Several financial policy measures, combined with low inflation and lower interest rates, give households a slightly more stable foundation to stand on now that 2024 has become 2025.

Many indications suggest that we will have a better economic situation, says Stefan Westerberg at Länsförsäkringar.

In the autumn budget, the government presented several initiatives for households, including reduced tax on wages and savings. Moreover, larger salary increases are expected in 2025 compared to 2024.

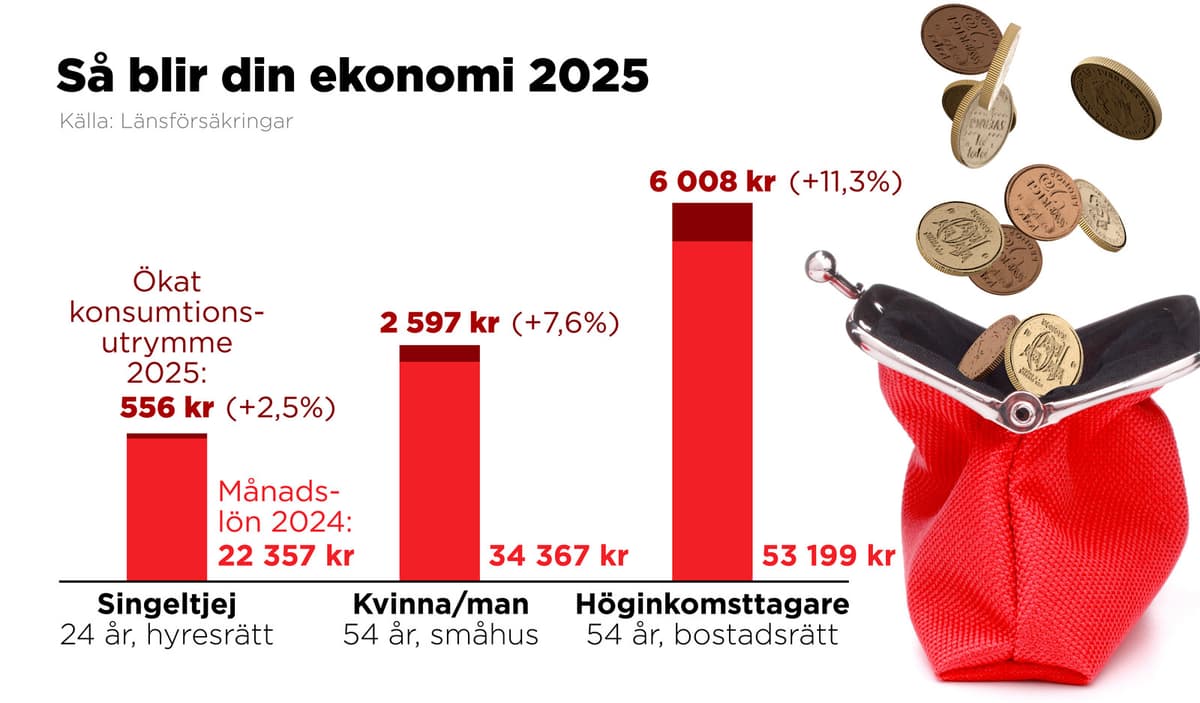

If you look at a typical family with two adults and two children, our calculations show an increase of 4,600 kronor per month, says Stefan Westerberg, private economist at Länsförsäkringar.

A clear winner

The tax cuts particularly benefit high-income earners, something the finance minister has previously stated is motivated to boost Swedish growth.

For a high-income earner in Stockholm who earns around 53,000 kronor per month, the tax cut means approximately 1,400 kronor more per month, according to Länsförsäkringar's calculations. For a single household with a monthly salary of around 34,000 kronor, it means around 375 kronor more in their pocket.

Those who earn more money will be able to take advantage of lower taxes, not just through the job tax deduction but also because the threshold for paying state income tax is increased.

However, it is monetary policy rather than fiscal policy that will provide the extra boost to households' finances in 2025.

Primarily, it is a result of lower costs, driven mainly by lower mortgage interest rates, says Westerberg.

Not beneficial for everyone

If high-income earners are the clear winners, there are households that will not benefit much from the changes, not least low-income earners and those who, for example, rent their homes.

Most people own their homes. But we have a certain part of the population that rents and there, housing costs are likely to increase as fees go up as it looks now.

For those who will have more money left over, Stefan Westerberg has a clear piece of advice: review your savings.

Insofar as you get better off, it's good if you first review your buffer and short-term savings so that you build up your economic safety nets.

For an average family with two children and two adults, the wallet is expected to be filled with around 4,600 kronor more per month in 2025. A number of things will put more money in their pockets:

* Tax cuts. The government's tax cuts are expected to give around 750 kronor more in the wallet for two working individuals with a monthly salary of around 43,000 kronor each.

* Lower household costs. Mainly, it is the lower cost of mortgage interest rates that will be noticeable in the wallet. For the average family, this means around 2,100 kronor more per month.

* Salary increases. For two parents with small children, it means around 1,750 kronor more per month. The assumption is based on real wages increasing by around 3 percent in 2025. The Swedish Central Bank expects real wage increases of around 3.5 percent per year in the coming years.

Source: Länsförsäkringar