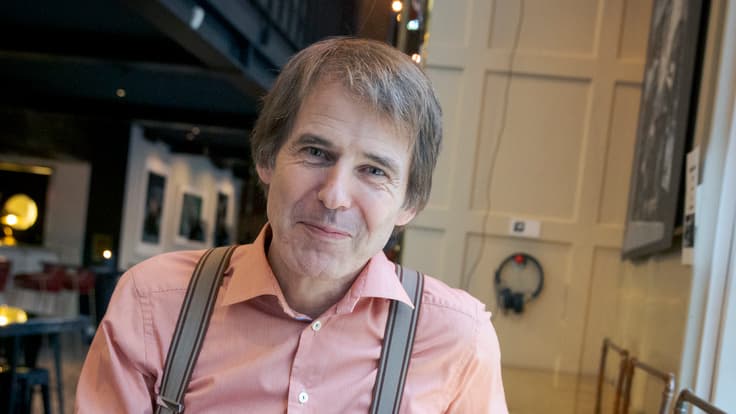

Claes Hemberg is now urging bank customers to take action – by haggling, negotiating, and more often switching banks – to get more lucrative loan offers.

It works. It's just that few do it, and that means there is no real pressure from the consumer side to influence the interest rates. The banks are quite untroubled. If everyone had haggled, it would have been much more momentum on the issue, he says.

Request Underlying Documents

The easiest way, according to Hemberg, is to call the bank and request your amortization underlying documents. It's a document that a new bank needs in connection with a bank switch.

When you ask for the amortization underlying documents, your bank will realize that you're on your way out, so they'll lower your mortgage interest rate.

Another basic tip is to call around to a few different banks and present yourself with your current salary and loan terms.

Offering a new bank to, in addition to the mortgage, also transfer accounts and savings is another move that can pay off.

No one follows up on whether you actually do it. It's more of a negotiating tactic to get the interest rate down.

"Enormous Interest Rate Savings"

The current situation points towards up to three more interest rate cuts from the Swedish Central Bank this year and more next year.

Claes Hemberg believes that many people don't realize the difference a few percentage points on a large mortgage can make.

We have an enormous interest rate savings ahead of us. The risk is that people feel comfortable, think it's nice to get more in their pocket, and are satisfied with that – when they could have gotten 10,000 kronor more just by calling a few banks, he says.

For a mortgage holder who doesn't want to negotiate, the best option may be to switch to a smaller niche bank, explains Hemberg.

The major banks' systems are built on negotiating, while, for example, SBAB's and Skandiabanken's model is built on not negotiating, and that's how people function.