The semi-conductor giant Nvidia's stock market crash is historically large. 550 billion dollars have been wiped out within the space of three days.

Small investors risk getting caught out, warns Daniel Ljungström, head of private savings at Max Matthiessen.

From the world's highest-valued listed company to a historic price fall, all within the space of barely a week. Following Monday's 6.7 per cent decline, equivalent to 5,750 billion kronor in market value has been wiped out.

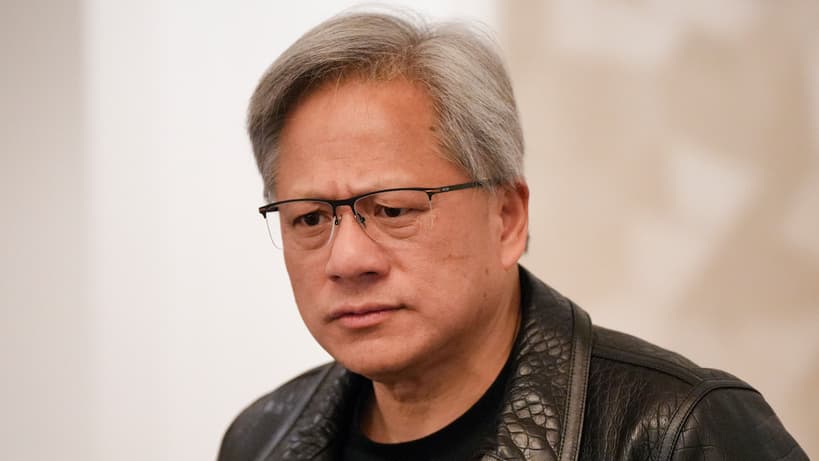

Daniel Ljungström at Max Matthiessen points out, however, that nothing fundamental has changed in the company over the past few days:

Given the recent development, it's a natural reaction. It's clear that many are choosing to take their profits and allocate capital elsewhere, he says to TT and highlights another factor:

It also becomes a psychological effect when you suddenly become the world's most expensive company. Then you're in a situation where you've almost reached the ceiling and it's tempting to take some profit and feel like you've made a good deal.

Now third

The decline has meant that both Microsoft and Apple have now surpassed Nvidia. The big question for investors is whether Nvidia, which has ridden the AI wave, will be able to maintain its dominant position in the long term? Daniel Ljungström sees a certain risk from the fact that more and more competitors are stepping up.

There are competitors who are currently lagging behind, but Nvidia's backpack is becoming increasingly heavy, which means that competitors can come up with faster and better solutions.

In the short term, Nvidia is absolutely a winner, but if you draw out the curve, I believe the risks are greater and it's quite rare for the original number one, like Nvidia, to be a winner over the long term.

Strong development

Since the turn of the year, however, Nvidia's share – despite the recent decline – has risen by 138.5 per cent. And someone who bought Nvidia shares for 10,000 kronor in 2020 can now sell them for over 200,000 kronor.

This development has not gone unnoticed by small investors, and many have jumped on the Nvidia bandwagon, with over 50,000 owners now at Avanza. The risk is, however, great that many of them are getting in at the wrong time, notes Daniel Ljungström:

You read about the company everywhere and everyone buys the share because they want to be part of the race. As long as the news flow continues and the hype remains, you can get continued growth, but also an increasing risk that means you can get declines like now – even though nothing has actually happened.