This is the meaning of the Fondtorgsnämnden's latest procurement, where the fund jungle is being cleaned up. The Fondtorgsnämnden is the authority that procures the funds in the premium pension system (what is usually called PPM funds).

Now, the board has announced two decisions that affect both actively managed Sweden funds and Sweden index funds (passively managed), with a total of over one million savers.

Reduce fees

The idea is, among other things, that fewer funds will provide economies of scale that can reduce costs and thus fees for savers.

The number of actively managed Sweden funds will be more than halved, from 22 to ten funds. All savers are affected in such a way that all affected 570,000 who have an actively managed Sweden fund on the fund market will receive a halved fee, from approximately 0.3 to 0.15 percent on average.

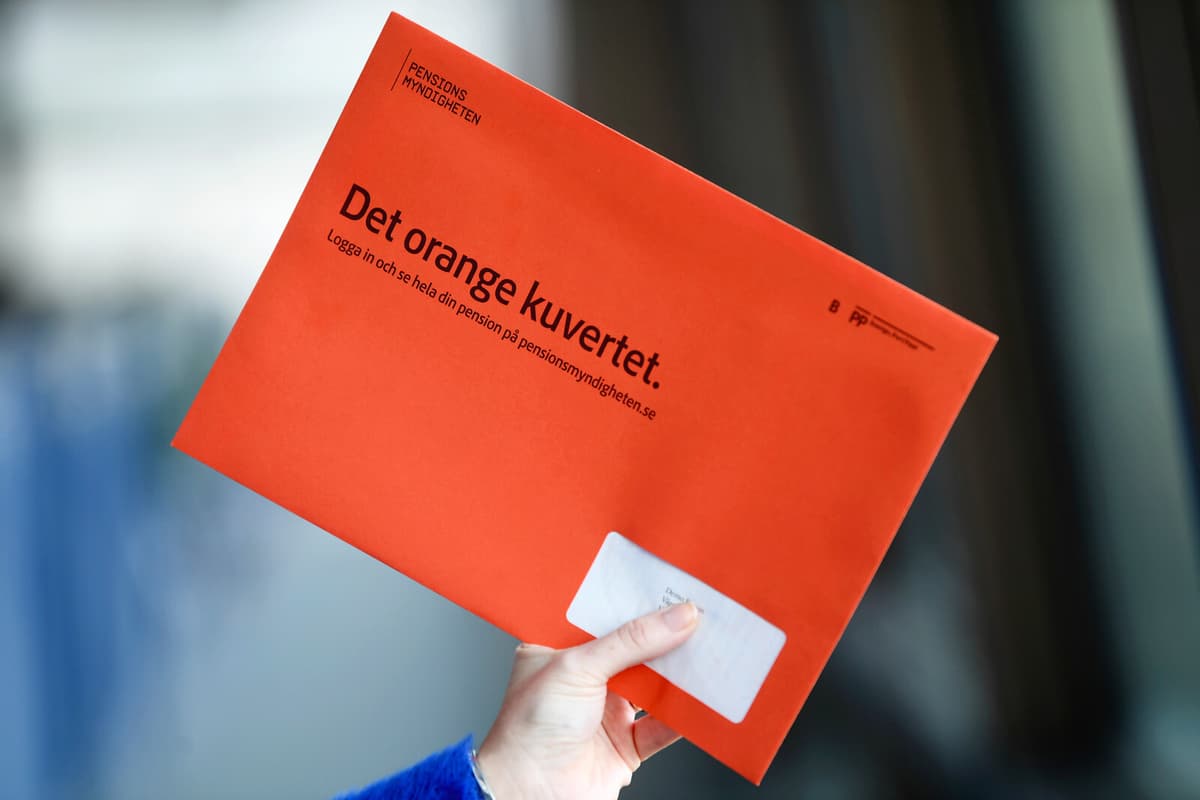

The other effect is that approximately 140,000 savers will lose their fund, which will disappear. They will receive a letter where they are offered to switch to another fund. If nothing is done, they will be automatically transferred to another equivalent fund.

Fewer index funds

In the same way, the Fondtorgsnämnden has trimmed the range of passively managed Sweden funds, so-called index funds. Here, the number has gone from eleven to five, and approximately 450,000 pension savers are affected. Among the funds that disappear are Avanza Zero and Storebrand Sverige. The winner in the index fund segment will be Handelsbanken with three out of five selectable funds.

Even here, the average fund fee is reduced, from 0.13 to 0.04 percent on average. But there are those who will get a higher fee because the largest fund with zero fees did not submit a bid in the procurement, writes Fondtorgsnämnden.

Further procurements of other fund types are ongoing or have been decided previously.

The pruning in the procurement process, where fund managers have applied for a place on the fund market, is based on quality and price, where the former has greater weight.

Quality is based on the fund manager's ability to create good returns for savers, says Viktor Ström, communications manager at Fondtorgsnämnden.