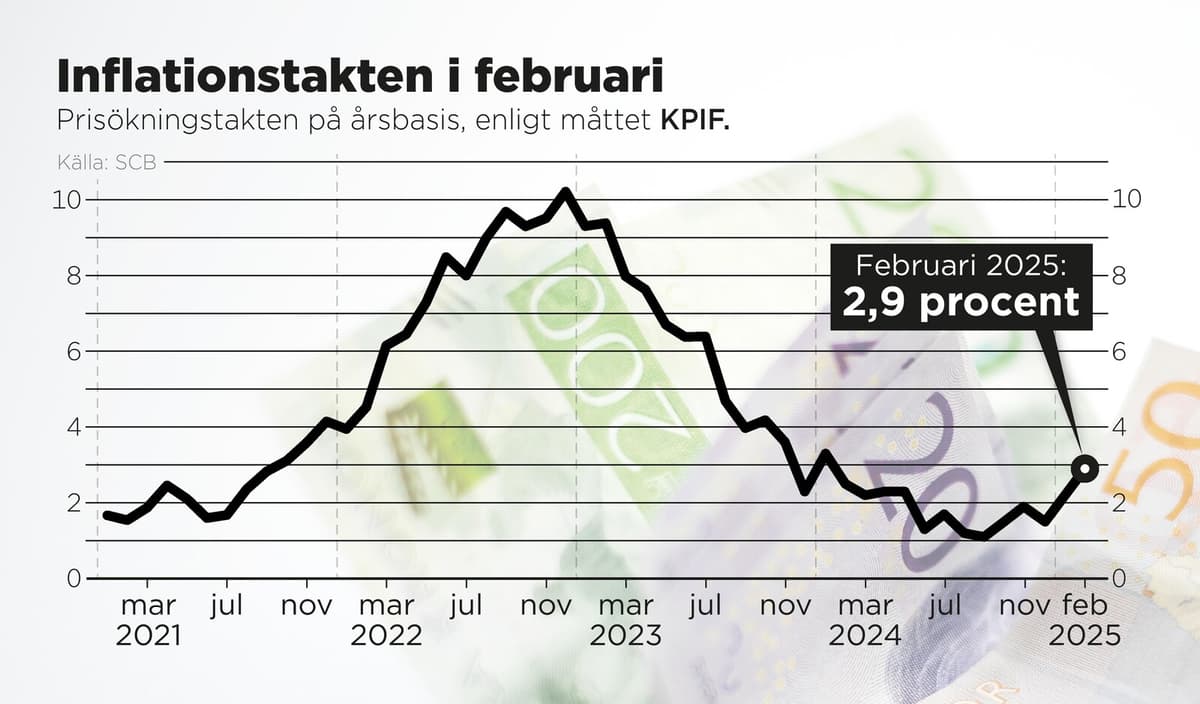

"A cold shower". This is how Länsförsäkringar's chief economist Alexandra Stråberg summarizes today's inflation figure. The Statistical Office's (SCB) calculations show an inflation rate of 2.9 percent according to the so-called KPIF measure, the highest in a year. This can be compared to last month's 2.2 percent on an annual basis, and the figure is now clearly higher than both market expectations and the Swedish Central Bank's inflation target.

This shows that last month's increase was not an exception. This will be problematic for the Swedish Central Bank, says Stråberg.

We have too high an inflation pressure for the Swedish Central Bank to feel comfortable, and this will affect in the short term, comments Swedbank's chief economist Mattias Persson.

More Uncertain

Just Swedbank is one of the players that still holds on to the fact that there will actually be another interest rate cut from the Swedish Central Bank's side in 2025. Mattias Persson now admits that after the latest months' inflation development, it is significantly more uncertain than before.

It's clearly something we'll discuss during the day, and I think it (the interest rate cut) is hanging very loose. I'm a bit worried about whether the recovery and the strong growth we've seen ahead of us will really be that strong, he asks himself.

The economists who TT has spoken to highlight a challenging situation for the Swedish Central Bank. At the same time as inflation is clearly taking off, consumption, which is intended to contribute to economic growth, has not done so to the extent predicted. If further signals of caution from the Swedish Central Bank's side were to come, it could create even more uncertainty among households, notes Mattias Persson.

I'm afraid this could make households hold back more than we had counted on.

Interest Rate Hike Instead?

A scenario that could actually be possible is that the Swedish Central Bank instead has to turn around and implement an interest rate hike, something that both Alexandra Stråberg and Johan Löf, forecasting manager at Handelsbanken, do not rule out:

This strengthens the image further that there won't be an interest rate cut in the short term. It also shows that there are risks of interest rate hikes, and it's not as one-sided as last year when it was only about how much the Swedish Central Bank would cut, says Johan Löf.

Inflation according to the KPIF measure rose to 2.9 percent in February, according to preliminary figures from the Statistical Office (SCB).

Last month, inflation, the price increase rate on an annual basis, was 2.2 percent.

Analysts had on average expected an increase to 2.7 percent, according to a compilation of forecasts made by Bloomberg.

The pure inflation measure (KPI), including interest rate changes, rose from 0.9 percent in January to 1.3 percent in February.