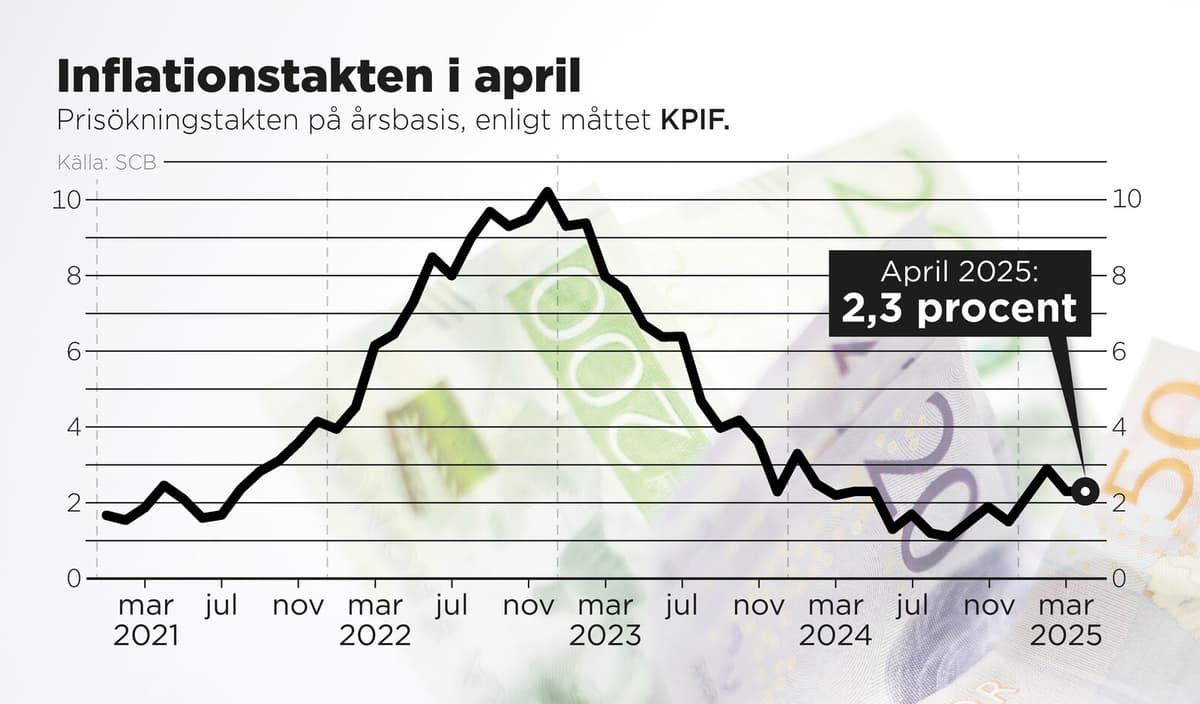

Inflation according to the KPIF measure was unchanged at 2.3 per cent in April – the same level as in March, shows a first calculation made by Statistics Sweden (SCB).

The underlying inflation, adjusted for energy prices, is however higher, above 3 per cent, which is still too high for the Swedish Central Bank to consider a rate cut, says Susanne Spector, chief economist at Danske Bank.

Which is still too high for the Swedish Central Bank to consider a rate cut, says Susanne Spector, chief economist at Danske Bank.

So, there will be no rate change?

No, these figures confirm the Swedish Central Bank's prognosis. So, this does not really change anything when they go into today's meeting, says she.

Not so weak

And the economy is not so weak that the Swedish Central Bank would act proactively and cut rates now, according to Spector, who believes that the Swedish Central Bank will keep the rate at 2.25 per cent throughout 2025. Several other bank economists, however, believe in one or two rate cuts later this year.

Jens Magnusson, chief economist at SEB, thinks that today's inflation figure is good news but something that will not prompt the Swedish Central Bank to cut rates in the current situation.

It will probably not affect the Swedish Central Bank's decision tomorrow, but it will be easier to open up for future cuts when there was a good figure today, says Jens Magnusson, who believes in a cut later this year.

Lower than expected

Analysts had expected the KPIF inflation would increase to 2.4 per cent in April, according to a compilation of forecasts made by Bloomberg.

In the KPIF measure, which is the one the Swedish Central Bank uses in formulating its inflation target, the effects of mortgage rates on inflation have been adjusted for.

If you include mortgage rates, inflation – according to the KPI measure – fell to 0.3 per cent in April. This can be compared to 0.5 per cent in March and an average forecast of 0.5 per cent also for April.

Swedish market rates and the krona did not move significantly after SCB presented the figures for April.