Net effect will be a slightly higher inflation pressure, says SEB economist Marcus Widén.

And it's reasonable to assume that the neutral interest rate will rise, he adds.

The neutral interest rate is the interest rate level required to reach the inflation target of 2 percent.

Germany's borrowing needs are increasing significantly as the historic investments in defense, infrastructure, and climate transition need to be financed. This fact has already had major effects on long-term market interest rates across Europe – and has thus contributed to increases in, among other things, long-term mortgage rates also in Sweden.

"Higher price pressure in the medium term"

Inflation impulses are part of the risk picture, according to Widén.

The direction is slightly higher price pressure in the medium term. And that's something central banks need to handle, he says.

In market pricing, expectations of the Swedish Central Bank's policy rate have risen by around 0.25 percentage points over two weeks – to 2.50 percent by the end of 2026.

But how European inflation develops going forward is genuinely difficult to predict – and it's one thing if there's upward price pressure on input goods like steel or critical components for defense equipment. It's a completely different story when it comes to wages or food and energy prices – which consumers feel.

The EU's shrinking working-age population inherently entails a risk of slightly higher inflation pressure. But the personnel and resources required for large investments in the construction and defense industries going forward can perhaps be seen as a replacement for the industrial downsizing expected among EU car manufacturers.

Plus for German GDP

Another question that determines the inflation effect is, according to Widén, how large a share of defense procurements is made from European companies:

If you put the money in Europe, it can have a positive growth effect and then inflation can increase via increased demand.

But if we buy American weapons or import from South Korea, you won't get that effect, neither on productivity nor inflation.

The impact of the investments on future confidence and thus investments and consumption also plays a role. Increased demand in the economy drives growth and creates upward pressure on prices.

We may need to add 0.2-0.6 percentage points to German GDP per year going forward, says Widén.

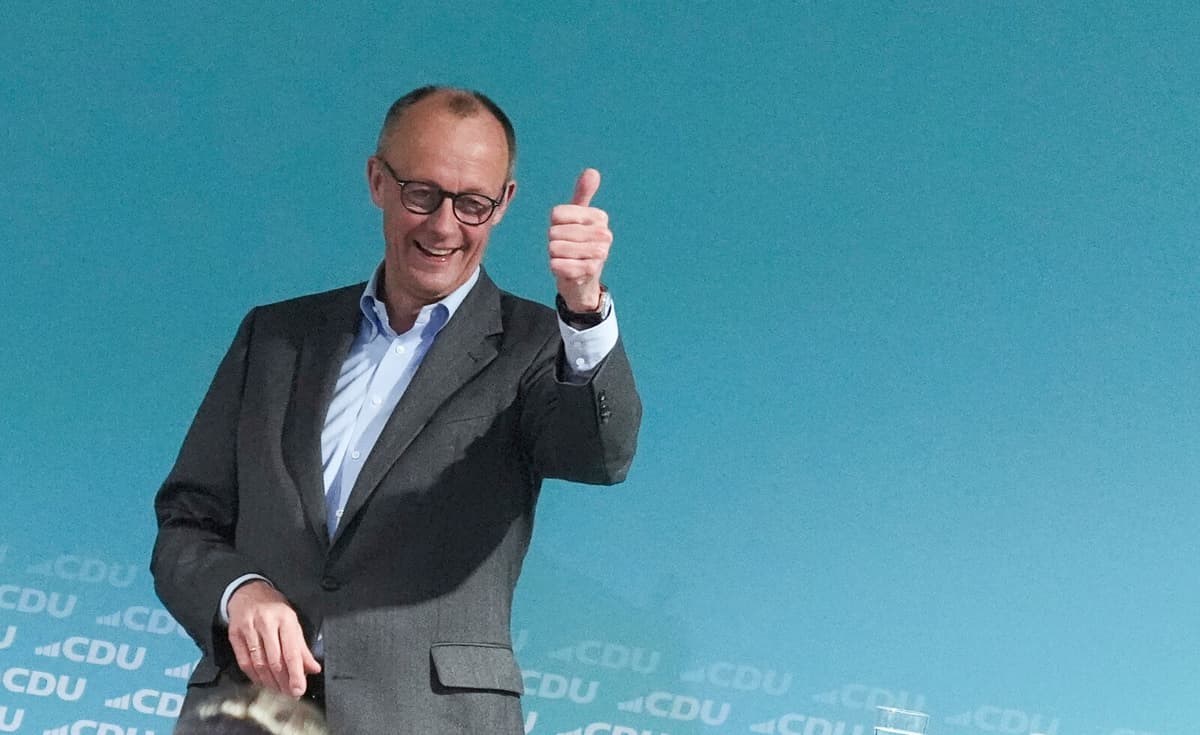

German market interest rates surged – the largest increase since German reunification in 1990 – when Friedrich Merz, who is expected to become the next Chancellor, launched the proposal for an exemption from Germany's debt brake for investments in defense and infrastructure.

At most, the ten-year interest rate was up at a peak of 2.94 percent. Since then, it has been dampened to around 2.80 percent – up by nearly 0.50 percentage points since the turn of the year.

On the currency market, the euro has risen sharply, up by nearly 5 percent against the dollar since the turn of the year, to around 1.08 dollars per euro.

Meanwhile, the Frankfurt stock exchange stands out with a price increase of 16 percent so far this year, which can be compared to minus 3 percent for the S&P500 index on Wall Street.

Heavy German defense stocks like Thyssen Krupp, Rheinmetall, and Hensoldt are in a class of their own, with price increases of around 100-140 percent so far this year. But other European defense stocks have also surged: British BAE Systems is up over 40 percent and Swedish Saab is up 65 percent.

The German parliament, the Bundestag, voted on Tuesday to approve a historic proposal that means all defense investments over 1 percent of GDP – approximately 45 billion euros – going forward will not be limited by the constitutionally enshrined German debt brake.

According to the proposal, a special fund of 500 billion euros – also outside the budget framework – will be established for investments in infrastructure and climate measures over twelve years.

German states will also get more room to loan-finance themselves when a requirement for a balanced budget is replaced with a cap on deficits of 0.35 percent of GDP.

On Friday, another vote on the proposal is expected in the Federal Council, Bundesrat, where representatives from the 16 German states sit. After that, Germany's President Frank-Walter Steinmeier will also give his approval.

The betting tip is that the proposal will go through all the way. It would mean that Germany's defense expenditures can soon become as large as they want and still not break the country's financial policy framework.