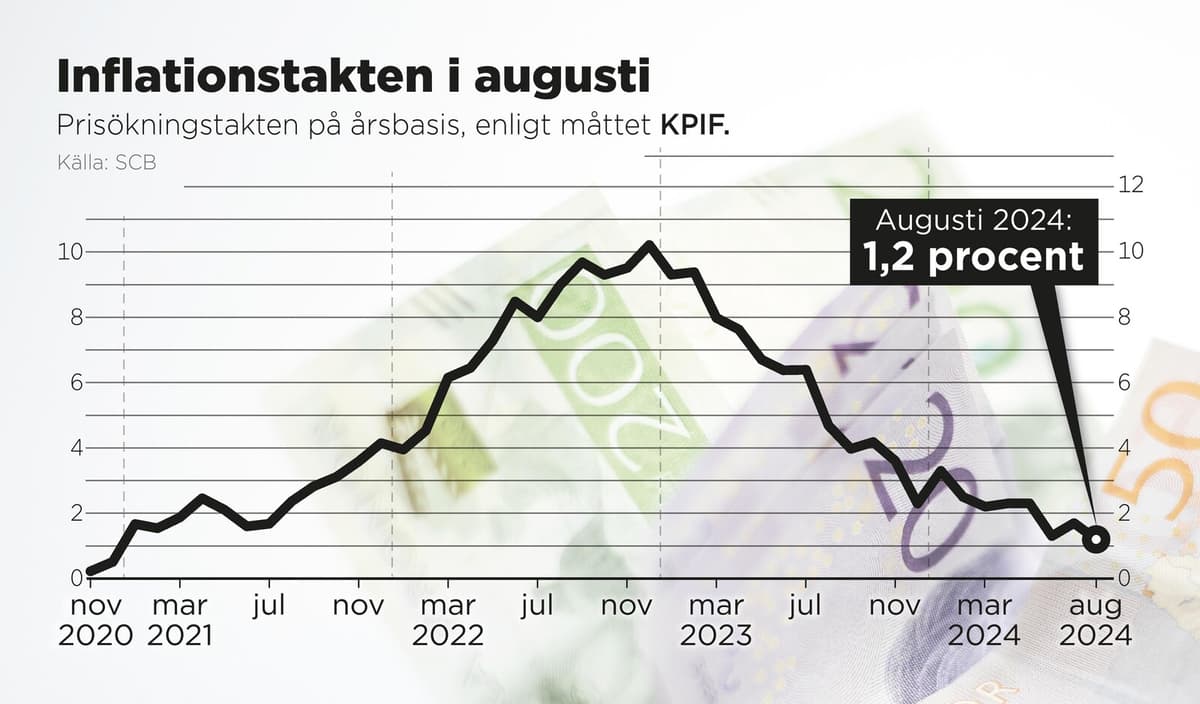

Inflation fell in August to 1.2 percent according to the KPIF measure, according to Statistics Sweden (SCB). It was slightly lower than expected and is now a good way below the Swedish Central Bank's inflation target of 2.0 percent.

In July, KPIF inflation was at 1.7 percent and it is mainly lower energy prices that are causing inflation to fall.

I think this should make it possible for the Swedish Central Bank to move much faster given that the Swedish economy is so weak, says Mattias Persson at Swedbank.

"Nothing to wait for"

He believes that the Swedish Central Bank could strike with a double rate cut at one of the upcoming meetings this autumn.

There is basically nothing to wait for, he says.

Alexandra Stråberg, chief economist at Länsförsäkringar, believes that today's inflation figure is a clear signal to the Swedish Central Bank to continue with rate cuts, possibly at every meeting. She does not see any reason for a double rate cut.

You have to distinguish between an economy in recession and an economy in crisis. We have an economy in recession and then I think you should save your powder, as a double rate cut might be needed if something happens in the world, which is very possible.

"Not on the agenda"

Neither does Nordea's chief analyst Torbjörn Isaksson believe in a double rate cut.

I still don't think it's on the agenda yet.

Excluding energy prices, KPIF inflation was at 2.2 percent in August, which is unchanged compared to July.

KPIF inflation, which the Swedish Central Bank uses in its inflation target, is an underlying measure of inflation where the effects of mortgage rates have been excluded.

Today's inflation figure is crucial decision-making material for the Swedish Central Bank ahead of its next interest rate decision, which will be announced on September 25. The Swedish Central Bank has previously signaled that up to three more rate cuts may come this year.

The immediate market reaction was moderate to SCB's inflation figure. The krona strengthened initially by a few öre against both the euro and the dollar.