Donald Trump's all threatening and drastic statements, shocking tariffs, and sudden decisions to pause tariffs are often dismissed as unthoughtful, dangerous, or vengeful politics. But behind "America First" – Trump's slogan – there is an agenda.

It's about a number of direct and indirect goals that Trump has reiterated or is clearly aiming for.

Negotiations

Trump often boasts about being a skilled negotiator. And it has been clear from the start that all tariff threats, tariffs, and decisions to pause tariffs are used by Trump as pressure against other countries in issues such as border controls and drug smuggling – which actually have nothing to do with trade deficits or state tariff revenues.

Eliminate trade deficits

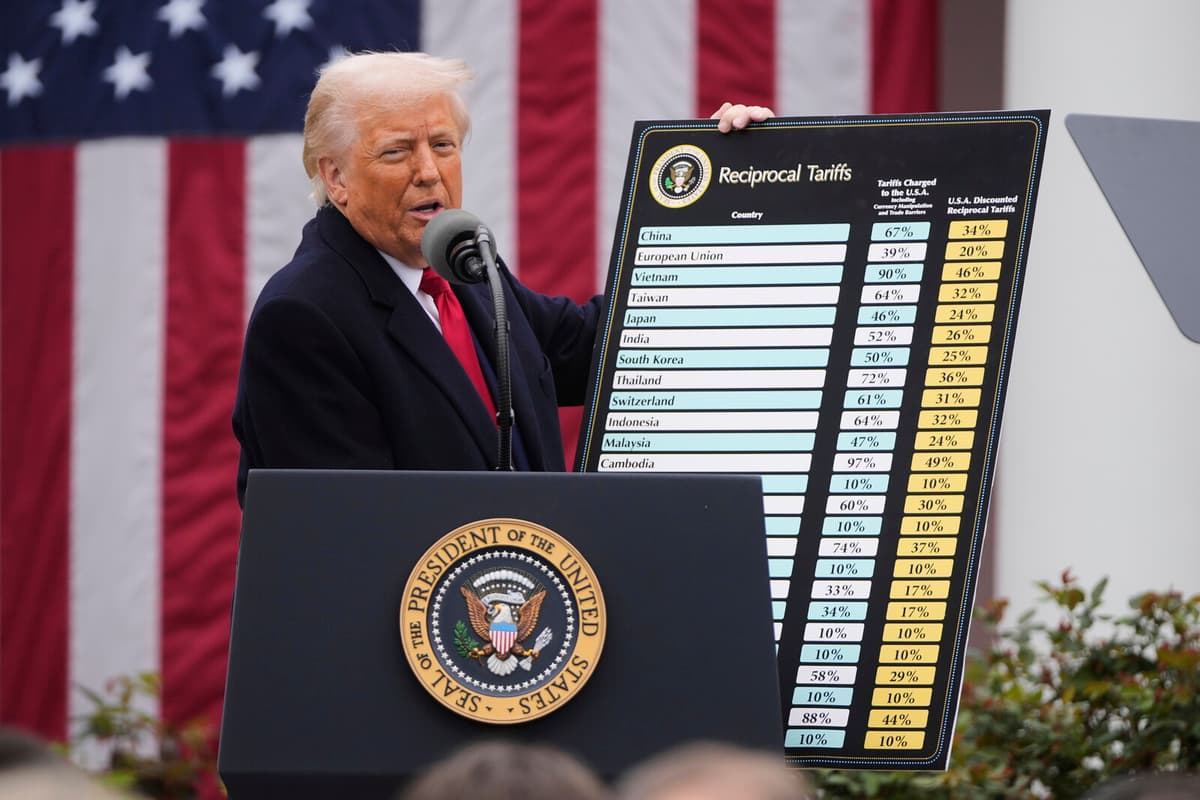

Trump describes the United States' large trade deficits with the rest of the world – significantly larger imports than exports – as unfair and wants to balance them with tariffs and agreements. This applies not least to China and neighboring countries Mexico and Canada, but also to the EU.

Strengthen supply chains in the US

Trump believes it is in the United States' national interest to build up a domestic production apparatus so that the US becomes more or less self-sufficient in critical materials and goods, such as steel, semiconductors, vehicles, and pharmaceuticals.

Pressure companies to move operations to the US

Trump wants to force companies to move production to and invest in research and development in the US, creating jobs and long-term growth, by imposing high tariffs on all imports to the US.

Lower taxes

Trump campaigned on lowering taxes in the US. Among other things, he wants to make the large reduction in corporate tax in the US (TCJA) permanent, which expires this year. But he also wants to lower other taxes and finance this with large public spending cuts and new state revenues from tariffs on goods from abroad.

Lower interest rates and a weaker dollar

The United States' growth and competitiveness can be strengthened by a weaker dollar and lower interest rates, according to Trump. And his policy has led to a fall in the dollar of over 10 percent against currencies such as the krona. There has also been a hard downward pressure on long-term American market interest rates, which affects the interest rate situation in the entire country – although it has turned upwards at the beginning of April.

Lower oil prices

The global market price of crude oil has fallen by over 25 percent since mid-January. Most of the decline is due to increased production from the oil cartel Opec, despite the uncertain situation regarding global demand in the wake of the trade war. But Trump often returns to wanting to see lower fuel prices for households and companies in the US.

Scale back US defense of "allies"

Trump wants so-called allied countries in Europe to finance their own security. This has been expressed, among other things, in threats to withdraw security guarantees to European NATO countries that do not meet NATO's defense spending targets and a drastic shift in the US's stance on the Ukraine war. Trump has also linked tariffs against EU countries to this issue.

Stock market upswings

From analysts and heavyweights on Wall Street, it is often heard that Trump sees the stock market as an important measure of the success of his policy. He is therefore expected to ultimately correct his economic policy if the reaction on the stock market and other key markets were to become too strong. An example of this was when he suddenly paused large parts of tariffs on most countries for 90 days on Wednesday.