Purchasing pressure increases in the supplier chain as Swedish industry gets back on track, shows a purchasing manager index from Swedbank and Silf.

However, it's not about any drama in the numbers that have just come out and it will take some time before the price increases are felt by consumers, believes Torbjörn Isaksson.

He reminds us that we have had a sharply falling demand for goods and a decline in global trade for over a year – a decline that makes the starting point for Swedish and global industry quite low in terms of demand. This makes the price pressure seen in the purchasing manager index for industry not worrying for him.

Isaksson no longer believes that the Riksbank will lower the interest rate in June. But he believes there will be rate cuts on the last four rate meetings of the year – down to an interest rate of 2.75% in December.

The Riksbank's rate path points towards two rate cuts in the second half of the year, down to 3.25% in December.

The purchasing manager index shows that the growth within industry this year has "gotten a bit more air under its wings lately", according to Jörgen Kennemar, responsible for the index at the large bank Swedbank.

He also sees signs of increased productivity. Employment is slightly down despite increased production. Added to this is increased optimism in the production plans of industrial companies.

Growth within industry is taking off, according to a new purchasing manager index for the sector from Swedbank and Silf, which rises to 54.0 in May from revised 51.9 in April.

The level in May is the highest in two years and close to the historical average of 54.3. An index value above 50 indicates increased activity in the sector.

The sub-index for industrial companies' production plans rose to 60.4, which is the first reading above 60 in 15 months.

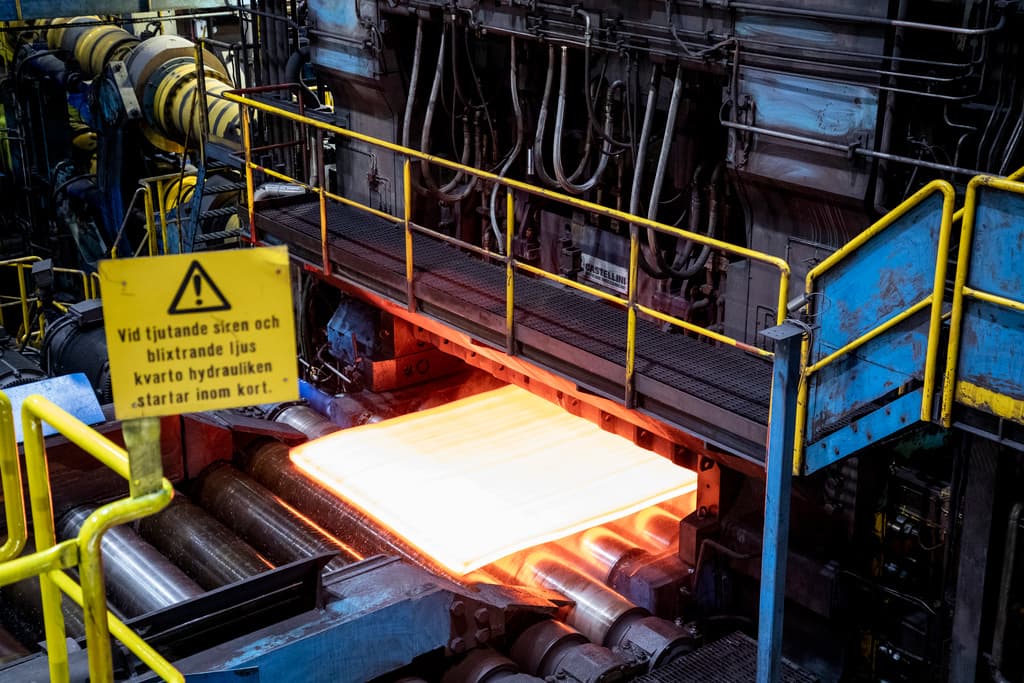

The index for suppliers' raw and intermediate goods prices rose to 55.4 in May, up from 53.4 in April. Higher global metal prices and a weak krona may have contributed to the price increase, according to Swedbank economist Jörgen Kennemar.

Source: Swedbank and Silf