More than a quarter of a million online frauds were reported to the police authorities in the Nordic countries last year, according to a new survey led by the Norwegian Økokrim. A total of 828 million euros is estimated to have been stolen. To put this into perspective, it is more than what the Swedish state spends on paying out all child benefits in a quarter.

For criminal groups, there is a lot of money to be made in this category of crime, says Karin Berggren, head of the national fraud centre at the Swedish police.

Among the frauds are phone scammers targeting the elderly, email scammers imitating company CEOs, and fake ads trying to get people to invest in fake cryptocurrency schemes.

Want to cut off the flow

The money disappears quickly out of the country. It is complicated and time-consuming for the police to follow the money, which is why investigations are often dropped. Berggren sees a risk that the money will lead to other crimes, such as weapon purchases.

That's why we want to cut off the flow as much as possible, she says.

The police are working against the wind. "The Nordic police are lagging behind technically and do not use the information we receive for analytical purposes", the report states.

The police need to improve their automation and share information with, for example, banks and telephone operators, which may require legislative changes. Banks and police also need to share information more quickly about new methods used by fraudsters. A third measure is to put pressure on tech giants, which currently allow unmonitored ads.

Several measures

There are good examples of how fraud has been combated in the Nordic countries. In Denmark, an information campaign led to a decrease in CEO fraud, in Finland, telephone operators have made it harder for phone scammers through filters. In Iceland, banks have introduced various barriers, such as stopping Google Pay installations on mobile phones abroad, making it harder for fraudsters.

In mid-November, the Swedish police are hosting a conference for Nordic colleagues on cooperation against fraud.

Online fraud is becoming more sophisticated and is happening on a larger scale. It's getting harder to protect yourself, so we need to intensify our efforts to make it harder and prevent fraudsters from operating online using modern technology, says Karin Berggren.

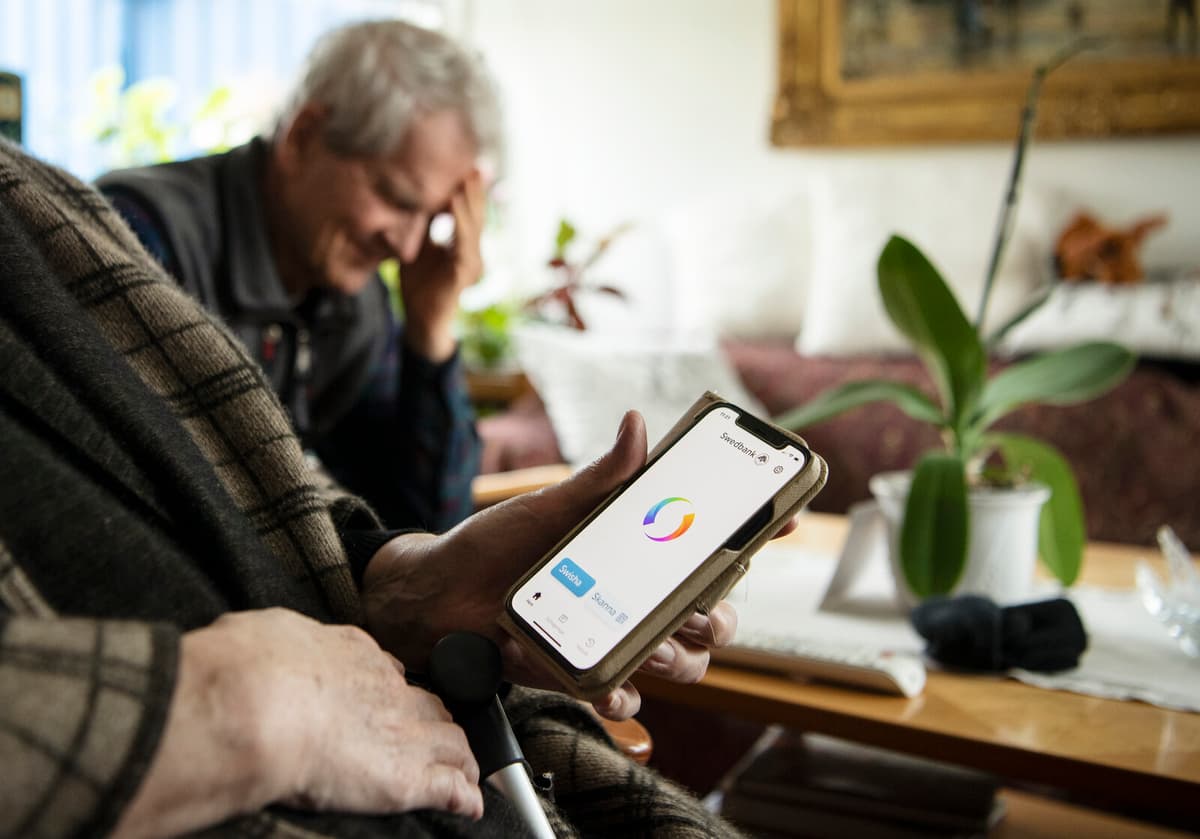

Bank fraud – Fraudsters contact often elderly victims and trick them into giving the fraudster access to their bank accounts.

Investment fraud – Victims are lured through ads to invest in fraudulent cryptocurrency trading platforms. The victims are often men and dating apps are used to lure them.

Business email compromise – Criminals target a company and pretend to be, for example, the CEO or finance manager, and trick the recipient into making quick transfers. This also includes fake invoices of various kinds.

Romance fraud – Trust is built up slowly to eventually get the victim to transfer money or provide bank details.

E-commerce fraud – Various attempts to get customers to buy goods through, for example, fake trading platforms, which are not what they claim to be or are never delivered.