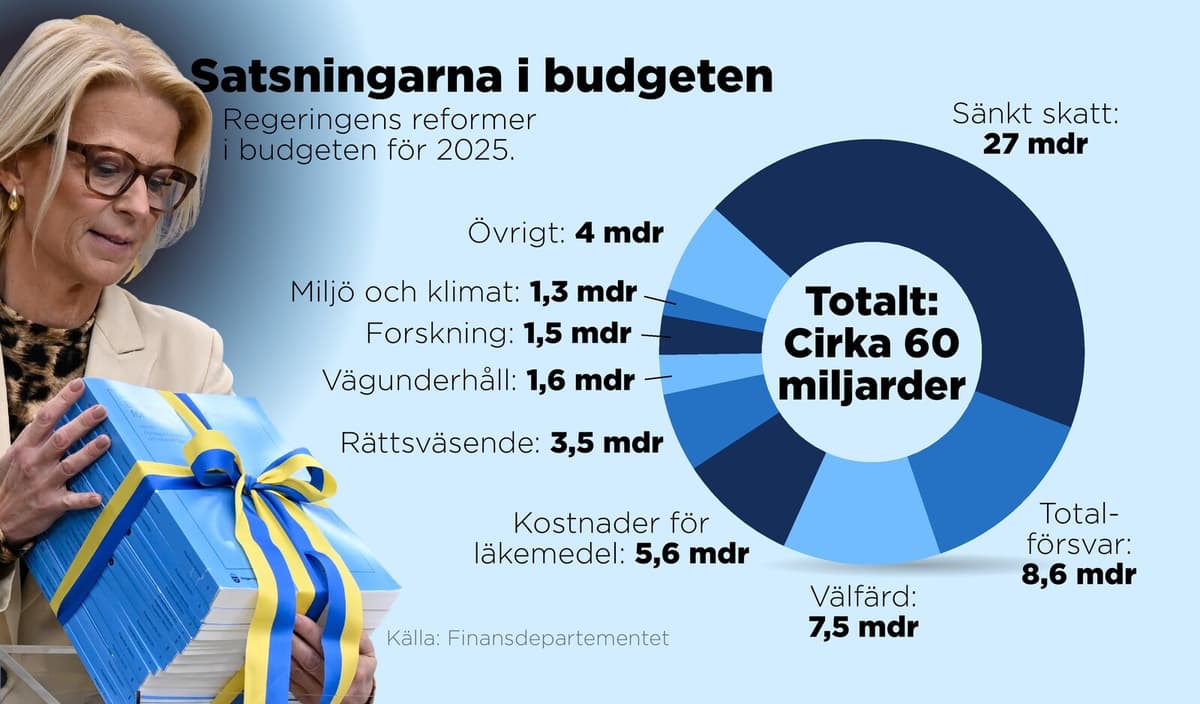

Minister of Finance Elisabeth Svantesson (M) presents a budget proposal for 2025 with a completely different profile than the one presented last autumn.

This budget is significantly more expansive and contains new reforms worth approximately 60 billion kronor compared to 39 billion in 2024.

Of the 60 billion, nearly 27 billion will go towards reduced taxes, which will benefit households in the form of reduced taxes on salaries and pensions, on savings, on gasoline, and on air travel in 2025.

Stimulating the Economy

Svantesson states that we are now leaving a tough period with high inflation behind us. Therefore, the government wants to support households and simultaneously "get the wheels turning" to get Sweden out of the recession.

People have lost ten years of real wage increases. It has been very tough for many, she says.

The government and the Sweden Democrats (SD) have primarily chosen to reduce taxes to support households. Contributions to vulnerable households, primarily an extension of the temporarily increased housing allowance for families with children, amount to 570 million kronor.

Over four million wage earners will benefit from an enhanced job tax deduction, which will give an average of 2,600 kronor per year in reduced taxes.

At the same time, nearly half a million people with the highest incomes will receive reduced taxes, with an average of 10,100 kronor per year, when the job tax deduction's tapering for high salaries is abolished in 2025.

"Pays for Itself"

Svantesson believes that the investment in high-income earners is justified to boost growth, as lower marginal tax rates increase the willingness to work more. High marginal tax rates "put a lid on growth", according to her.

In kronor and ören, those who earn a lot will still have a higher tax even with our budget, she says.

