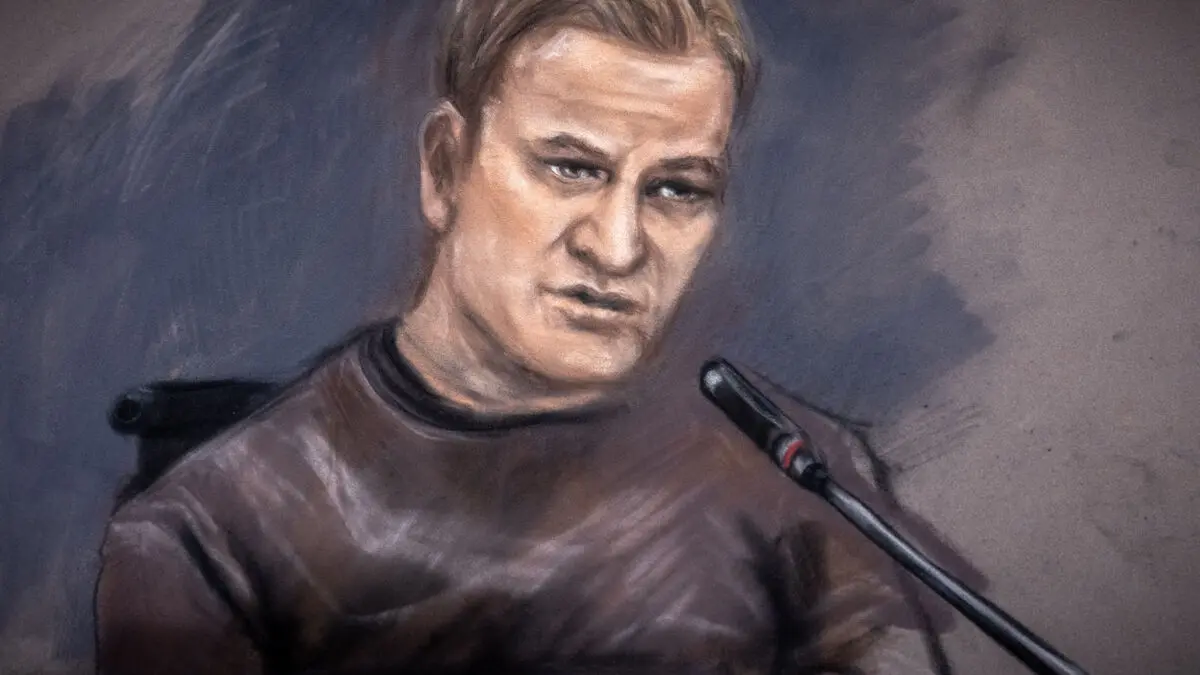

The savings economist Shoka Åhrman at SPP notes that we are living in a rapidly changing economy and world right now with sudden turns.

It's a super tough situation, but I don't think you should interpret too much and not act too quickly on what's happening.

But for those who are considering fixing the interest rate on their mortgages, the advice is to look around for the best offer.

If you want security and exactly know your housing cost going forward, including interest cost, then start checking the banks' average interest rates and negotiate, advises Shoka Åhrman and continues:

But maybe also, given the uncertainty we find ourselves in, not fix for the longest loan periods.

She emphasizes that you absolutely should not fix your mortgage if you have plans to separate, move or sell your home, in order not to risk paying the interest rate difference cost.

For households that still want to have a variable interest rate on their mortgages, Shoka Åhrman urges them to keep in mind that most households two years ago managed with higher variable interest rates than today's.

Calculate and think about how you handled when interest rates were at a slightly higher level. And how worried do you get at potential continued uncertainty, which I believe we will have going forward, affecting the variable interest rate.