In the corresponding Kantar Prospera survey from June, expectations were at 2.4 percent. And on a two-year horizon, an inflation of 1.8 percent is expected, compared to 2.0 percent previously.

On a five-year horizon, inflation expectations remain at 2.0 percent, unchanged compared to the June survey.

Inflation expectations are, alongside inflation and other economic indicators, an important factor when the Swedish Central Bank makes decisions on the interest rate.

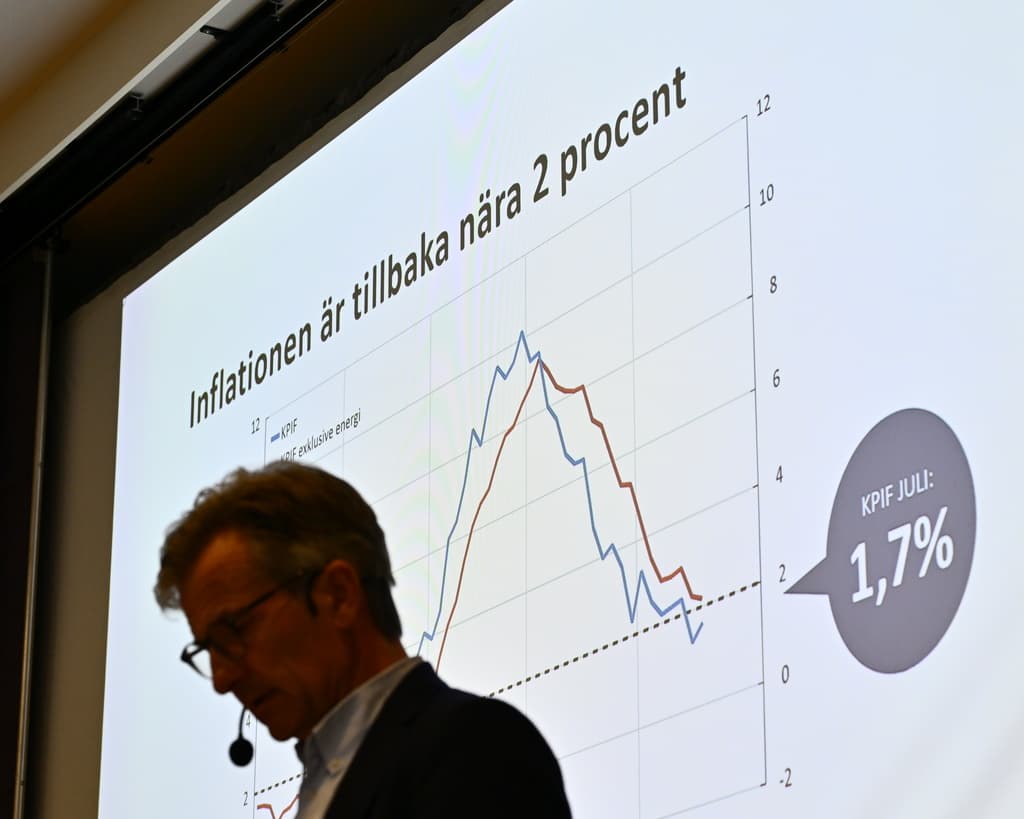

The KPIF inflation, which according to the Swedish Central Bank's inflation target should be at 2.0 percent, is an underlying inflation measure where the effects of mortgage rates have been excluded.

Wednesday's survey is of the larger type that Prospera conducts, where the money market, purchasing managers, and representatives of the labor market parties are included in the data.

The survey – which is conducted on behalf of the Swedish Central Bank – shows that expectations of the Swedish Central Bank's interest rate, which was lowered to 3.50 percent in August, are at 2.50 percent in one year and 2.30 percent on a two-year horizon.

The krona is expected to strengthen against both the dollar and the euro to 9.84 and 10.77 kronor, respectively, on a two-year horizon.