The rise was broad among the most traded stocks in the OMXS30 index. The best performer was heat pump manufacturer Nibe, up 6.7 percent. Defense conglomerate Saab recovered after Tuesday's fall and rose 4.3 percent.

Among the losers in OMXS30 were primarily the major banks. Nordea lost the most, falling 1.9 percent.

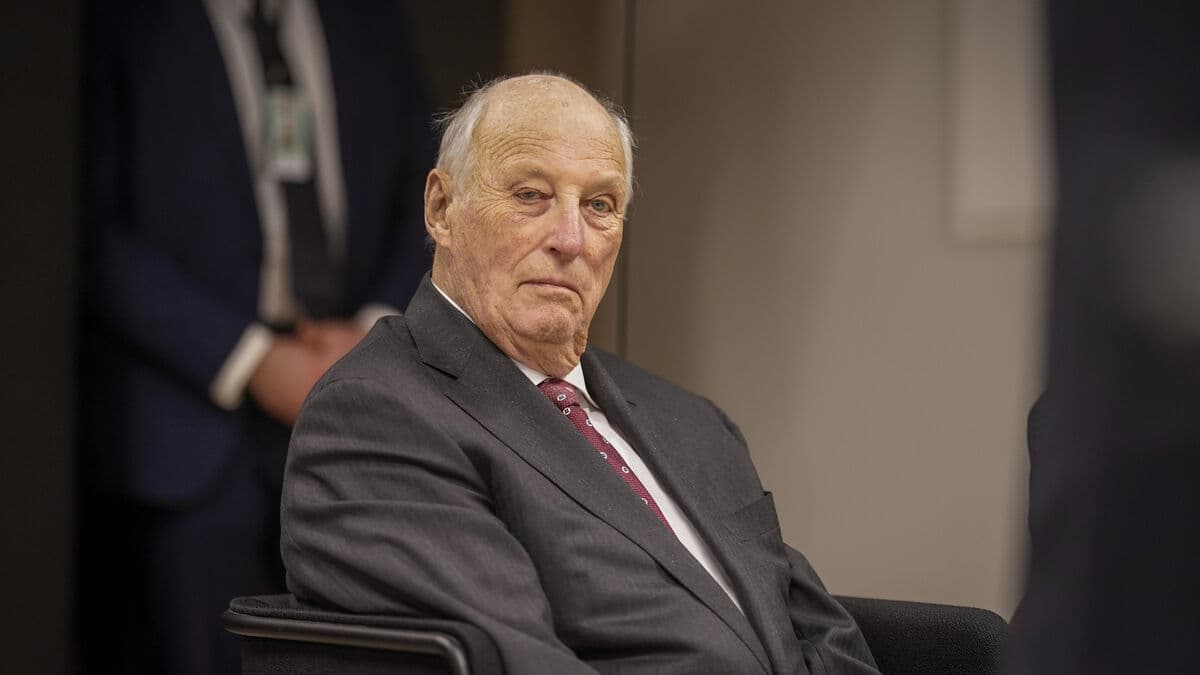

Most of the price increase was already in place before the Swedish Central Bank's interest rate decision – following a new historic record for the S&P 500 index on Wall Street on Tuesday and continued stock market gains in China and Hong Kong after stimulus measures from China's central bank. But after a press conference with Riksbank Governor Erik Thedéen, the rise got a little extra fuel.

The interest rate decision from the Swedish Central Bank followed the unusually large stimulus package from China's central bank earlier in the week and last week's unexpected double rate cut by the US Federal Reserve.

The Swedish krona – which has been a punching bag on the currency market during the inflation shock of 2022–2023 – has strengthened since the summer. One dollar cost 10.17 kronor at the close of the stock exchange, and one euro cost 11.34 kronor.

Swedish market interest rates have been pushed down in a global wave, but rose after the interest rate decision. The yield on a ten-year Swedish government bond rose 0.05 percentage points to 1.97 percent.

The leading European stock exchanges fell. Indices in Frankfurt, London, and Paris fell by about half a percent.

The OMXS index fell by 0.3 percent on Tuesday, but since the turn of the year, the index has risen 11.4 percent.