Inflation fell to 1.3 percent in June according to the KPIF measure. It was an unexpectedly large decline and it is good news for all households and companies pressed by interest rates.

"Lovely music" for mortgage borrowers hoping for lower interest rates, according to SBAB's chief economist Robert Boije.

The inflation pressure in June is the lowest measured by Statistics Sweden (SCB) since 2020. But it is also clearly lower than expected and a good bit below the Swedish Central Bank's target of 2 percent in KPIF inflation.

This means that everything points to the Swedish Central Bank lowering in August and it is likely that the Swedish Central Bank will also lower in September, says Nordea's chief analyst Torbjörn Isaksson in a comment.

Inflation figures are volatile and much can happen. But today's outcome strengthens the view that there will be more interest rate cuts than the Swedish Central Bank has signaled during the second half of the year, he adds.

Four cuts this year

Four cuts down to 2.75 percent in the repo rate by the end of the year, Isaksson believes it will be. The Swedish Central Bank's interest rate path indicates two-three cuts.

Robert Boije, chief economist at the state-owned mortgage institution SBAB, makes the same assessment as Isaksson and believes in four cuts.

"Today's message from SCB about inflation should be lovely music for mortgage borrowers hoping for lower interest rates ahead," he writes in a comment to TT.

When the Swedish Central Bank tightened monetary policy in 2022-2023, several unusually large hikes of the repo rate were made – adjustments of up to 1 percentage point at a single occasion – instead of usual adjustments of 0.25 percentage points.

Isaksson believes the cuts that are now expected will be normal, i.e., 0.25 percentage points each.

It is clear that if inflation continues to fall, it may become relevant, but this notation does not justify a double cut, he says.

He expects the Swedish Central Bank to continue to lower the repo rate in 2025 as well, down to 2.50 percent from today's 3.75 percent.

Can lower mortgage costs

Variable mortgage rates usually follow the repo rate up and down. If it becomes 1.25 percentage points lower mortgage rate on a mortgage of three million kronor, it lowers the interest cost by 37,500 kronor per year or 3,125 kronor per month – if you disregard the effects of interest deductions.

On the currency market, the krona loses a few öre against both the dollar and the euro after the SCB figures. Earlier in the week, when the US inflation came in unexpectedly low, it strengthened.

Swedish market interest rates are also falling as the probability of interest rate cuts from the Swedish Central Bank increases in pricing on the market.

KPIF inflation – where the effects of mortgage rates are excluded – fell to 1.3 percent, down from 2.3 percent in May, according to Statistics Sweden. A decline to 1.6 percent was expected, according to Bloomberg's compilation of forecasts from analysts.

The underlying inflation – where energy prices are excluded – also fell to 2.3 percent. This can be compared to 3.0 percent in June.

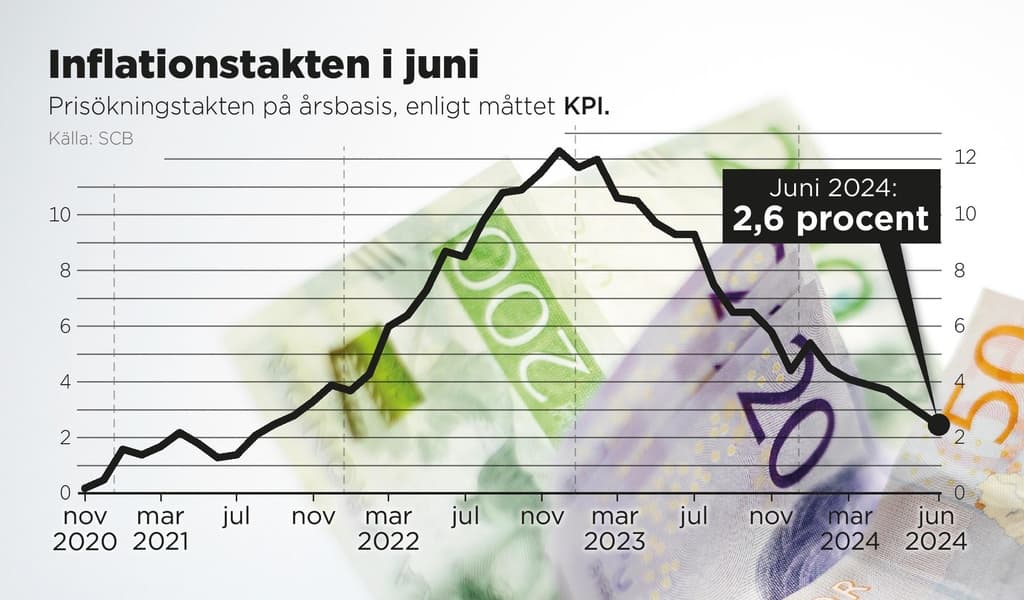

Inflation according to the KPI measure fell to 2.6 percent in June. In May, KPI inflation – i.e., the annual price increase rate – was 3.7 percent. Economists had on average expected a KPI inflation of 2.8 percent.

In monthly terms, consumer prices fell by 0.1 percent in June. Expected was an increase of 0.1 percent and in May, consumer prices rose by 0.2 percent compared to the previous month.

Source: SCB