It was a shaky year for the stock market, but share savings increased in Sweden in 2025, and more Swedes than ever owned shares. The largest ownership group is the 31-40-year-old age group, which now takes the top spot from the 51-60-year-old group.

Although the age groups share many favorite stocks, their stock choices differ.

"There are usually a lot of companies that are quite new that appeal to younger groups. If you look at older age groups, you generally find companies that have been around for quite a long time," says Krister Modin, analyst at Euroclear Sweden.

80-year-olds are betting

The group increasing the most, both in number and in percentage, is those aged 81-90. More and more people in their 80s are starting to save in stocks.

"We can note that, as a curiosity, there have been quite a few additions in that age group. It is a bit difficult to say exactly what is behind this increase, but it is interesting," says Krister Modin.

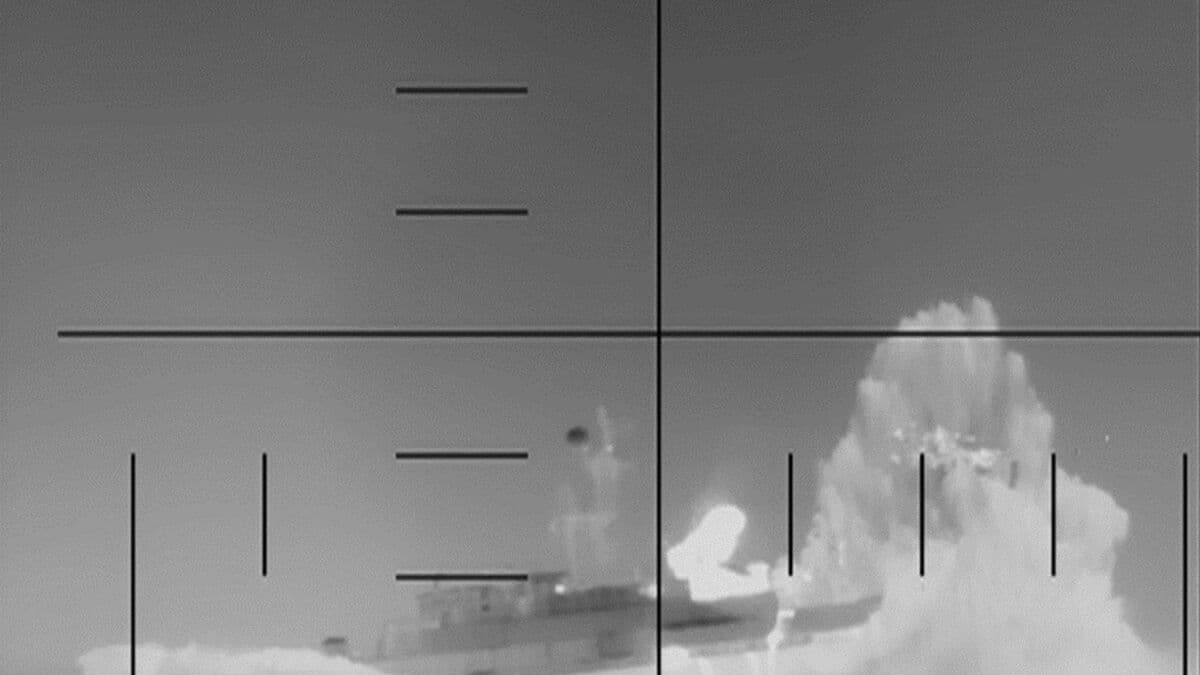

Many of the new shareholders in the older age category are investing in the defense group Saab, among others. Saab is also the stock seeing the largest increase in new shareholders. The stock is now the sixth most common in Swedes' portfolios, up from 12th place in previous years. The most popular stock is still Investor.

Generation Z is leaving

Among younger 26-30-year-olds, some have chosen to leave the stock market. In 2025, there were 20 percent fewer people in that group on the stock market compared with the peak year of 2021.

"There were a lot of young people who invested in companies that maybe didn't always do so well, and that can affect the willingness to invest more. Depending on what kind of journey you've had, it may have led you to decide not to be involved," says Modin.

But while more Swedes own shares, portfolio diversification is decreasing somewhat, and share investors had an average of only 4.8 companies in their portfolios. One reason for the decline in the number of companies may be that shareholders feel compelled to sell certain shares. Among the most sold shares last year was the housing company SBB.

"When you follow over time, you see that you often buy almost at the top and sell almost at the bottom, because you don't have the opportunity to follow all the way out and wait for an uptrend again," says Modin.

1, Investor: 692,800 shareholders

2, AB Volvo: 423,100 shareholders

3, Telia: 416,300 shareholders

4, Swedbank: 281,800 shareholders

5, Ericsson: 371,400 shareholders

6, Saab: 296,200 shareholders

7, SEB: 291,300 shareholders

8: Handelsbanken: 267,600 shareholders

9, SSAB: 266,300 shareholders

10, H&M: 198,600 shareholders

Source: Euroclear