On Tuesday, the government's investigator presented a proposal that, in brief, means that venture capitalists' profits will be taxed as capital instead of labor, resulting in lower taxes.

The proposal is estimated to reduce the state's revenue by 600 million kronor in the first year and 300 million annually thereafter. The investigator suggests financing it with an increased tax on alcohol and tobacco.

"A commissioned job"

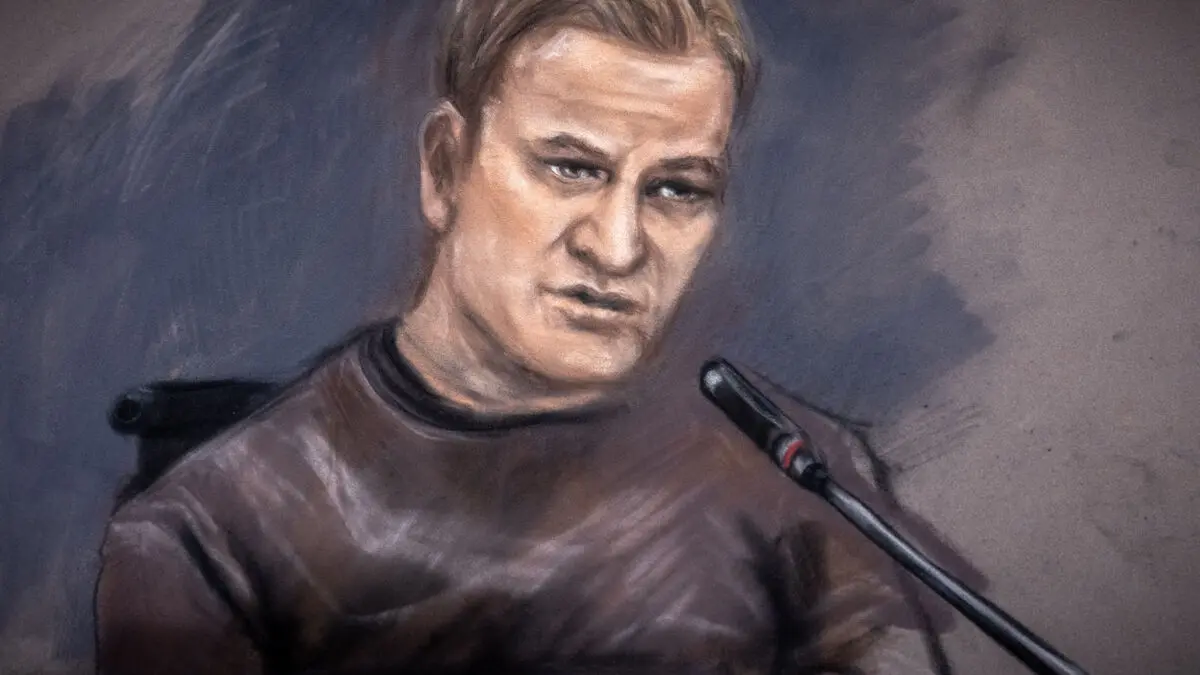

Niklas Karlsson (S), chairman of the Riksdag's tax committee, believes it is a commissioned job from the venture capitalists.

It is provocative and completely unacceptable to do it this way, it can be likened to some form of corruption.

He would have liked to see the issue investigated more broadly than the directives indicated.

Our starting point has been that it requires an unconditional investigation, it's not about anything else than that predictability is needed in the tax system, he says.

He also thinks there is a "deep injustice" in the proposal.

This is about individuals with annual incomes of hundreds of millions of kronor, who have now ordered that they should pay lower taxes than a nurse.

Vänsterledaren Nooshi Dadgostar is also deeply critical. In a comment to TT, she says that the proposal means that "ordinary people will pay for billionaires' luxury lives" and calls it "grotesque."

"Jimmie Åkesson and Ulf Kristersson should be ashamed and look every healthcare worker, police officer, construction worker in the eye and explain why they made this priority," she writes.

Unnecessary time

Finance Minister Elisabeth Svantesson (M) says in a comment that the investigation will now be sent out for review and that the government will return to the issue after that:

"Fundamentally, the tax system should be predictable. Otherwise, it's difficult for households and companies to know how much tax they will pay. And the Tax Agency risks spending unnecessary time on administration. The Tax Agency states that they have spent at least 30,000 days on handling this," she writes.

Many prominent venture capitalists have criticized the existing tax rules and disputed with the Tax Agency over the years.

Last spring, the authority taxed 67 venture capitalists with 1.6 billion kronor.

The investigator proposes that the new rules should come into force on January 1, 2026.