Nvidia's stock was down 7 percent during the night's futures trading after the quarterly report. But it had recovered to minus 2 percent by the start of trading on Wall Street on Thursday.

Nvidia beats expectations. But not with the same convincing margin as in the previous quarterly reports.

The market has become very spoiled, expecting them to beat expectations every quarter. Now they just came in a little better than expected, says Carl Armfelt, manager of the independent technology fund TIN World Tech.

"Really great report, actually"

Manager Johan Nilke of the Lannebo Teknik fund makes the same assessment.

It's a really great report, actually. But the market has become accustomed to Nvidia beating expectations quite significantly, not least in terms of prognosis, he says.

There is still room for growth. Nvidia's stock value surged 239 percent last year. And it has continued to rise 150 percent this year – despite a decline in early August.

In the report, Nvidia downplays production problems with the next generation of AI chips, called Blackwell. They settle for saying that Blackwell sales can bring in "several billion" dollars in the fourth quarter.

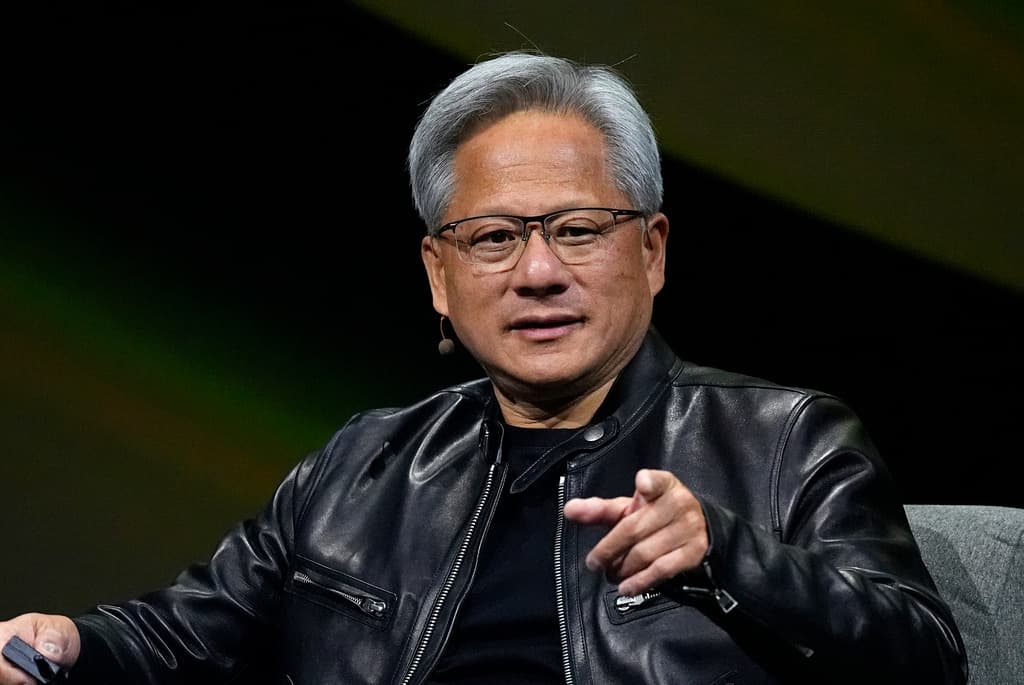

Nvidia's CEO Jensen Huang adds that major customers, such as Microsoft, Amazon, Alphabet, and Meta Platforms, get a good return on their purchases of AI chips from Nvidia from "day one".

Nilke thinks Jensen Huang is expressing himself more vaguely than usual. Among other things, he reacts to "several billion":

What are billions?

And they don't even acknowledge the problems of starting up Blackwell. It's blowing over, they say. Then they say that sales to data centers will "grow quite a lot" next year. It's a bit vague, that everything is just fine.

"Unchallenged number one"

Major semiconductor manufacturers like Intel and AMD are trying to challenge Nvidia and the tech giants in Silicon Valley are searching high and low for cheaper alternatives and their own solutions. But all are technically far behind Nvidia.

Nvidia is unchallenged number one. The other players are not even close, and there are long lead times, says Armfelt.

Both TIN World Tech and Lannebo Teknik have around 4 percent of their holdings in Nvidia shares.

It's not a company you can live without, but in 1-2 years, the risk in the stock is slightly on the downside, says Armfelt.

The American chip manufacturer Nvidia was a leading manufacturer of graphics cards for gaming computers when the AI boom took off. This gave Nvidia a head start when the Silicon Valley companies' competition in artificial intelligence (AI) took off.

Nvidia's sales of equipment to data centers rose to $26.3 billion in the second quarter. Sales of chips to the gaming industry were $2.9 billion. And overall, it was a more than doubling of revenue compared to the previous year. Excluding one-time items, the profit landed at 68 cents per share, compared to expected 64 cents.

In its forecast for the third quarter, Nvidia is aiming for revenue of $32.5 billion. This can be compared to an average forecast among analysts of $31.9 billion, where the most positive forecasts point to $37.9 billion.

The 239 percent surge in 2023 and the more than doubling of Nvidia's stock value this year have made Nvidia the world's second-highest valued listed company after iPhone manufacturer Apple, with a market value of over $3,000 billion.