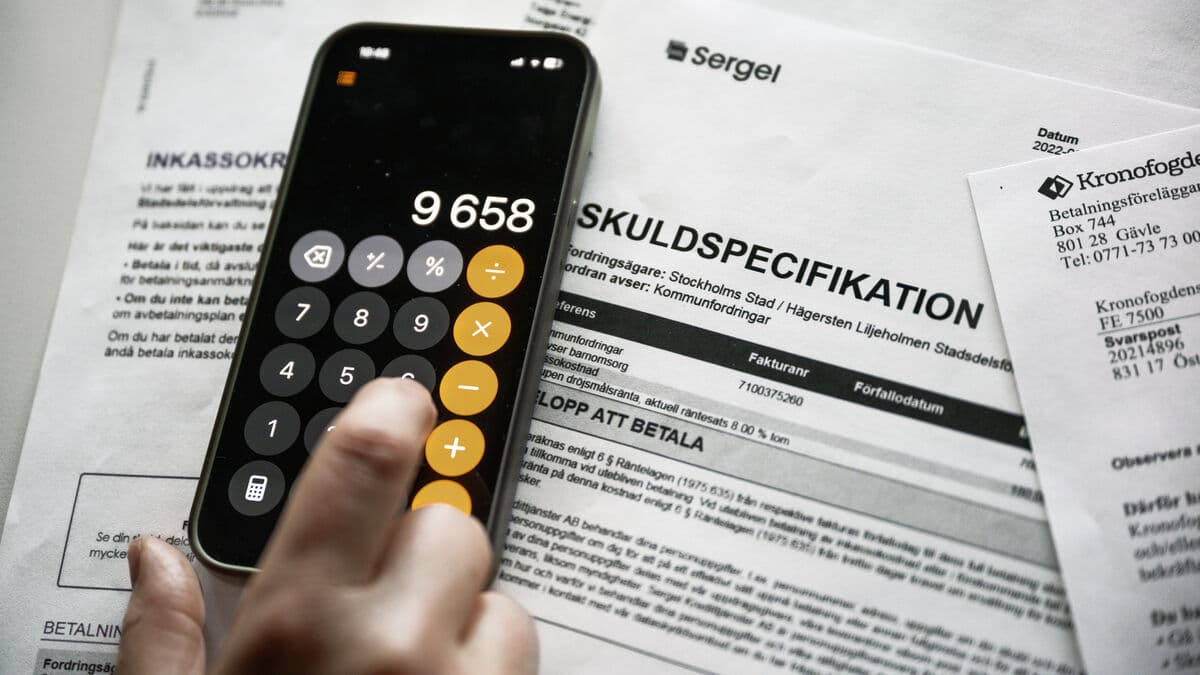

Preliminary annual statistics produced by the industry association for TT show a significant decline. In total, there will be just over 7.9 million new debt collection requests in 2025, a decrease of 12 percent compared to the previous year.

The explanation is the general economic situation, says Fredrik Engström, lawyer and chairman of the Swedish Debt Collection Association:

This is due to the prolonged recession that has been going on for a long time and which has reduced households' purchasing power and willingness to buy, as well as their ability to pay.

Reduced consumption

A clear sign of this can be seen in e-commerce, where reduced consumption has now led to fewer debt collection claims.

People still have needs for certain things, of course: you have to pay your rent, your electricity bill and your mobile phone subscription. We don't see any major reduction in the number of debt collection cases there, but the reduction is on this regular consumption side.

The statistics are now being reported at the same time as the parliamentary decision to completely phase out the interest deduction on unsecured loans comes into effect.

For the individual consumer, this type of loan will therefore be more expensive because consumers will not receive a tax deduction on their tax return. The change is politically motivated by the fact that fewer households will be interested in such loans, thereby reducing the risk of over-indebtedness.

Fredrik Engström, however, shares the view of, among others, the Swedish Financial Supervisory Authority (FI), and is critical:

The interest deduction in particular has been a lifeline for many people who have been on the verge of asking, "Will I be able to pay my bills or not?" By abolishing the interest deduction for unsecured loans, all credit agreements, even older ones still in effect, will become more expensive for all private individuals.

A potential increase

For example, FI had wanted the abolished right of deduction to apply only to new loans, or alternatively for there to be an extended phase-out period. The agency estimates that 30 percent more borrowers could now have debts with the Swedish Enforcement Authority. Fredrik Engström shares that view.

We are relatively convinced that it will lead to more people falling through the system, ending up with collection agencies and the Enforcement Authority because they cannot meet these margins. We believe it will have major effects.