Interest in global funds and US funds has grown significantly in popularity when Swedes save their money.

At online broker Nordnet, a clear trend towards wanting more of the US in their savings can be seen. The number of owners of US funds has increased by 36 percent this year at Nordnet.

It follows very closely how the American stock exchange has performed compared to the Swedish stock exchange, says Frida Bratt.

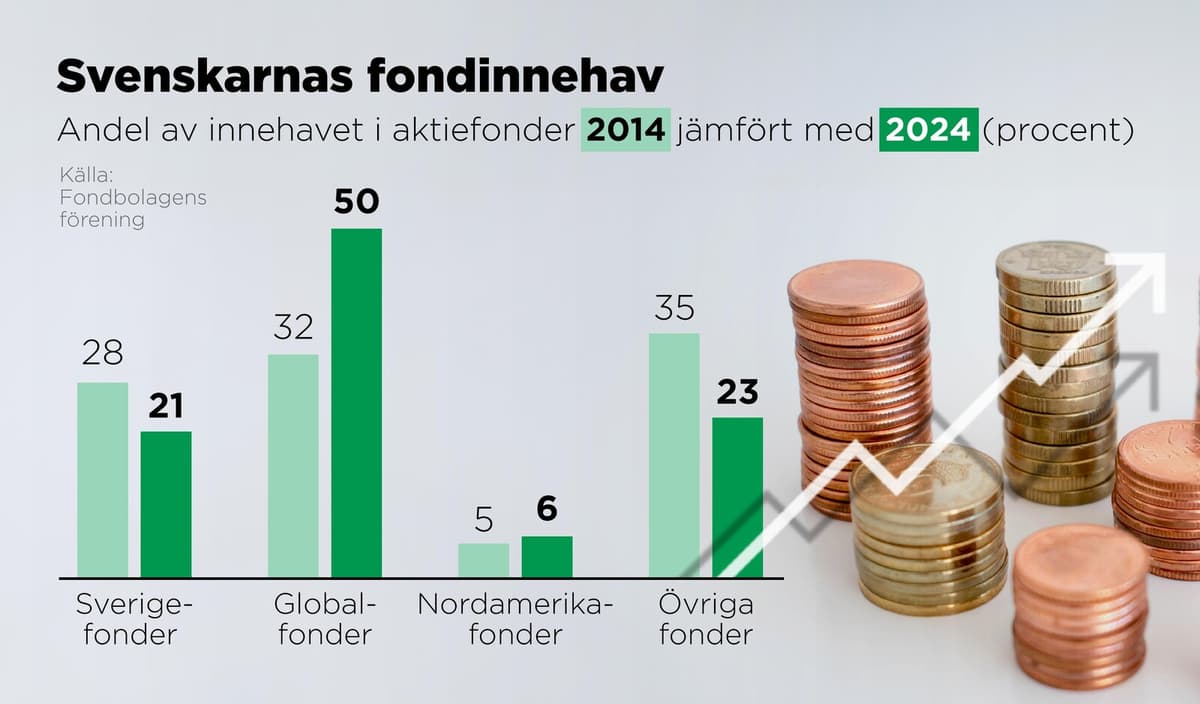

Ten years ago, 28 percent of Swedes' savings were in equity funds in Swedish funds, now it's 21 percent, according to the Swedish Investment Fund Association.

The S&P 500 index, with the largest listed companies in the US, has risen 193 percent over the past ten years. This can be compared to the broad OMXS index on the Stockholm Stock Exchange, which has risen 75 percent during the same period, according to Nordnet.

Well-known companies

Furthermore, a clear dollar strengthening can be seen, which has given extra fuel to US savings.

Savers are very aware of this currency effect.

Interest in the US is also spelled tech. The fact that the large tech giants, which have been strongly driving the stock market upswing in the US, attract can be because many Swedes can relate to them, Bratt believes. More than large companies found in Sweden.

These are companies that feel like home to us. We come into contact with the companies' products, a lot is written about them.

The fact that interest in the US has become greater does not mean that Swedes have abandoned Sweden. Among the ten most owned funds by Avanza's customers, the first two are Swedish funds. Then come, among other things, global funds and US funds.

Unchallenged number one

According to Avanza's savings economist Philip Scholtzé, it has so far this year been a clear advantage to have one's money invested globally rather than in Sweden. Several global index funds are up over 30 percent this year. For a Swedish fund that follows the index, it's about 10 percent.

Both Avanza and Nordnet emphasize, however, that as a saver, one should be aware that global funds, despite their name, are heavily focused on the US, and not least on a few larger companies.

The concentration has become enormous on the US because the US has done well, with technological development and the large companies. Tech companies have really exploded and driven, not just the American but also the whole world's development.

This in itself does not have to be bad:

But one should be aware of what one is investing in, he says.