The US tech giants' stock market development is leaving clear tracks in Swedish pension funds.

However, some popular funds have been better than others at finding AI star Nvidia.

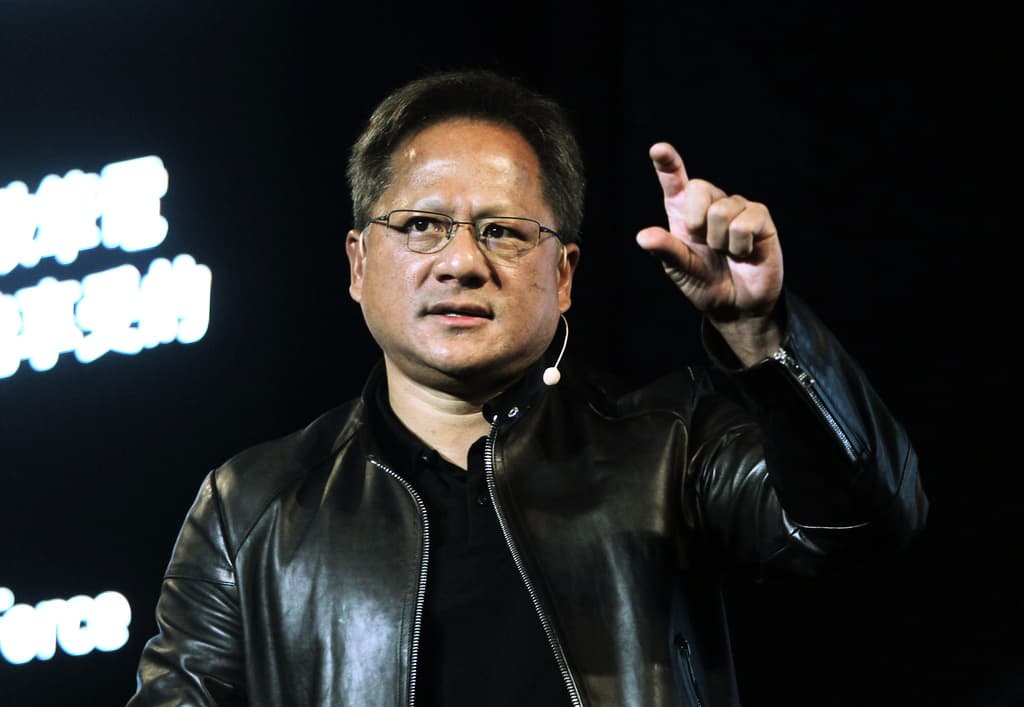

American Nvidia, one of the world's most highly valued companies, has become the talk of the town in the global AI sprint. The stock market surge of over 140% this year and over 200% in the past 12 months also brings a welcome addition for Swedish pension savers.

Among several of the most popular funds at Avanza, the large tech giants, also known as "the magnificent seven", are at the top in terms of holdings. This includes, in addition to Amazon, Alphabet (Google), Apple, Meta, Microsoft, and Tesla, also Nvidia.

Among the largest funds at Avanza that invest in foreign stocks, it is Swedbank Robur Technology, with around 150,000 savers, that has benefited the most from Nvidia's success. The fund has around 9.6% of its holdings in Nvidia, making it the fund's largest holding. Over the past year, the fund's value development is 29.5%.

Avanza Global, with nearly 462,000 owners, has 4.2% of its holdings in the company, while Länsförsäkringar Global Index, with around 300,000 owners, has a holding of almost 5.0%.

A popular fund that has a relatively small holding in the company is Avanza Auto 6 with only 1.3%. The fund is up 12% over the past year.

In the spring, Dagens Industri reported that 90,000 savers in Avanza's US fund had completely missed the Nvidia rally since they had chosen to exclude the company for sustainability reasons. However, the fund has since reconsidered and invested in Nvidia, with 9.5% of the fund's holdings now in the stock.

The state-owned pension fund AP7 Såfa, which is the managed alternative for those who do not want to make their own fund choices for their premium pension savings, invested in Nvidia in 2010, when the amount was 27 million kronor.

Today, it's about 35 billion kronor – equivalent to 3% of the fund's value, with a value increase of 17 billion since the turn of the year.