The amortization requirement has been too strict and, combined with the mortgage ceiling, has had negative effects on households' welfare, according to the investigation submitted to the government on Monday.

Young households, and perhaps especially those with relatively good future prospects, have been forced to amortize a lot and have had a very heavy burden on their economy, says Professor John Hassler, one of the investigators.

At the same time, it is difficult to say whether the measures have really had any positive effect on financial stability, which was the intention when they were introduced.

The responsibility for the regulatory framework being questioned lies with the Financial Supervisory Authority (FI), with Daniel Barr as director-general. He welcomes the evaluation, but does not want to review the proposals before the response is formulated by FI's board later in the process.

We will carefully examine the investigation's proposals, so that we do not just get increased indebtedness and higher housing prices as a result of them, he says.

Does not get easier

He opposes the notion that the regulatory framework has had no effects.

Households have bought smaller homes and borrowed less, he says.

And when it comes to what excludes young people from the housing market, he highlights prices as the most important factor.

And if prices rise further, it will not get easier.

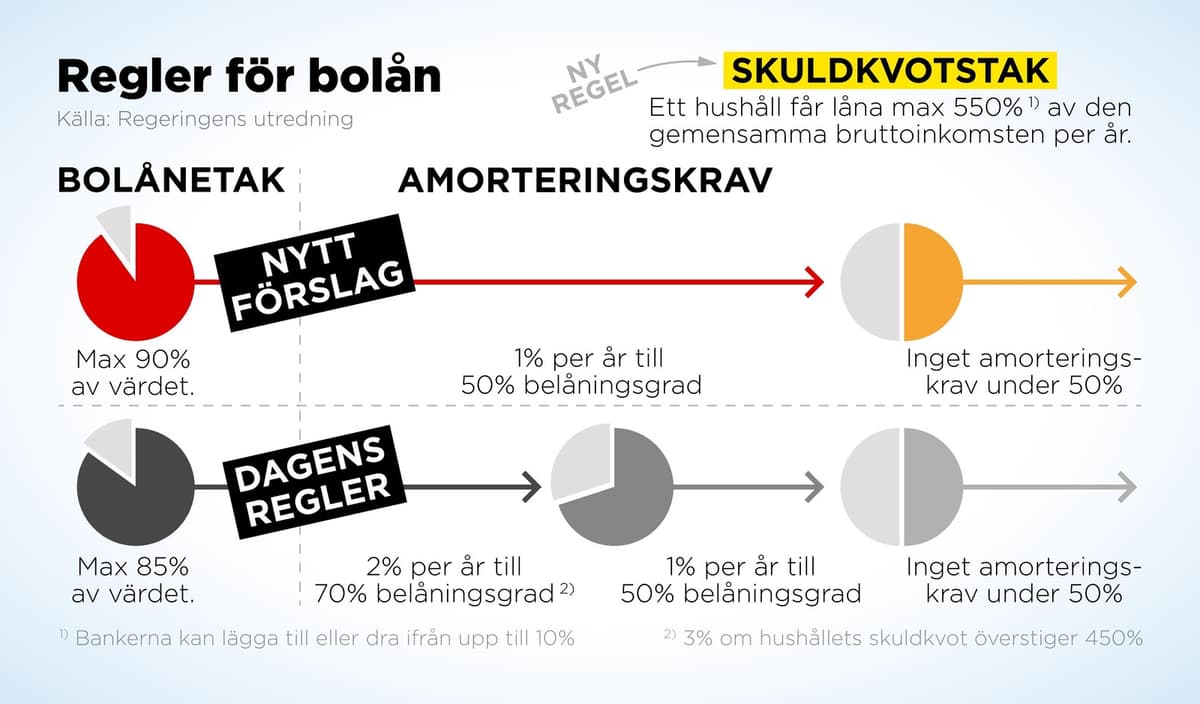

The investigators propose that the amortization requirement be softened to require all those with a mortgage exceeding 50 percent of the property's value to amortize 1 percent. The mortgage ceiling is proposed to be raised to 90 percent, from today's 85 percent.

The investigators also propose a new debt-to-income ratio ceiling, which means that it should not be possible to borrow more than 550 percent of one's annual gross income – with room for banks to make exceptions for 10 percent of the loans.

Higher prices

The effect of the proposals may be higher housing prices.

This will lead to a slightly higher demand for housing, which will also lead to slightly higher prices. But nothing dramatic, we're talking about probably single-digit percentages, says John Hassler.

Financial Markets Minister Niklas Wykman (M) says that the government will return with a referral in the spring.

But it is clear that young people should be able to enter the housing market. It should not unnecessarily be beneficial to be born with money instead of working for it, he says.

He also flags that more of the regulatory framework may come to be regulated directly in laws, rather than the responsibility lying with FI.

Today's mortgage ceiling of 85 percent was introduced in 2010 and means that households cannot borrow more than 85 percent of the property's value with the property as collateral.

This was complemented in 2016 by an amortization requirement, which means that households that borrow more than 50 percent of the property's value must amortize at least 1 percent of the original loan each year. Those who borrow more than 70 percent must amortize at least 2 percent.

The amortization requirement was further tightened in 2018 with a rule stating that households with mortgages larger than 4.5 times gross income must amortize 1 percent in addition to the first amortization requirement.

Source: Financial Supervisory Authority