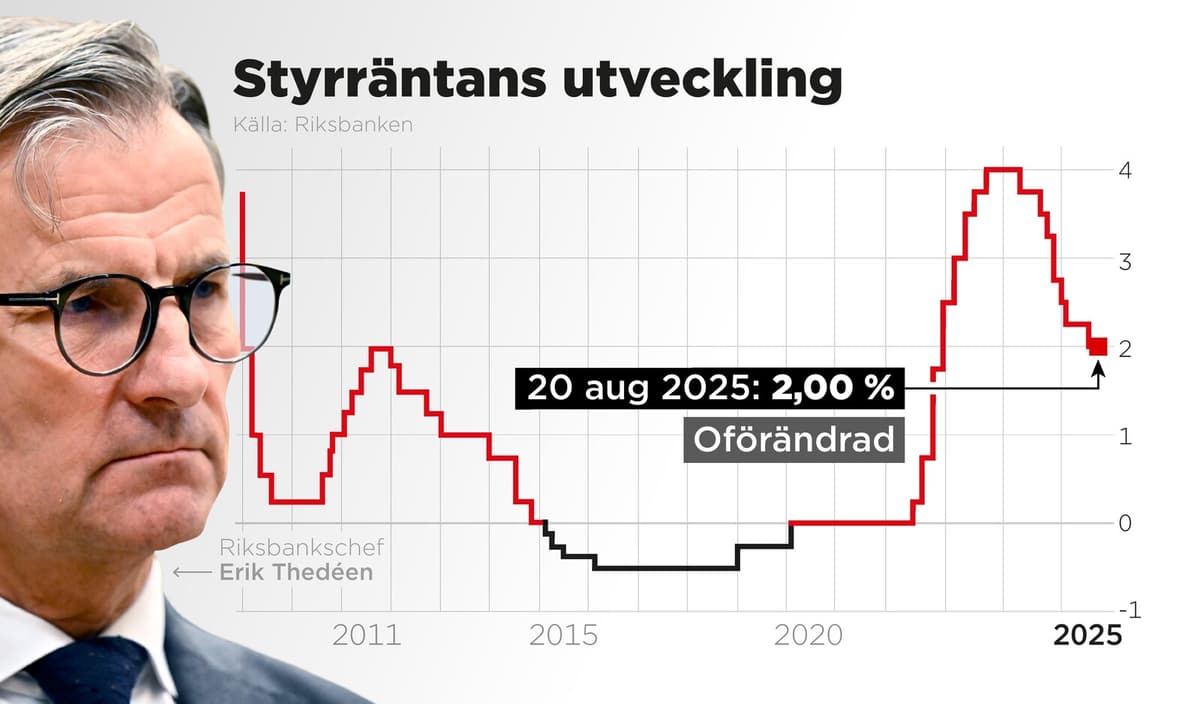

Today's interest rate decision was as expected. The repo rate will remain at the current level, 2.00 percent, announces the Swedish Central Bank.

At the same time, they stick to the same line as in the previous interest rate decision, namely that there may be a reduction later this year.

– We retain the exact wording of the communication we had in June, namely that there is a certain probability of an interest rate cut later this year, says the Governor of the Swedish Central Bank, Erik Thedéen, at a press conference.

On a question of whether it is more or less likely that there will be an interest rate cut now compared to June, Thedéen says:

The simple answer is that the probability is the same as then. However, it is far from certain that we will cut, it depends entirely on incoming data.

Interest rate cut requested

From several quarters, such as trade unions and trade and interest organizations, such as Företagarna and Svensk Handel, interest rate cuts are being requested. However, the major bank Nordea does not consider it likely this year.

It's a dilemma. On the one hand, the economy is weak, but on the other hand, inflation is too high and higher than the Swedish Central Bank thought, notes Winsth.

She also highlights the uncertainty surrounding President Donald Trump's tariff policy, which she calls a "global experiment".

We do not know how the tariffs will affect inflation and one should be humble about it.

Her colleague at SEB, interest rate and currency strategist Amanda Sundström, sees reasons why the Swedish Central Bank may actually choose to cut the repo rate as early as September.

Whether she believes it may even lead to two cuts this year:

I would say that based on the data we have available now, there is a reason to believe that there is a certain probability of another cut. I do not want to rule it out, but in our main forecast, we only have one cut.

Advertisement

Decisive factor

A decisive factor is, however, how the labor market develops, emphasizes Annika Winsth. The latest figures from the Employment Agency showed an increase from 6.8 to 7.1 percent over a year.

What is important is to look ahead at the labor market. It will have great significance for how the Swedish Central Bank will act.

What would suggest a possible cut in September, according to Winsth, is if the labor market develops worse than the Swedish Central Bank's forecast.

The labor market is okay, but the indicators do not look great.

Advertisement