The number of shareholders in chip manufacturer Nvidia among online broker Nordnet's customers has increased from around 20,000 to 61,000 since the turn of the year.

An increase of a staggering 200 percent just this year, says Frida Bratt.

Extra boost after stock market fall

The development looks similar among online broker Avanza's customers, where the number of Nvidia shareholders has increased by 161 percent to almost 64,400 this year.

At Avanza, Tesla remains at the top among US stocks, with 79,122 owners. But at Nordnet, Nvidia has made a rapid climb to ninth place among the platform's most owned shares, causing Tesla to fall out of the top ten list.

The demand for Nvidia shares among Nordnet's customers received an extra boost in connection with the turbulence on Wall Street in early August, when prices plummeted for, among others, Nvidia itself.

Nvidia's share was one of the most net-bought when it shook the most. It became cheaper. Then we could see that the number of owners took off, says Bratt.

The backlash against the electric car trend around the world and tough competition from China in the global electric car market, combined with many seeing co-founder and CEO Elon Musk as "unpredictable", explain why Tesla interest has leveled off.

Frida Bratt does not believe that Musk's clear support for former President Donald Trump ahead of the US election in November – both in the form of campaign contributions and statements – has affected the development so much. It's about the company's development.

Tesla is valued as a growth company, but the profit isn't growing. How does that add up? asks Bratt.

Tesla has been in the absolute forefront and the valuation is based on the assumption that they will continue to do so. But there are some question marks, adds she.

A quarter of Wall Street's rise this year

Many Nvidia shareholders have bought their shares at a price close to the historical record of $140.76 per share. But tens of thousands have at least been able to follow the year's price increase from $48 to today's price around $130 per share.

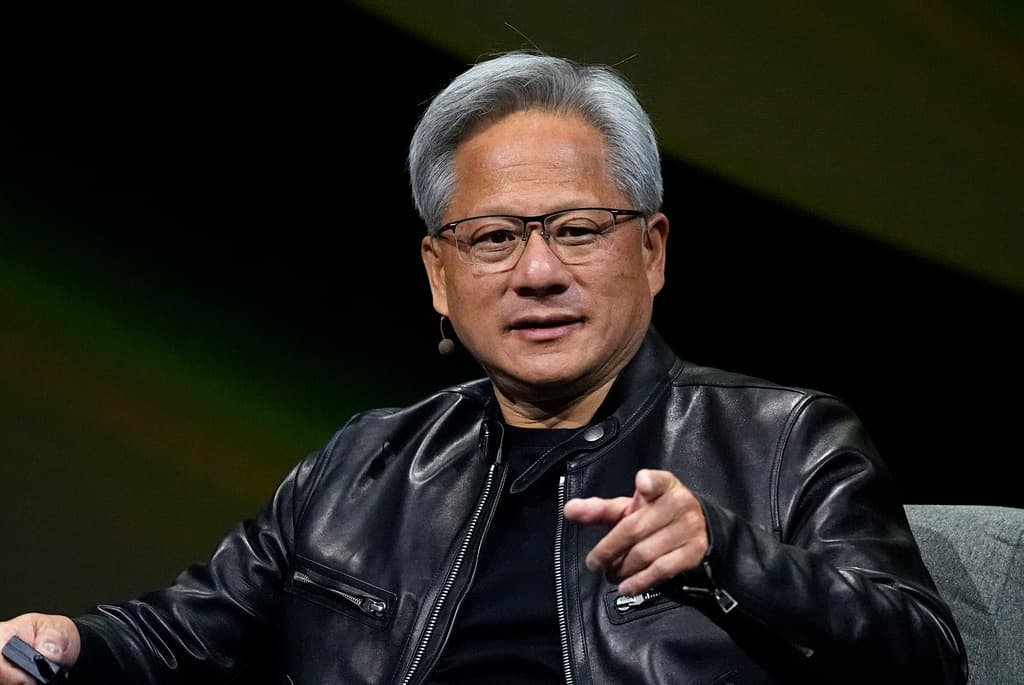

Nvidia – with its eccentric CEO Jensen Huang – accounts for a quarter of the Wall Street index S&P 500's value increase so far this year. And the market value of the entire company is currently up at $3,182 billion (32,460 billion kronor). This has made Nvidia the second-highest valued company on all of Wall Street – after iPhone manufacturer Apple – and over four times more valuable than Tesla.

The California-based chip manufacturer Nvidia is one of the biggest winners on the wave of investments in artificial intelligence (AI) in recent times. And the company has exceeded market expectations in the last six quarterly reports.

Ahead of Wednesday's report, the average forecast for revenue is $28.7 billion, a significant doubling in one year. Net profit is expected to rise to almost $15 billion or 65 cents per share.

Expectations ahead of Wednesday's report have been cranked up this summer since reports from tech giants like Google, Meta, Microsoft, and Amazon – Nvidia's major customers – have continued to make large investments in AI.

Sources: Bloomberg Intelligence, Financial Times

The number of Nvidia shareholders on online broker Nordnet's platform has increased by over 200 percent – from around 20,000 to 61,000 – so far this year. This gives a ninth place overall among Nordnet's favorite shares.

Tesla's share has consequently been knocked out of the top ten list to an eleventh place.

Nvidia has also surpassed the most owned Swedish share, Investor, with 54,000 Nordnet customers as owners.

The five most owned shares among Nordnet's customers are:

Novo Nordisk (Denmark): 162,000 owners

Nordea (Finland): 120,000 owners

Fortum (Finland): 82,000 owners

Norwegian Air Shuttle (Norway): 82,000 owners

Mandatum (Finland): 80,000 owners

Besides tens of thousands of Nordic small investors with direct ownership in Nvidia, all savers with holdings in US funds, technology funds, and global equity funds are exposed to Nvidia's share.

Source: Nordnet