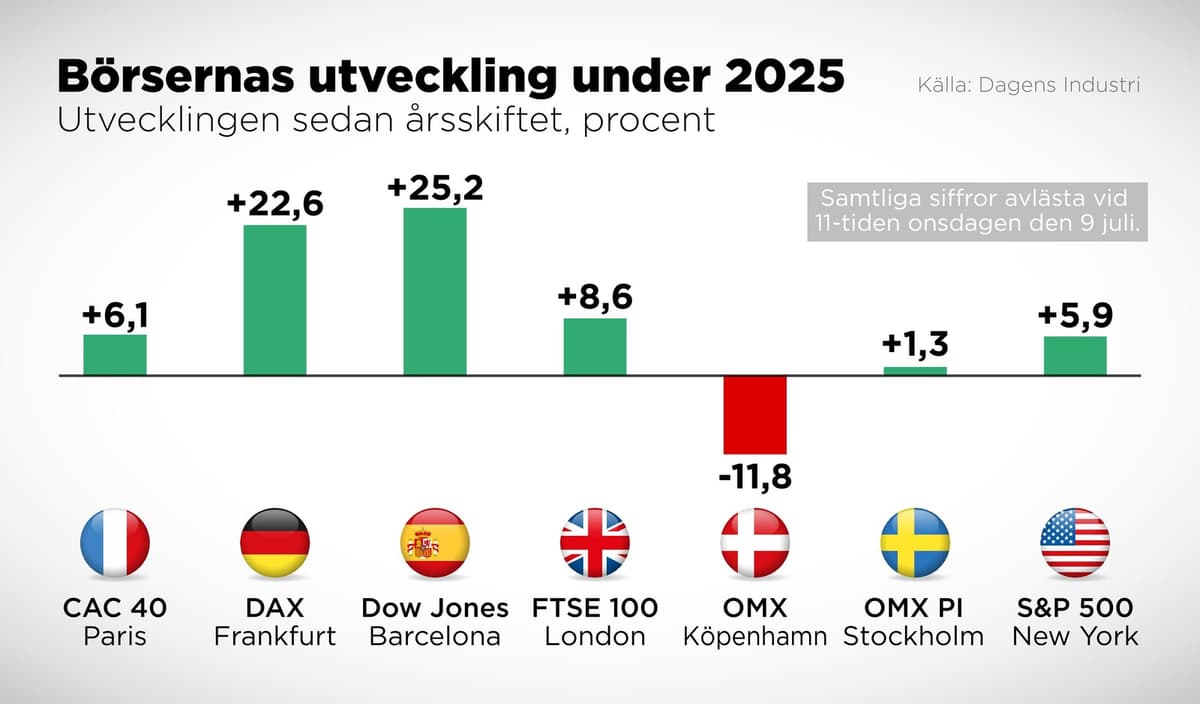

The Frankfurt stock exchange has risen by over 22 percent, the Paris stock exchange is up 6 percent and the London stock exchange by just over 8 percent. Even the Oslo stock exchange has risen and is up 14 percent and the Warsaw stock exchange has soared by as much as 33 percent. Wall Street's broad index is in turn up 5 percent this year.

One of the few stock exchanges that has performed worse than Stockholm is the Copenhagen stock exchange, where the most important stock, the pharmaceutical giant Novo Nordisk, has plummeted and dragged down the entire stock exchange by over 11 percent.

Other European stock exchanges have been favored by many investors choosing to move capital from the US to other markets, during the turmoil surrounding President Donald Trump. Maria Landeborn says that the Stockholm stock exchange is a relatively small stock market compared to the large markets in Europe.

When the money goes to Europe, it does not necessarily benefit us first and foremost, she says.

Cyclical economy

According to Jon Arnell, investment manager at von Euler & Partners, several stock exchanges have also been favored by major infrastructure and defense investments in Europe. In addition, the Swedish stock exchange is not as undervalued as the other European stock exchanges have been.

The Stockholm stock exchange is more cyclically heavy compared to European stock exchanges that have more value companies and thus lower-valued companies, says Jon Arnell.

The Stockholm stock exchange consists, among other things, of large industrial companies that are clearly affected by the global economy. A more stable global economy could give the Stockholm stock exchange new momentum.

Here and now, I think that the combination of uncertainty surrounding tariffs, the economy and the significant krona strengthening we have seen this year, is a combination that is bad for us, says Maria Landeborn.

Advertisement

Currency shocks

The fact that the krona is a small, volatile currency also increases the risks for foreign investors, and affects the Stockholm stock exchange's many export companies.

Now that the krona has strengthened, it means that the competitiveness of Swedish industrial companies decreases, but also that revenues and margins are squeezed, says Maria Landeborn.

Both Maria Landeborn and Jon Arnell believe that the Stockholm stock exchange will catch up when the global economy eases. Jon Arnell, on the other hand, sees greater investment opportunities on the continent than in Stockholm.

In terms of valuation, they are lower valued, you have profit momentum in the right direction and you have these large investments in infrastructure and defense that should drive the stock exchanges upwards.