Recently, the financial families Ax:son Johnson, Persson and Wallenberg, through their foundations, invested 300 million kronor in the renovation of the Royal Opera.

But Sweden is worse than its Nordic neighboring countries when it comes to private contributions to the cultural sector. The government wants to change this. By introducing tax relief for both private individuals and companies, more people will be encouraged to donate money.

Matching system

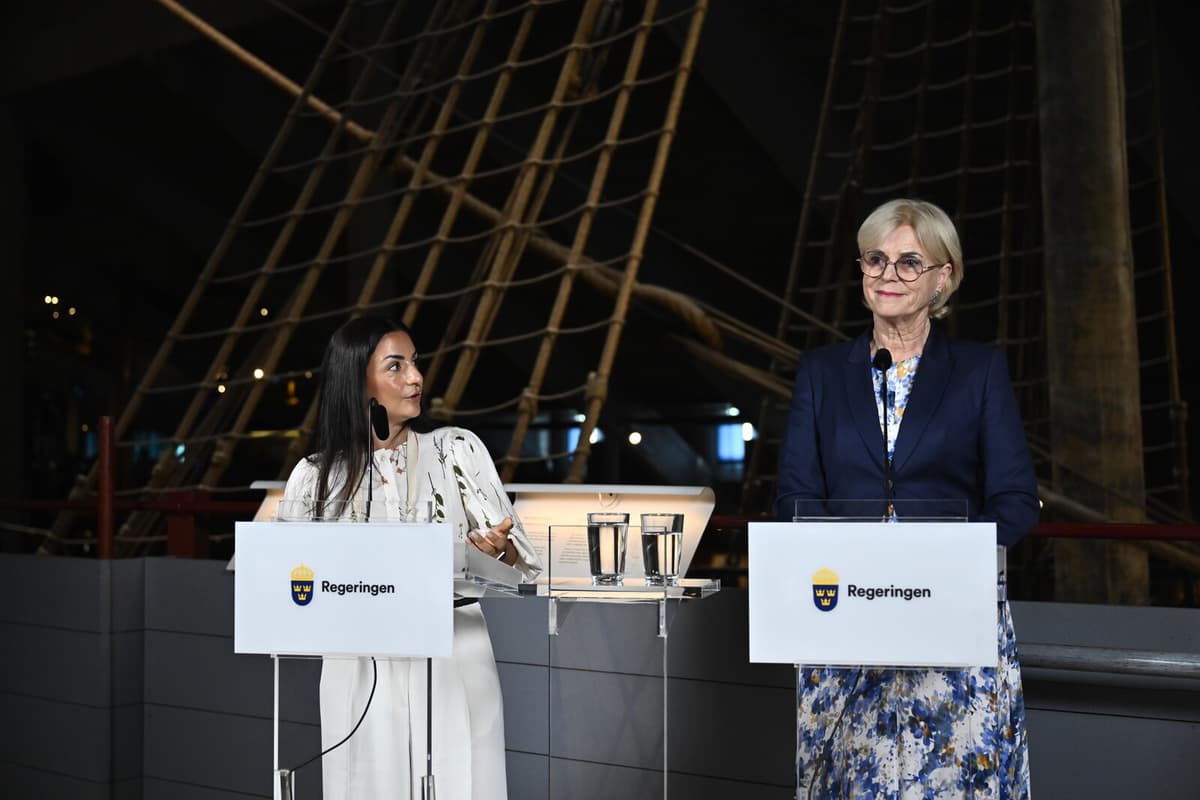

An investigation led by Karin Forseke is now being launched to examine how this will be done. The investigation will be completed in May 2026.

Parisa Liljestrand emphasizes that private funds should not replace public funding, but rather be seen as a supplement.

I think that with broader financing, the total share of money for culture can increase, if we can also extend the incentives for private giving, says Parisa Liljestrand.

In addition to tax relief, the investigation will also analyze the possibility of introducing a so-called matching system, where the public sector strengthens individual private donations.

Breadth

Patrons and entrepreneurs want to be seen at large institutions, such as the Royal Opera and the Vasa Museum. How will the matching system then affect the balance, so that, for example, smaller theater groups and others can also benefit from this?

The idea is precisely to enable giving across a broad spectrum. We don't have to look further than our Nordic neighboring countries to see examples of similar systems. It's not as if it's restrictive or solely aimed at larger institutions, says Parisa Liljestrand.

In the USA, the federal government, on the orders of President Donald Trump, has cut back on allocations to public cultural activities and public service. Parisa Liljestrand believes that it is good if Swedish cultural institutions increase their independence.

It applies regardless of whether one is a cultural institution or a private person or some other form of institution. If one has funds from one source of income, one is more vulnerable than if one has sources of income from several.

Sara Haldert/TT

Mikael Forsell/TT

Fact box: Gifts and taxes

TT

Already today, it is possible to get a tax reduction of 25 percent on gifts of up to 12,000 kronor, but only to social welfare activities and scientific research in foundations or organizations approved by the Tax Authority.

According to Parisa Liljestrand, gifts to culture may be included in the future, although it is unclear whether the amount should be increased.

"One can say that it is probably that part of the tax legislation that we are also taking a stand against. And it is from this that the directives are written. The idea is that the investigation should be able to look at. How can one work culture into that part? Then the investigation will have to work on it so we see what they come up with", she says.