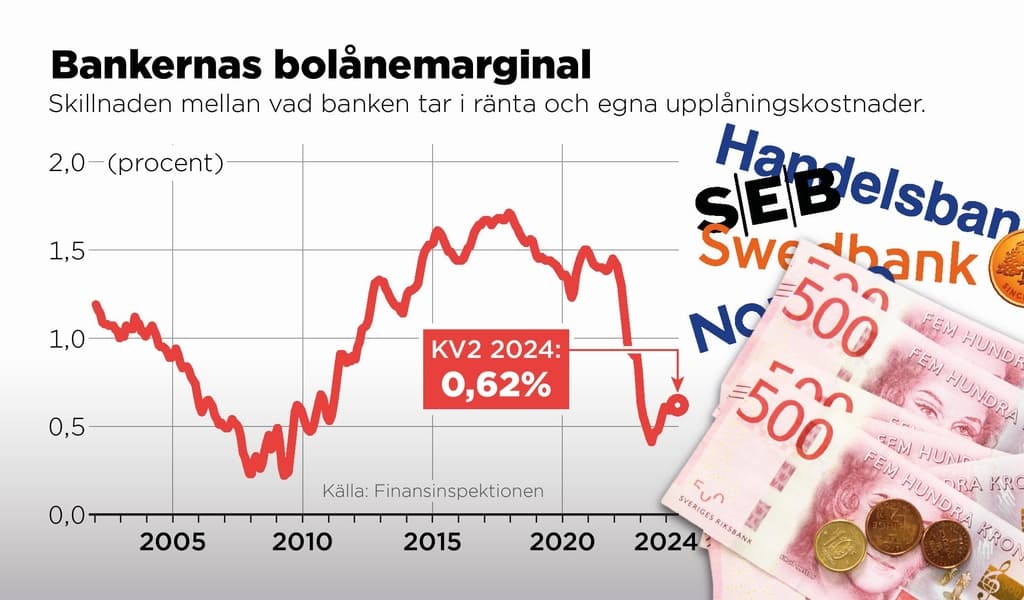

The banks' profit margin on loans with variable interest rates increased slightly during the second quarter, compared to the previous quarter, according to the Financial Supervisory Authority's (FI) recurring measurements.

The so-called gross margin, the difference between what the bank charges in interest and its own borrowing costs, increased from 0.59 to 0.62 percent. The statistics show over time that when interest rates are falling, banks' margins rise. It may seem small, but every hundredth of a percentage point becomes large sums for the banks.

Higher interest rate

The increase in the gross margin on loans is small, but it can be interpreted as the banks being set to increase their margins. And that's serious in itself for consumers, says Yasemin Bayramoglu, communications manager at the Swedish Consumers.

At the same time, fresh figures from Statistics Sweden show that the average variable mortgage interest rate was higher in July than in June, 4.54 compared to 4.51 percent. This despite the Swedish Central Bank lowering the repo rate by 0.25 percentage points just before the summer.

One can conclude that they continue to make very good money on private customers, says Yasemin Bayramoglu.

"There is often room for consumers to negotiate down their interest costs. If more bank customers are active and willing to vote with their feet, it would likely lead to the average interest rate for mortgages being pushed down," says Moa Langemark, consumer protection economist at FI, in a press release.

Difficult to understand

Many consumers find it difficult to understand the banks' interest rate setting.

"FI urges banks to provide consumers with clearer information about the bank's average interest rate and information before interest rate discounts expire," says Langemark.

Often, banks present their list rates to customers, percentage rates that are far above what the average customer actually pays, the so-called average interest rate, which banks must publish on their websites but which advisors are not always eager to talk about.

At the same time, banks' deposit interest rates are relatively low, according to FI. And that can make the banks' total interest income, the difference between what they earn on lending and deposits, higher.

They are so quick to lower deposit interest rates. But lag behind when it comes to lowering mortgage interest rates. Every day they delay lowering mortgage interest rates in line with the repo rate, the banks earn as much money as possible, says Yasemin Bayramoglu.