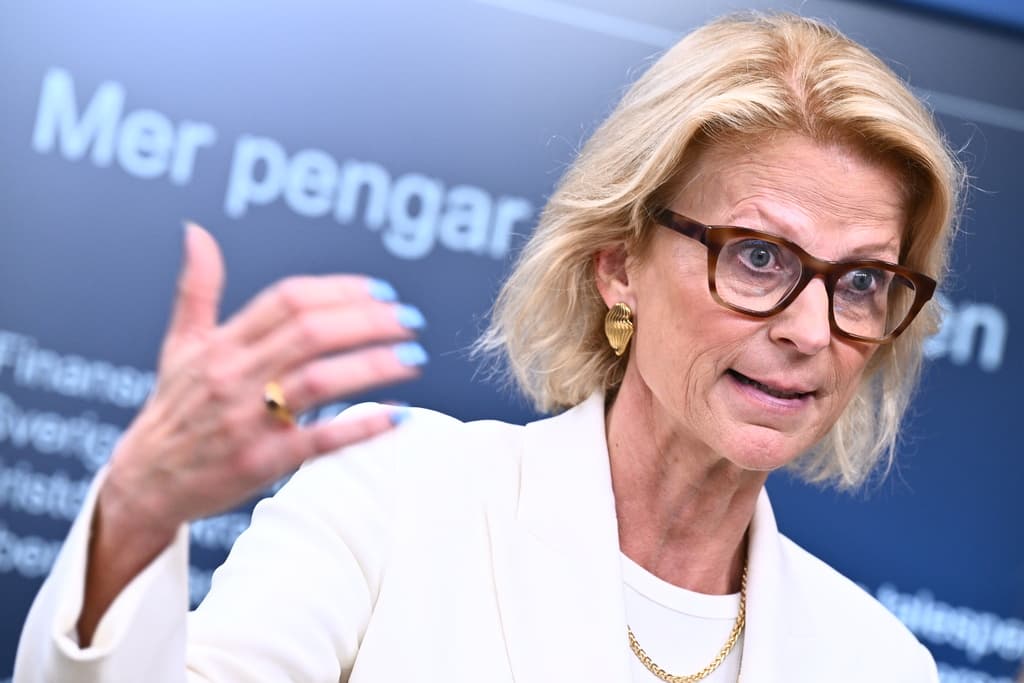

So-called investment savings account, commonly referred to as an ISK account, has been a very popular savings form and also beneficial in low-interest times. The government with Finance Minister Elisabeth Svantesson (The Moderate Party) now wants to give the savings form an additional boost.

Savings up to 150,000 kronor will be tax-free from next year. The level will be raised to 300,000 kronor in 2026.

However, the proposal was already criticized by several referral bodies in the spring, and the view has not changed, including at the National Institute of Economic Research (KI).

Our criticism remains. The main criticism was that the government does not clearly show that savings need to increase, says Sebastian Escobar-Jansson, who has presented the referral response at KI.

Advertisement

Questioning the argument

From KI's perspective, the argument that buffer savings would be placed in an ISK account where one traditionally saves in funds and shares with a certain risk associated with the savings is being questioned.

ISK is primarily intended for long-term savings in shares and funds, and it's a bit difficult to see why one would have buffer savings there. You probably have that mainly on savings accounts instead, says Sebastian Escobar-Jansson.

The limit, 300,000 kronor, is also pointed out by KI as being very high considering that the average saver has 78,000 kronor in their ISK account.

A significantly lower amount could have achieved the same thing, and then the cost of the proposal would have been significantly lower.

Advertisement

The proposal is estimated to cost the state 4.4 billion kronor in 2025 and 7 billion kronor in the following years.

Can divide the savings

Another point that is being raised is that a family with, for example, two children can divide their savings among all four family members and thereby get tax-free savings of up to 1.2 million kronor.

We believe that there is a significant risk of this type of planning of savings, notes Sebastian Escobar-Jansson.

Finance Minister Elisabeth Svantesson says that she is not worried about the risk, but that the government will follow it closely.

At the bottom, we see that the benefits outweigh the potential risks and drawbacks, she says.