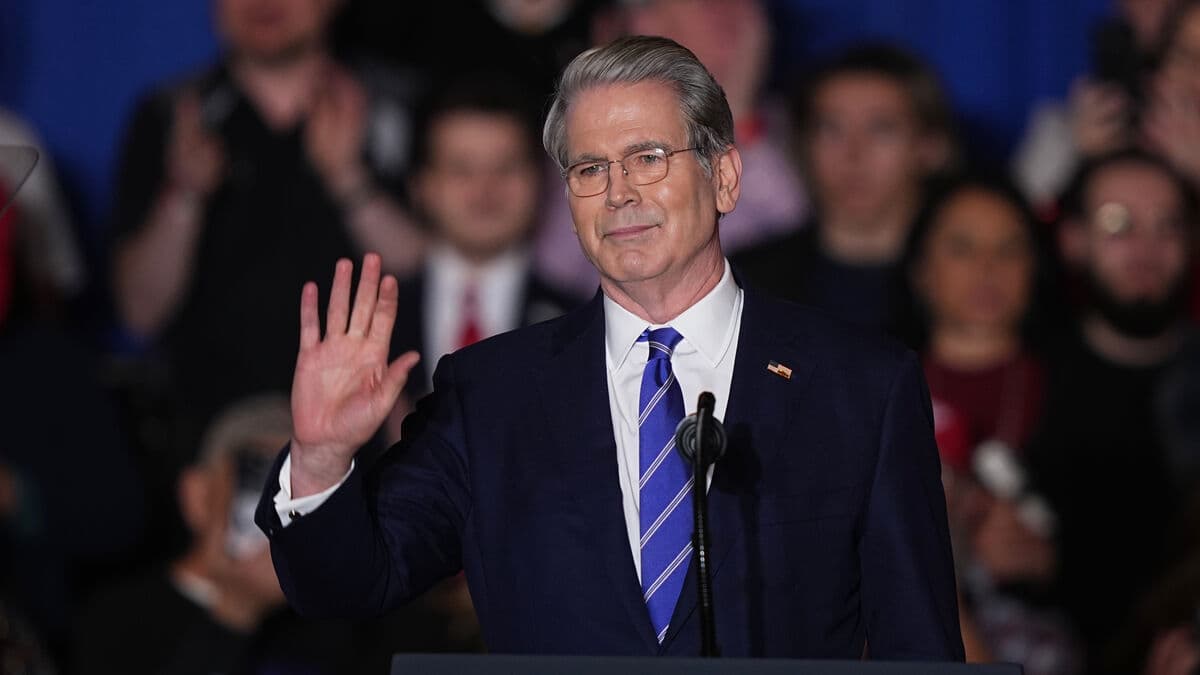

US Treasury Secretary Scott Bessent calls the new agreement, agreed to by nearly 150 countries, "a historic victory for preserving US sovereignty and protecting American workers and businesses from extraterritorial dominance."

The original 2021 agreement, negotiated through the OECD by the US, EU, UK, South Korea, Japan and Canada, was intended to prevent multinational companies from shifting profits to tax havens such as Bermuda and the Cayman Islands to pay lower corporate taxes.

Former President Joe Biden's Treasury Secretary Janet Yellen was instrumental in brokering the deal, which has now been watered down by Biden's successor, Donald Trump. Shortly after taking office in January last year, Trump ordered officials at the US Treasury Department to develop "safeguards" to stop countries from levying "extraterritorial fees" on US multinationals.