As a consequence of the federal shutdown, now the longest in US history, economists and investors are having to do without a number of important market data, such as monthly figures on the US labor market that were actually supposed to be reported on Friday afternoon.

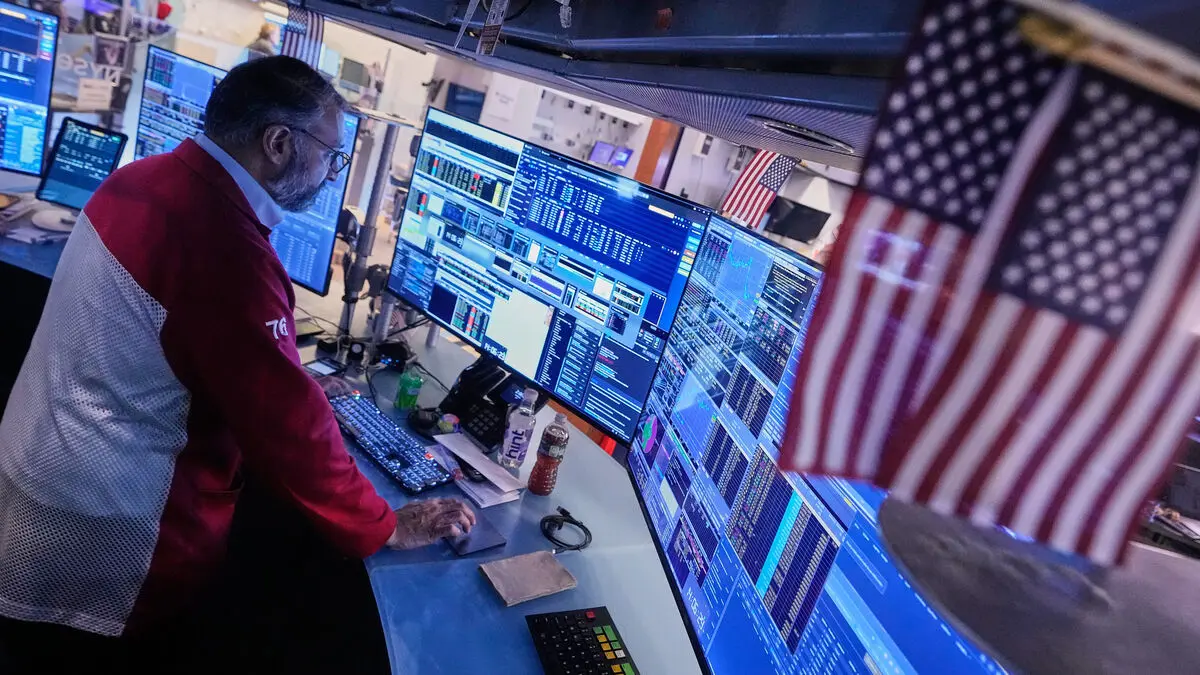

In the absence of employment figures, among other things, other statistics can have very large consequences for stock trading, something that was noticeable during yesterday's trading with sharp declines on the New York Stock Exchange.

Different situation

The private firm Challenger, Gray & Christmas showed that last month the American business community announced cuts of a whopping 153,000 jobs, the highest monthly figure in 20 years. Tommy von Brömsen points out that normally this statistic would not carry much weight, but now the situation is different.

"When you don't get other data, it becomes more difficult for everyone and the data you actually get is given more and more weight. You're pulling a little too much gear," he says.

This is the second month in a row that US jobs data has been missing due to the lockdown. Among the statistics that are now actually being reported are figures from the private payroll administrator ADP.

If they too start to look weak, the concern increases and then you want to see the actual and public figures that the statistics authority produces. Is it really this bad or are we just seeing noise, points out Tommy von Brömsen.

As long as the numbers from ADP come in okay, there's no real concern.

Affects the tech sector

The decline in the stock market has now primarily affected the tech sector, where companies such as Nvidia and Microsoft and the AI security company Palantir are among the losers.

This means that for November as a whole, all leading indices on the US stock exchanges are now in the red. The valuation of several AI companies has also led more and more people to talk about a bubble similar to what was seen in connection with the IT boom. Tommy von Brömsen, however, does not share that opinion:

Even though the valuations are high for AI companies, AI is seen as the future and I have a hard time seeing anything else. You can talk about a bubble, but I still believe that there is a pullback and we are not facing anything resembling the IT bubble.