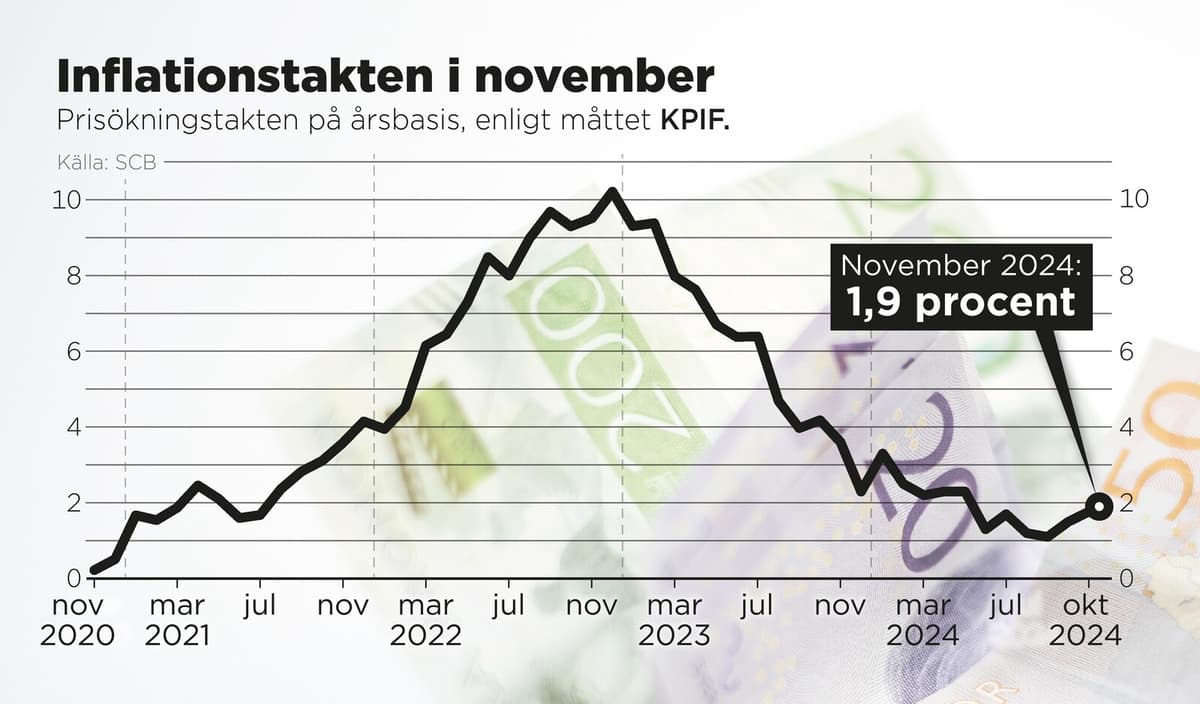

According to the KPIF measure, inflation rose clearly in November, to 1.9 percent, compared to the price increase rate of 1.5 percent in October, according to Statistics Sweden's (SCB) quick measurement.

It is precisely the KPIF measure, where the effects of mortgage rates are excluded, that the Swedish Central Bank looks at primarily ahead of the upcoming interest rate decision. The Swedish Central Bank also had a significantly lower inflation figure in connection with its forecast in September.

On December 19, the next interest rate decision will be made, but the mortgage borrowers who are now worried about getting a tough Christmas present from the Swedish Central Bank Governor Erik Thedéen in the form of a missed interest rate hike can lean back safely, according to the major banks.

The Swedish Central Bank will lower the interest rate in December anyway, says Nordea's chief analyst Torbjörn Isaksson about the higher inflation.

There are no signs that inflation will take off.

Same line

Johan Löf is on the same line, and Handelsbanken also expects an interest rate cut of 0.25 percentage points from the current 2.75 percent.

Inflation is now back at the Swedish Central Bank's inflation target (2.0 percent), so in that sense, it's good news. Then it can be perceived as revolutionary that we had an inflation rate of nearly 1 percent last summer, says he about the inflation development.

The explanation for the Swedish Central Bank's forecast miss is, according to Handelsbanken, that they did not take into account that electricity prices would return to a more normal level during the autumn.

According to Torbjörn Isaksson, the inflation uplift can also be explained by the Swedish krona's weakening, which may have lifted import prices.

Swedish households should not have to be too worried that the remaining winter half-year will involve an electricity price shock like the one experienced in previous winters.

The underlying factors are not present now, says Johan Löf, referring to how the European energy system was paralyzed by Russia's invasion of Ukraine.

Not even Finance Minister Elisabeth Svantesson (M) sees the inflation upswing as very problematic:

The fact that inflation is ticking up now does not create anxiety, but one should really keep an eye on it. We are following it naturally, but one or two upswings are not a reason for anxiety, she says at a press conference.

"The inflation rate measured in KPIF rises to 1.9 percent, which was entirely in line with expectations. Even though the Swedish Central Bank's forecasts indicated a significantly lower rate, we can expect continued interest rate cuts given that we are below the target and that the Swedish economy is in great need of further easing."

Jon Arnell, investment manager at von Euler and Partners.

"We still believe that the Swedish Central Bank will lower the repo rate by 25 points in December, to 2.50 percent. Inflation is under control, and the Swedish Central Bank likely wants to provide support to the economy since they have expressed concerns about the economic development in recent times."

Lars Kristian Feste, rate chief at Lannebo capital management.

"If we look beyond these temporary effects, the inflation pressure is still low, and the economy is still hesitant. This means that the Swedish Central Bank will continue to lower the interest rate, and we do not rule out that the repo rate reaches 1.50 percent in the spring."

Alexandra Stråberg, chief economist at Länsförsäkringar.

Inflation rose clearly in November, to 1.9 percent, according to preliminary statistics from Statistics Sweden. In October, the KPIF inflation rate – where the effects of mortgage rates are excluded – was 1.5 percent.

Analysts had on average expected an increase to 1.9 percent in November, according to a compilation of forecasts made by Bloomberg.

The CPI inflation rate remained steady at 1.6 percent, unchanged from the previous month. The underlying CPIF inflation rate, excluding energy prices, rose to 2.4 percent, from 2.1 percent in October.

Statistics Sweden will present its regular inflation figures for November on December 12, with more detailed information and definitive figures.