The company is coming from a period that can be described as turbulent, where the stock has been on a rollercoaster ride for a while.

In June and July, it reached its absolute highest levels, but then came the crash. Financial concerns linked to the US labor market caused the tech sector, led by Nvidia, to fall sharply. Within a month, the stock plummeted by over 25 percent. A significant setback in the company's success story, which has meant a price development of over 3,000 percent over a five-year period.

"Set a world record"

However, the recovery has been marked recently, and the stock is now around $125, almost back at previous record levels.

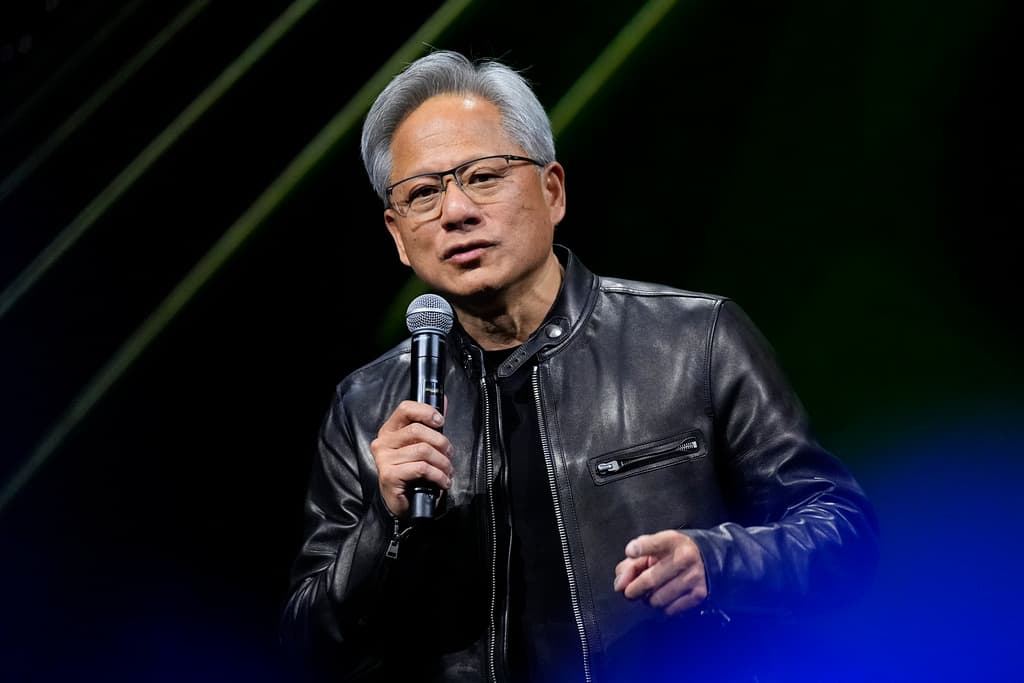

Nvidia is the company that has set a world record for the fastest growth in revenue and profitability ever, but now we're entering a period with tougher comparative figures for the company, says Carl Armfelt to TT.

He manages the global fund TIN World Tech with a total value of several billion. From previously being the fifth-largest holding, the fund's exposure to Nvidia has decreased slightly and is now the sixth-largest, with Microsoft as the clear number one.

Nvidia's success recipe has been linked to the AI revolution, where other tech giants, such as Meta and Alphabet, are some of the company's largest customers.

Nvidia is also considered part of the group of companies that are referred to as the "Magnificent 7", giant players that are also connected to each other, where poor figures for Nvidia could have a snowball effect.

Large investments

All these companies are making large investments, but you can see that over the past month, it's been a bit more subdued. They're thinking about what to use AI for, and it hasn't been as enthusiastic as six months ago, says Carl Armfelt.

He points out that a profit miss from Nvidia could raise new questions about the tech sector and have an impact on the stock market, particularly the Nasdaq composite index in New York, where these companies are listed.

At the index level, it could definitely have a pretty strong impact. Nvidia is also the company that is hardest to value among these.

What speaks in favor of a positive stock market development, however, is another factor, he notes.

Many listed companies are doing very well with good profit development. We're also entering a new phase in the economy with interest rate cuts, and consumers are also doing better.

Nvidia will publish its interim report on the evening of Wednesday, August 28.