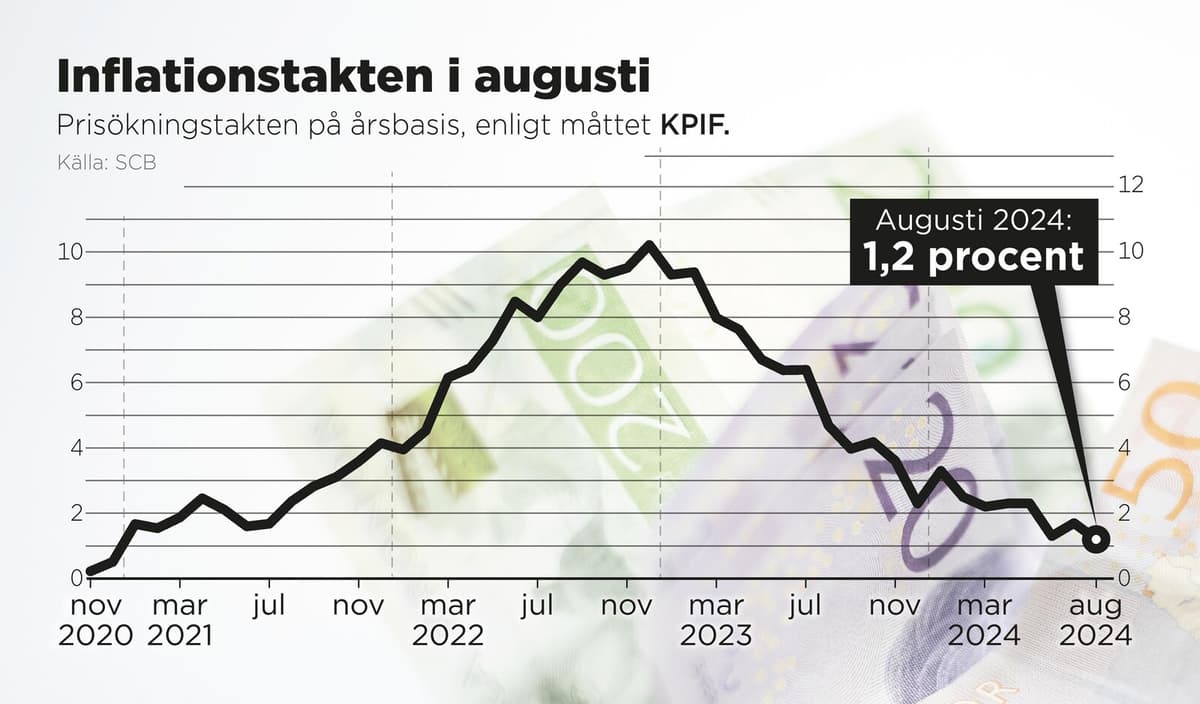

The August figure can be compared to an average forecast among analysts of 1.4 percent according to Bloomberg's compilation. The Swedish Central Bank's inflation target is 2.0 percent.

In July, the KPIF inflation rate was 1.7 percent, according to SCB.

Lower energy prices are behind most of it, according to Caroline Neander, price statistician at SCB.

A Boost

These figures give Thedéen a boost to continue with interest rate cuts and maybe cut at every meeting, says Alexandra Stråberg, chief economist at Länsförsäkringar, about today's figures.

However, she does not think this gives any higher pressure on Erik Thedéen and the Swedish Central Bank to make a double cut this autumn.

You have to distinguish between an economy in recession and an economy in crisis. We have an economy in recession and then I think you should save your powder, as a double cut might be needed if something happens in the world, which is very possible.

Aside from energy prices, food prices also fell in August. Even transport prices dropped, including prices for international air travel, car rentals, and fuel.

More Expensive Clothes

"The price cuts were counteracted, among other things, by higher clothing prices, which is seasonally normal", writes SCB.

Excluding energy prices, the KPIF inflation rate was 2.2 percent in August, unchanged compared to July.

The KPIF inflation rate, which the Swedish Central Bank uses in its inflation target, is an underlying measure of inflation where the effects of mortgage rates have been excluded.

Today's inflation figure is a crucial decision-making basis for the Swedish Central Bank's next interest rate decision, which will come on September 25. The Swedish Central Bank has previously signaled that three more interest rate cuts may come this year.