”We are taking these measures in a very special conflict situation. The situation in the Gaza Strip is a serious humanitarian crisis. We are invested in companies that operate in a country that is at war, and the conditions on the West Bank and in Gaza have deteriorated recently”, says the oil fund's CEO Nicolai Tangen in a statement according to the news agency NTB.

The decision comes after a meeting between Nicolai Tangen and Ida Wolden Bache, the head of Norges Bank – the country's central bank.

The Norwegian investments have increasingly come under scrutiny as the Israeli warfare in the Gaza Strip has continued and the humanitarian situation in the area has deteriorated

”Important decision”

The media have revealed that the oil fund has, among other things, bought shares in the Israeli combat aircraft company Bet Shemesh Engines.

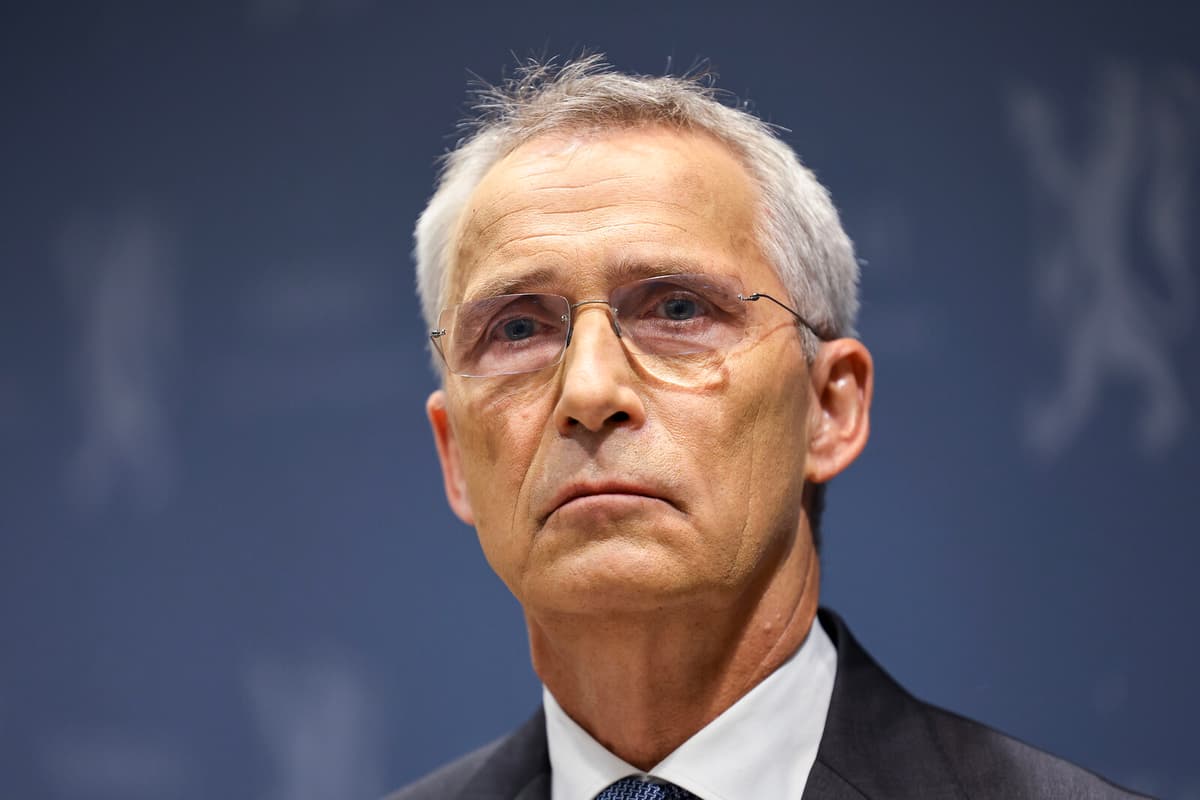

Last week, Stoltenberg – formerly, among other things, Secretary General of NATO – demanded that investments in Israel be reviewed, and now the minister says he is satisfied.

This is an important decision. I am glad that the bank has followed the call and acted quickly, he says.

The oil fund is one of the world's largest pension managers and owners of listed companies.

Currently, it manages assets equivalent to approximately 18,800 billion Swedish kronor.

May be more

Stoltenberg clarifies that the fund should not have ownership in companies that contribute to warfare.

The ethical guidelines for the fund state that it should not invest in companies that contribute to states' violations of international law. Therefore, the pension fund should not have ownership shares in companies that contribute to Israel's warfare in Gaza, he says.

When asked if this can have consequences in the future also for ownership in American companies, Stoltenberg replies:

We must expect that there may be further withdrawals, both from Israeli companies and from non-Israeli companies.