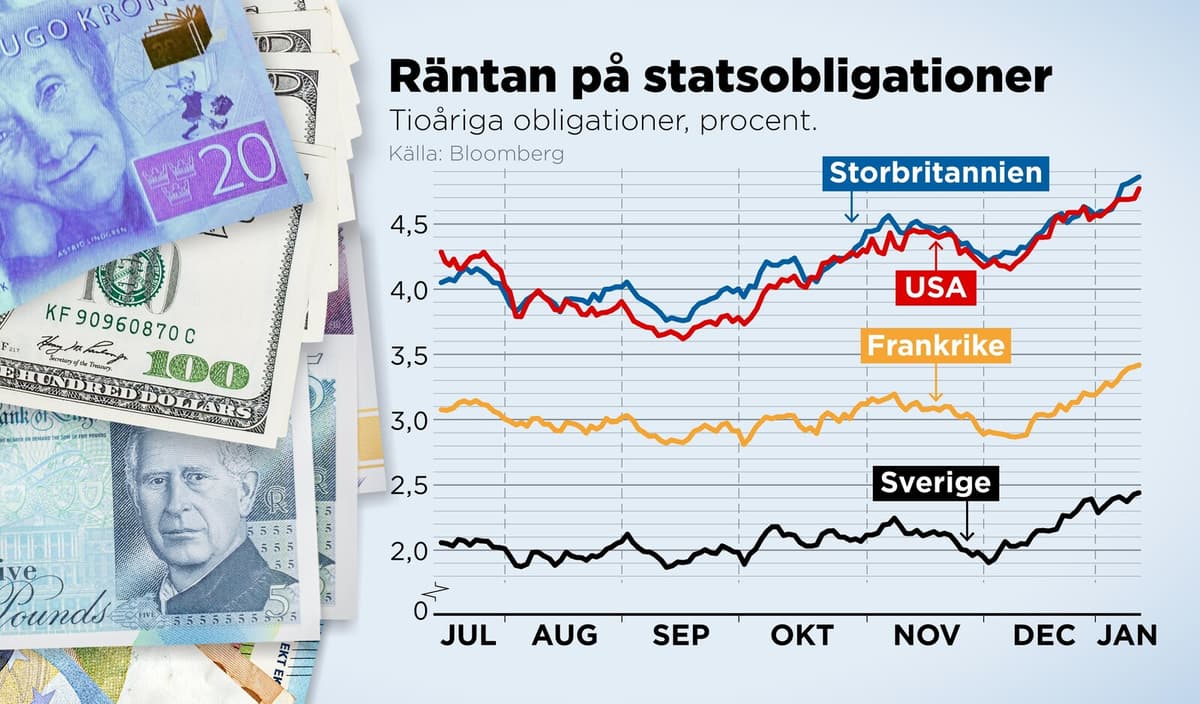

If you follow the trend, we see some kind of bottom for the long bond yields now, says Christina Sahlberg.

The declines have stopped. Some are raising and some are not lowering and are waiting a bit, she adds.

The shift does not apply to floating mortgage rates, which follow the Swedish Central Bank's policy rate down rather than long market rates up at the moment.

"A shift now"

State-owned SBAB, which finances most of its lending on the bond market, went out as recently as Friday with a hike in long mortgage rates by up to 0.20 percentage points. In the motivation for the decision, SBAB CEO Mikael Inglander points to the fact that long market rates have moved upwards.

Smaller players on the mortgage market - such as Landshypotek, Skandia, and Hypoteket - have also raised rates on mortgages with long binding periods recently, according to a compilation made by Compricer.

It's clearly a shift now. But as always, you have no idea where it's going. So much is happening in the world, says Sahlberg.

The US is one step ahead. There, rising long-term rates have already pushed up 30-year American mortgage rates from just over 6 to almost 7 percent in four months.

The rate hike got new fuel from an unexpectedly strong job figure from the US on Friday and after the week's protocol from the US central bank Federal Reserve (Fed). The protocol revealed that Fed members are worried about feared inflation effects from Trump's battery of tax cuts, tariffs, and migration policy.

They have made larger adjustments to their forecasts than expected, says Elisabeth Kopelman, US economist at major bank SEB.

Large budget deficits

Last autumn, the market pricing pointed to perhaps four Fed rate cuts this year. After Friday's job figure, only one rate cut is priced in.

The expected rate cut has also been pushed forward in time, from January last autumn to May-June earlier in the week and finally to September-October after Friday's job figure.

Unusually large budget deficits in the UK and France, combined with significant political and economic uncertainty in Germany, are also haunting the bond market.

The UK is in focus after proposals for higher taxes and sharply increased government borrowing volumes. The British government's 30-year borrowing rate was on Friday at its highest level since 1998.