SD's economic policy spokesperson Oscar Sjöstedt believes that SD's voters, regardless of whether they benefit from the tax reduction, "understand the logic". According to him, the measure pays for itself since people want to work more.

It's a wise reform, primarily because Sweden has a very high marginal tax rate. It has been at 55 percent, now it will land at 52 percent, says Sjöstedt.

Another clear difference between this year's budget and the new one for 2025 is that there will be significantly less new allocations to welfare.

Healthcare, education, and social services will receive nearly eight billion kronor in new allocations in 2025, of which over four billion will go to healthcare. This is half of what was allocated in last autumn's budget proposal for 2024.

This is because the municipal sector's economy is expected to strengthen significantly next year.

Tax Reduction: 26.7 billion kronor (44 percent)

Enhanced job tax deduction: 11 billion

Tax reduction for pensioners: 2.5 billion

Abolition of job tax deduction tapering: 4.7 billion

Tax reduction on ISK savings: 4.4 billion

Tax reduction on gasoline: 3.2 billion

Abolition of air travel tax: 0.9 billion

Welfare: 7.5 billion (12 percent)

Healthcare: 4.6 billion

Education: 2.8 billion

Social services: 0.1 billion

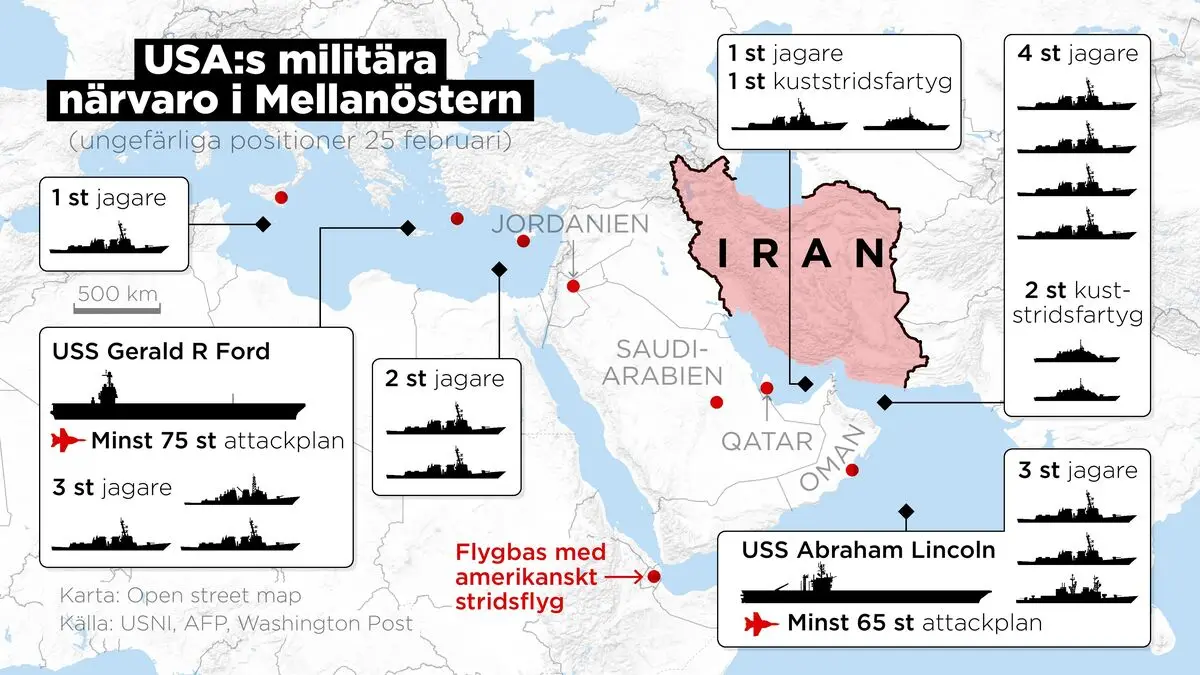

Total Defense: 8.6 billion (14 percent)

Environment and Climate: 1.3 billion (2 percent)

Judicial System: 3.5 billion (6 percent)

Infrastructure (road maintenance): 1.6 billion (3 percent)

Research: 1.5 billion (3 percent)

Medicine Costs: 5.6 billion (9 percent)

Other: approximately 4 billion (7 percent)

Total: Approximately 60 billion (100 percent)

Source: Ministry of Finance