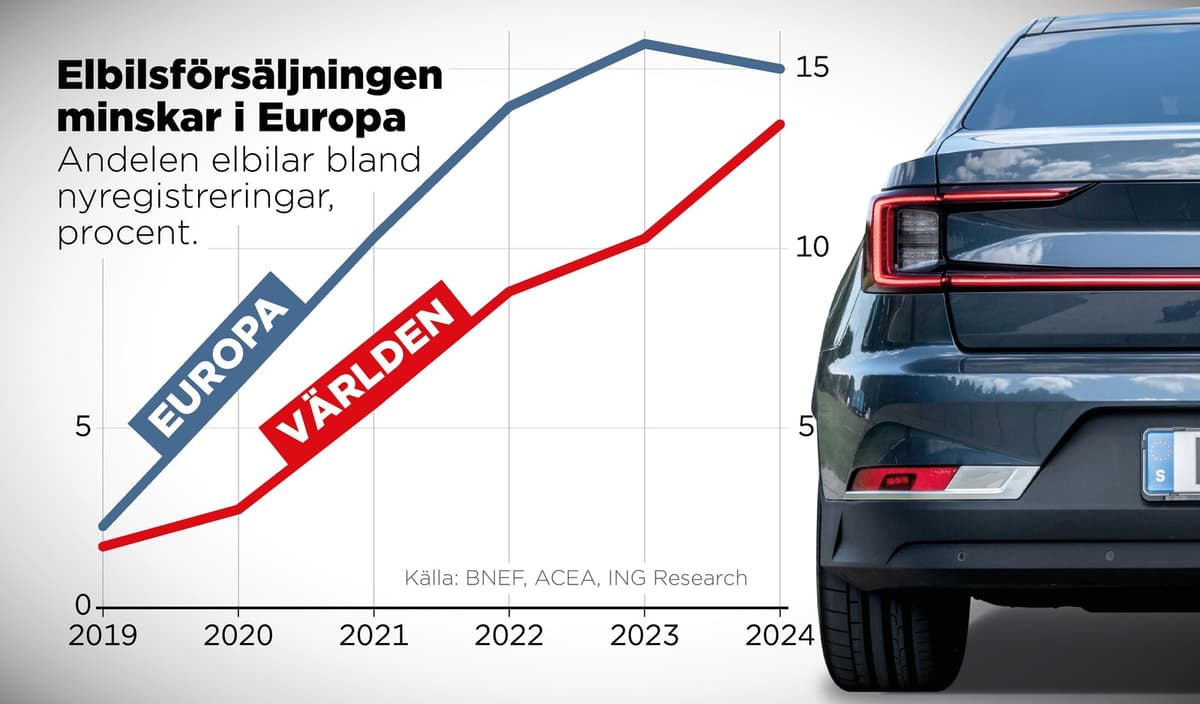

The headwind for the European electric car cluster has been going on for a while. It comes from declining demand in the west, political uncertainty, and tough competition both within and from China.

After the summer, the problems have become increasingly acute. BMW issued a profit warning last week, and a industry index shows that the sector's shares have fallen by 24 percent just since April this year. The largest player, German Volkswagen (VW), is record-low valued on the stock exchange and has for the first time ever opened up for the possibility of closing down factories in its home country Germany.

Layoffs

Various production targets have also been adjusted. Volvo Cars recently scrapped the goal of phasing out fossil-fueled cars from production by 2030. The news was an echo of similar news from some of the world's largest car manufacturers: VW, Mercedes-Benz, and Ford. Additionally, truck giant AB Volvo paused a battery project in Mariestad on Friday.

Battery manufacturer Northvolt is another Swedish-based player in the electric car cluster with obvious problems. The company has recently flagged paused investments, possible divestments, shutdowns of units, and layoffs – including at the large factory in Skellefteå.

Unprofitable factories and projects within the electric car industry that lack a capital buffer are living dangerously right now.

They risk being knocked out, says Mikael Östling, professor of electronics at the Royal Institute of Technology (KTH).

Then it will start again. That's how it looks in all financial fluctuations, he adds.

Overproduction in China

Professor Anders Nordelöf at the Swedish National Road and Transport Research Institute, who focuses a lot on battery production, also tones down the drama despite all the setbacks.

There is nothing to suggest that electrification is slowing down from a broader perspective, he says.

According to Nordelöf, Northvolt's and other European players' problems can be explained by tough competition from Asia, where China has invested in overproduction of cells for car batteries and secured supplies of raw materials. China is also technically far ahead in battery technology.

It's hard to get it right and bring home new orders and investments with the incredibly strong development that has been in China, he says about Northvolt's situation.

Jens Hagman, researcher at the state institute Rise, doesn't know if you can call what's happening in the electric car sector right now a crisis. Rather an adjustment to a downturn.

The high interest rate environment hits electric cars harder than fossil-fueled ones. Electric cars are normally more expensive, and many finance their car purchases through loans, according to Hagman.

"What should politics do?"

Car buyers in the west who hesitate to switch to electric are also an important factor. It's about political winds, attitude, but also about how the infrastructure for battery charging looks.

The first wave of electric car buyers – we see in Sweden and Norway – are primarily villa owners with a slightly better economy. The second wave is maybe a bit harder to get going than the first, says Hagman.

Access to reasonably priced charging is crucial, he believes.

If everyone is to have an electric car, it means everyone, including those who don't have charging opportunities at home, says Hagman.

KTH professor Mikael Östling – who expects new fossil-fueled person cars and so-called plug-in hybrids to be sold for many years to come – agrees.

It's a big question. What should politics do? Who should ensure that there are charging points? And what should you pay? says he about the charging conditions for households in apartment buildings.

He also believes that many hesitate to buy electric cars due to so-called "range anxiety".

Consumer behavior takes time to change, says Östling.

"Jobs are what matters"

For European electric car manufacturers, there are also other dark clouds on the horizon. They are threatened by billion-dollar fines if they don't meet the EU's stricter emission regulations by 2025. And there is a high risk that they will be squeezed when China responds to the punitive tariffs on Chinese electric cars that the EU has flagged.

It's clear that jobs are what matter in Europe. That's how it is. The automotive industry is large – not least in Germany, says Hagman.

At the same time, the three large German manufacturers – VW, Mercedes-Benz, and BMW – sell more than every third car in China.

Geopolitics is important. It's not just about price and lowest production cost anymore. It's about where production takes place. It's strategically important, adds Hagman.