A customer should choose a pension plan, hire an insurance broker who advises to move money from a traditional insurance to a fund insurance. A piece of advice that risks being misleading and marked by a thicket of interest conflicts, if one believes the results of the analysis presented by the Financial Supervisory Authority of 278 insurance brokers in the country.

The results reveal a risk-prone market where independent, smaller brokerage firms are becoming fewer and larger actors – often with risk capital in the background – have taken a stronger position.

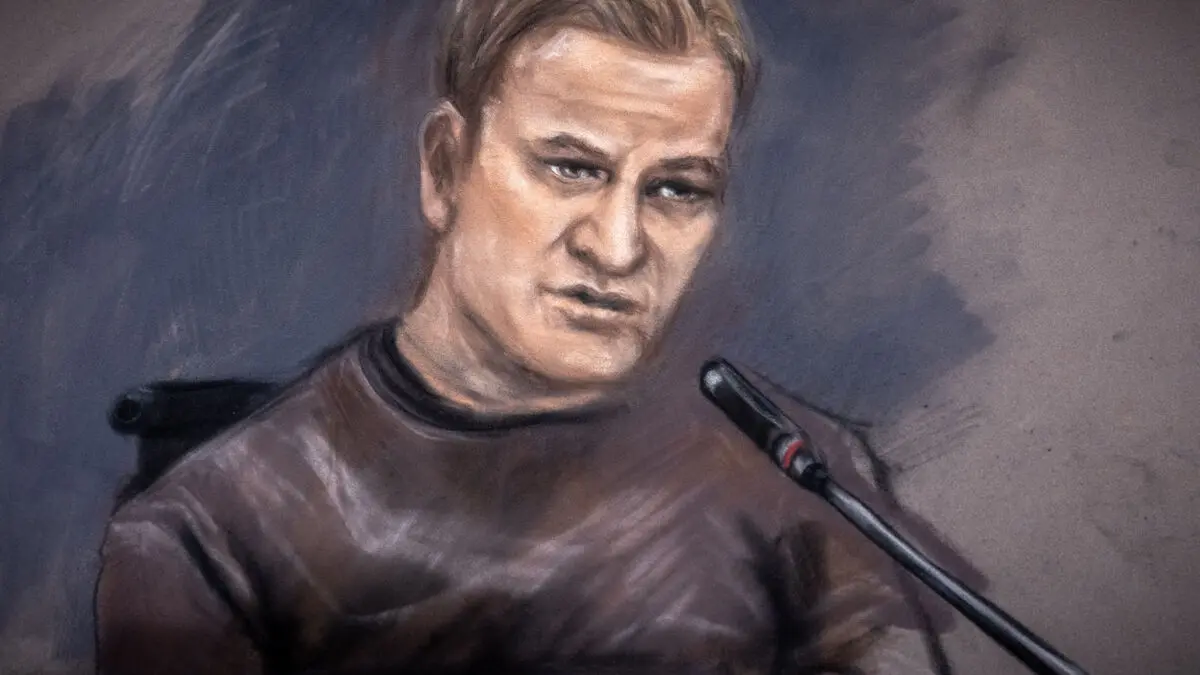

We also see a significant increase in moves between insurance companies, says Daniel Barr.

It is basically good, the Financial Supervisory Authority welcomes competition, he emphasizes.

But commissions, not primarily in the customer's interest, seem to be driving a large part of these moves.

Cross-selling more common

The commission is part of the agreement between brokerage firms and insurance companies.

But the companies are required to suggest products and services that are in the customer's interest. The risk is now that the brokerage firms steer the choices towards the one that pays the highest commission instead of looking at what is good for the customer, he says.

A high risk of interest conflicts also exists on the collective agreement market for pensions in the wake of the fact that it now to a greater extent offers cross-selling, Daniel Barr believes.

You can be persuaded to move your pension to a company and in connection with that get a discount on a mortgage loan. But then the choice may show up to be much more expensive in fees and costs a few years later, says Daniel Barr.

Be suspicious

So how should one think as a customer to not be misled?

You should have a healthy skepticism. The advisor may actually be a salesperson who wants to sell you a product that benefits the advisor more than you, he says, and emphasizes that the fee and risk generally increase if you switch from a traditional insurance to a fund insurance.

His advice is also to ask for proper documentation, written information and to find out what alternatives are available.

Ask how the advisor is paid. Then you can think about how it affects the advice, says Daniel Barr.

An insurance broker must have a permit from the Financial Supervisory Authority and be registered with the Swedish Companies Registration Office. The insurance broker presents information about insurance to the customer before a contract is entered into and generally receives a commission from the insurance company on entered contracts.

Supervisory responsibility for insurance brokerage firms is shared between the Swedish Consumer Agency and the Financial Supervisory Authority.

The Financial Supervisory Authority will now continue to conduct ongoing supervision of companies that have a permit from it. If they see something that needs to be scrutinized more closely, they will start a supervisory investigation. If the investigation shows that a company has committed an infringement, the FI can notify a warning, a warning or ultimately revoke the company's permit.

Source: Financial Supervisory Authority and Swedish Consumer Agency