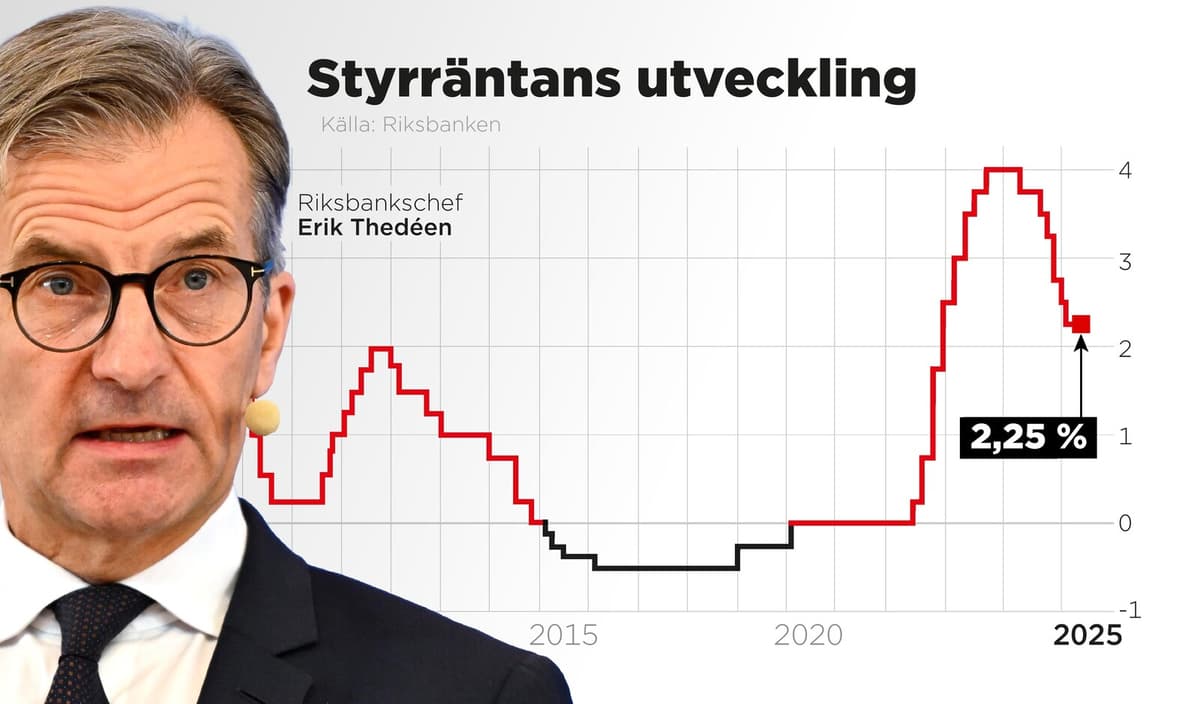

The Swedish Central Bank is expected to decide on an unchanged interest rate on Thursday – just like at the previous meeting.

Swedish inflation has, despite the low economic growth, remained somewhat above the inflation target. And Wednesday's preliminary inflation figure for April from the Statistics Sweden (SCB) to point to continued upward pressure on Swedish prices – at the same time as the economic situation is still very uncertain after the Trump administration's tariffs and sudden turns.

They believe in one or two this year

Analysts expect the SCB report that the so-called KPIF-inflation has risen to 2.5 percent in April, up from 2.3 percent in March. The Swedish Central Bank's inflation target is 2.0 percent.

Highly indebted Swedish households and companies can, however, hope for one or two interest rate cuts later this year, according to the pricing on the interest rate market. This usually pushes down variable mortgage rates.

In the USA, the Fed Chairman Jerome Powell and his direction are expected to leave the interest rate unchanged at 4.25-4.50 percent in the uncertain situation after Trump's tariffs. This despite strong political pressure from President Trump, who has clearly stated that he wants to see interest rate cuts to get the economy going.

British cut expected

The US economy shrank by 0.3 percent in the first quarter and the inflation pressure appears – despite the effects of Trump's tariffs – to continue to slow down.

British borrowers can likely look forward to a cut on Thursday, from today's 4.50 down to 4.25. The Bank of England would, in that case, follow the European Central Bank (ECB), despite the fact that inflation in the UK is clearly above target. The ECB cut its key interest rate to 2.25 percent in April.

Joakim Goksör/TT

Facts: Central banks are preparing interest rate decisions this week

TT

A number of interest rate decisions from central banks are coming this week.

It starts with Pakistan (Monday) and Madagascar (Tuesday). But then it picks up pace:

Wednesday: USA, Brazil, Poland, Georgia, Malawi.

Thursday: Sweden, United Kingdom, Norway, Czech Republic, Malaysia, Uganda, Peru.

Friday: Serbia.

Source: Bloomberg