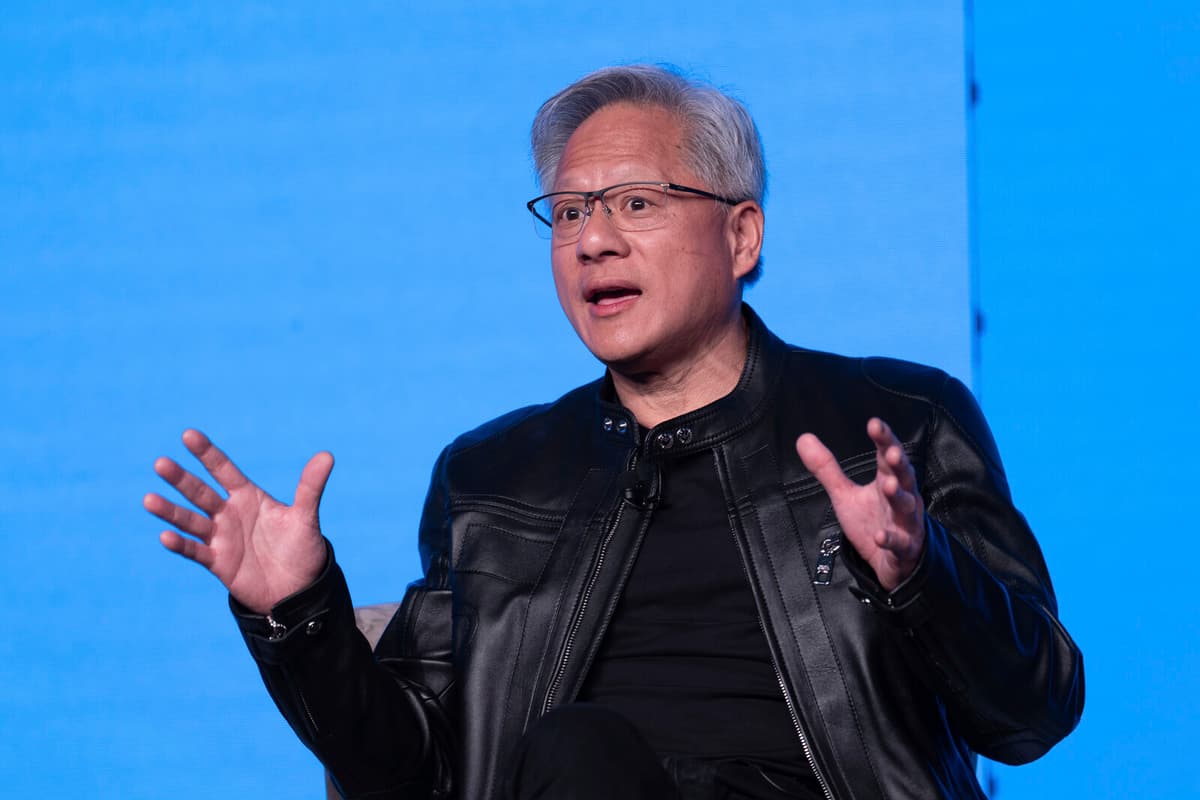

Trade and geopolitical tensions between China and the US are causing problems for Nvidia, with its founder and CEO Jensen Huang.

Sales in the second quarter, which ended on July 28, increased by 56 percent to $46.7 billion. The profit for the quarter amounts to $1.05 per share. Both sales and profit were slightly above the average forecast among analysts.

Fell after the report

From the quarterly report - presented after the close of trading on Wall Street on Wednesday - it also appears that Nvidia during the current quarter, which ends in October, sees continued growth ahead. Nvidia's forecast points to a sales increase to $54 billion.

But China is not included in that calculation. And since the forecast signals a slightly lower growth rate, there is now a concern among investors that the two-year boom in AI investments around the world will slow down.

Nvidia's share fell by about 3 percent in futures trading after the report, but recovered before the opening of the stock market in New York on Thursday.

And analysts see continued upside in the stock, with 72 buy recommendations, 7 saying hold and a single sell recommendation. Ten analysts have also raised their target price for the stock since the report, according to Bloomberg.

15 percent to the US treasury

The Trump administration earlier this year banned the export to China of Nvidia's so-called H20 chips, which were developed specifically for the Chinese market. Nvidia has made a deal with the Trump administration in August and got the green light for sales in China again, on the condition that 15 percent of the revenue goes to the US treasury.

The detailed rules for how this tax on China sales will work are not yet clear.

According to Nvidia's CFO Colette Kress, Nvidia, in addition to the $54 billion in sales that are already included in the company's forecast for the current quarter, may add $2-5 billion in H20 sales to China - if the specific regulation comes into force.

Fact: The world's most valuable listed company

TT

American Nvidia - manufacturer of graphics cards and processors for artificial intelligence (AI) and machine learning - has with a stock market increase of around 35 percent this year reached a market value of staggering $4,428 billion. The company is thus by far the most valuable listed company in the world.

But large price falls in Nvidia's share can have a major impact on the stock market climate in general and not least hit all small investors who have invested in technology, US or global funds.