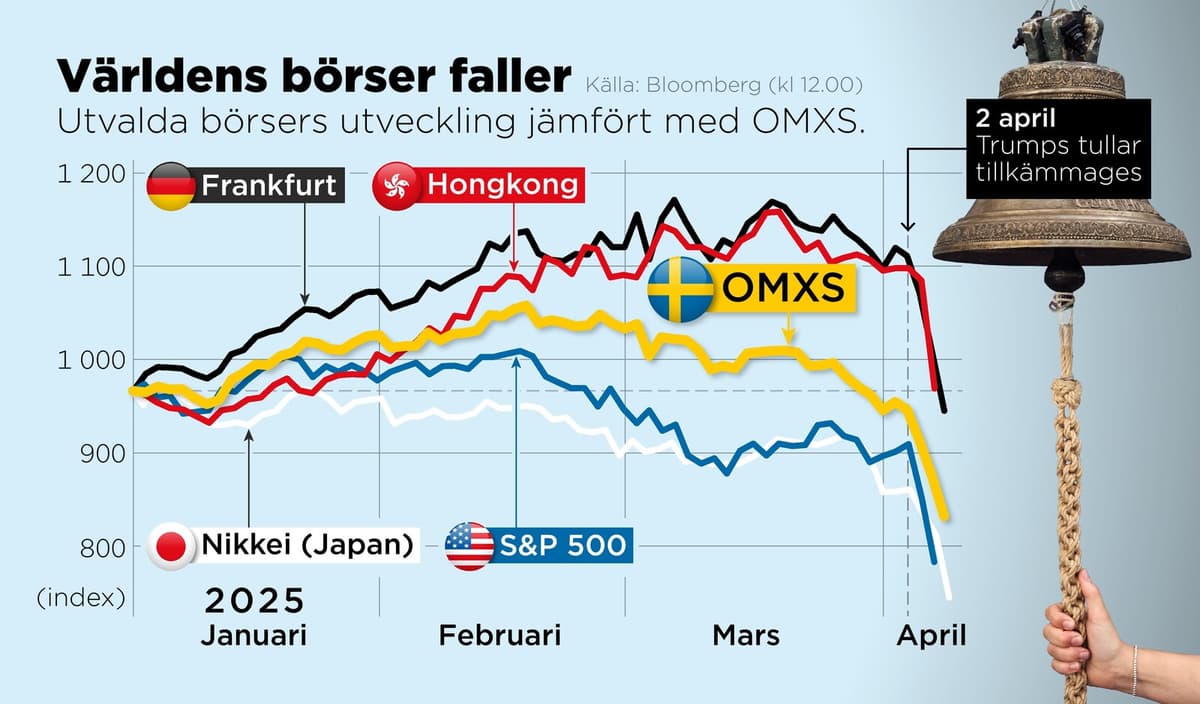

In just one month, the Stockholm stock exchange has lost almost a fifth of its value. Monday was bloody with declines of nearly 8 percent initially, although prices later recovered temporarily, only to close just below 5 percent.

What is a stock market crash?

There is no clear definition. However, it should be a large, dramatic decline, around 20 percent, according to several experts. Daniel Waldenström, professor of economics at the Institute for Business Research, sees a stock market crash as a decline of 4-5 percent in one day.

This is among the bloodiest we've seen in a long time, you can say, he says.

Advertisement

What causes a stock market crash?

At the core, it's about people who invest in the stock market believing that the price tomorrow will be lower than today and that prices will continue to fall. When everyone does this simultaneously, as is happening now – which is extremely unusual – we see these enormous downturns, says Rikard Westerberg, who teaches economic history at the Stockholm School of Economics.

Can the entire stock exchange be stopped?

The entire stock exchange can actually be stopped – or closed – in extreme events. On the New York Stock Exchange, so-called "circuit breakers" are activated if the broad index falls by at least 7 percent, then the exchange is stopped for a quarter of an hour.

What historical parallels does the current decline have?

Trump's tariff decision has led to reactions similar to the beginning of the financial crisis in 2008 and the pandemic in 2020. During Black Monday in 1987, the world's stock exchanges plummeted due to fears of a war between Iran and the USA, and fell by over 20 percent in some places.

In the financial crisis of 1990 with Nyckeln and Gamlestaden, the stock exchange fell by 25 percent. And in the Kreuger crash, the stock exchange fell by over 30 percent in March 1932. So what we've seen today (Monday) is still not on the same historical level, says Waldenström.

Are there any differences?

One difference from many other crises is that it hasn't been triggered by inflated values – i.e., a bubble bursting.

This is more than ever a politically triggered crisis. It's not a giant bubble that has burst in the same way as in 2008, says Lars Magnusson, professor of economic history at Uppsala University.

How long does it take for the stock exchange to recover?

It depends on whether the decline leads to a broader economic downturn or if it's a temporary dip, according to Magnusson.

If you look at the classic of all stock market crashes, Wall Street in 1929, which was followed by the long depression of the 1930s, the stock prices didn't return to the same level until the 1950s, he says.

In other crises, it has taken around a year for prices to recover.

But I also think that good economic news could quickly turn this around, says Westerberg.

Can it lead to a new depression?

If the high tariffs are here to stay, it could lead to a depression – a prolonged recession of at least two years. The spiral can begin with people choosing to postpone purchases. This, in turn, makes companies that sell goods and services get worse results and have less to do, and they lay off staff. Then unemployment rises.

These tariffs that Trump is now imposing are, in practice, a tax on goods. And that means things become more expensive. And when things become more expensive, we get inflation, which makes it harder to buy things with the money you have, says Westerberg.

Unemployment and inflation can lead to social unrest.

In the long run, it can also have very severe political effects. That people lose faith in the political system and choose other types of leaders. So it can have all sorts of unpleasant consequences, says Westerberg.

Advertisement

Financial crisis: 2007–2010. A crisis that originated in the American housing and interest rate market. 2007–2008, the OMX30 more than halved in the wake of the crisis.

Pandemic: Fears of the spread of Covid in early 2020 wiped out a third of the Stockholm stock exchange's value in a month.

IT bubble: In the wake of the IT bubble, the largest companies on the Stockholm stock exchange lost an average of 24.5 percent per year from 2000 to 2002.

Black Monday: Fears of a war between the USA and Iran spread panic on the world's stock exchanges in 1987. The New York stock exchange fell by over 22 percent in one day.

Stock market crash and depression: Wall Street's crash began in 1929, and within three years, 89 percent of the stock exchange's value had disappeared. In 1933, the unemployment rate in the USA was 25 percent. In 1932, the news of Ivar Kreuger's death caused the Stockholm stock exchange to fall by over 30 percent.

Sources: The Swedish Central Bank, Avanza, Nordea.