The increasingly uncertain global situation made Saab outperform most stocks with a wide margin last year. The price has risen by over 50 percent over the past year, even more in the long term, and the Swedes were on board, at least the men, with nearly 84,000 new individual owners. Only one in four Saab shareholders is a woman.

But if women may have missed the Saab train, they as a group managed to beat the men on the Stockholm Stock Exchange overall in 2024, with a return of 5.0 percent compared to 4.3 percent for the men.

And it was the second year in a row, says Krister Modin, analyst at Euroclear Sweden, which compiles Swedish share ownership.

Among typical women's stocks, we find fashion giant H&M, forestry company Billerud, appliance manufacturer Electrolux, major bank SEB, and telecom company Ericsson, where the first-mentioned did not exactly thrill the market last year.

Investor at the top

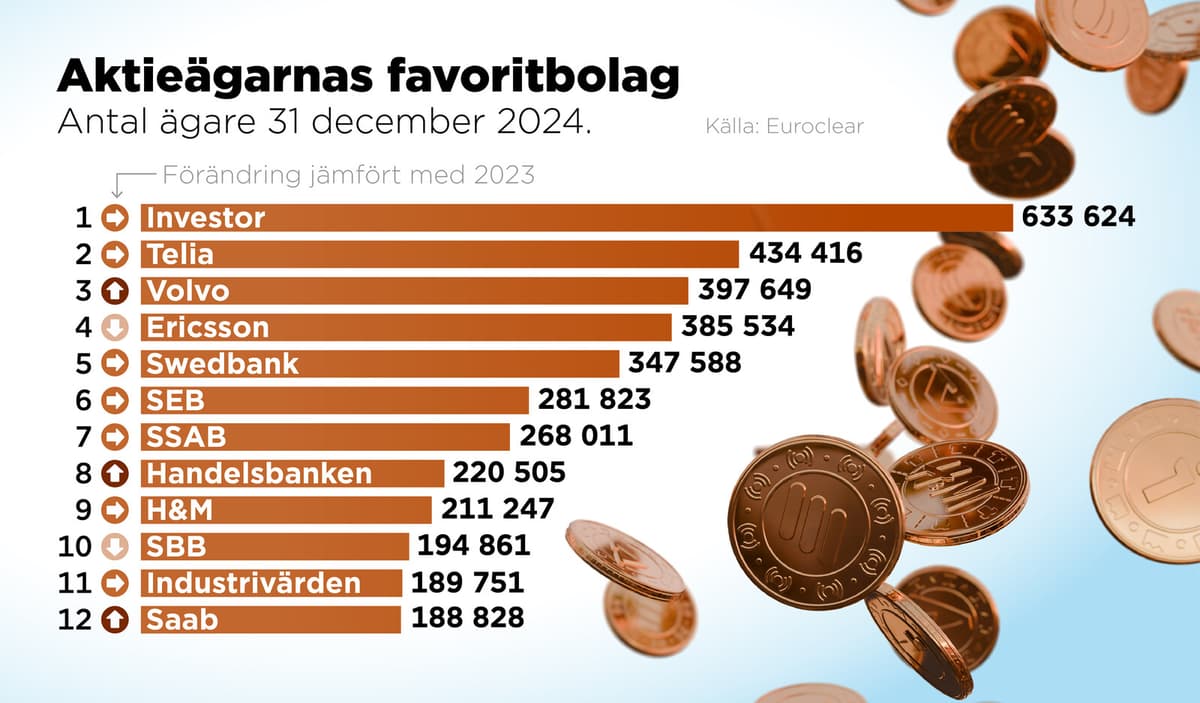

In the list of the largest number of new individual owners of Swedish shares in 2024, Saab tops the list. Then comes Investor, major shareholder in Saab, with 73,000 new owners, making the Wallenberg family's investment company the most popular stock among small investors, with 634,000 individual owners, a position the stock has held for several years now. This means that about one in four shareholders has an Investor share in their portfolio.

Next in the list of the largest folk shares comes Telia, which lives on old merits. In connection with the highly publicized IPO just after the millennium shift, the number was over a million, now the figure is down to 434,000.

From 8 to 28

It's also an explanation for why the number of folk shares has increased so sharply, from 8 in 2014 to 28 today. Many jump on the bandwagon, and then largely stay on even after the hype has subsided and the price may have gone down.

It has also become more common for small shareholders to own very small stakes, perhaps 10-50 shares. Krister Modin, analyst at Euroclear, speculates about why:

It could be that there are more savings platforms. And it's not that expensive to buy these small stakes compared to before.

The tax-favored ISK savings has "definitely" also contributed, he believes.

A folk share is defined as a company with at least 100,000 individual owners. The number of folk shares has increased from 8 to 28 over the past ten years.

This is what the list looks like:

Company, number of owners

Investor, 633,624

Telia, 434,416

Volvo, 397,649

Ericsson, 385,534

Swedbank, 347,588

SEB, 281,823

SSAB, 268,011

Handelsbanken, 220,505

H&M, 211,247

SBB, 194,861

Industrivärden, 189,751

Saab, 188,828

Nibe, 177,091

Volvo Cars, 168,400

Kinnevik, 161,282

Atlas Copco, 141,966

Sandvik, 134,934

Axfood, 130,059

Boliden, 121,985

Latour, 118,802

Source: Euroclear