"Nvidia delivers a nice report again. Expectations are always high, but they are being beaten again," says Maria Landeborn, senior strategist at Danske Bank, to TT.

The company's profit for the latest quarter was $1.30 per share, compared to an expected $1.26, according to a Bloomberg report. This was while the company's revenue was $57 billion (expected $55.2 billion).

More importantly, however, is the guidance for the current quarter, especially after the market turmoil of recent weeks where there has been speculation about an AI bubble ready to burst.

Sales are picking up

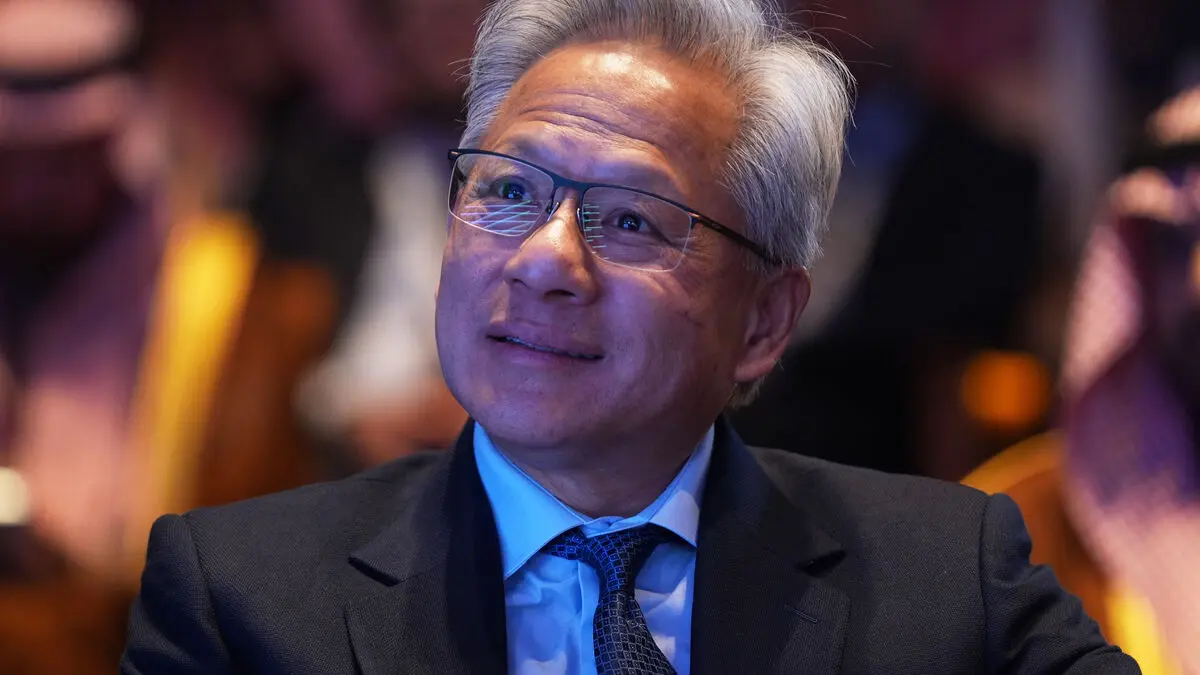

Here, the company estimates that sales will rise further, to $65 billion, also above market expectations. CEO Jensen Huang himself played down concerns about an AI bubble in the analyst and media conference:

There has been a lot of talk about an AI bubble. From our side, we see something completely different, says Huang, highlighting that, for example, the company's GPUs (specialized processors) "are sold out."

Maria Landeborn points out that it was not entirely surprising that the quarterly figures were so strong, as several of Nvidia's customers have already reported strong quarterly reports. This makes the forecast for the future all the more important.

"If you look at the report, you see that demand for Nvidia's chip is intact. The report can now contribute to calm in the market. It confirms the picture of sky-high demand," she says.

The stock is rising

The stock rose 6 percent in after-hours trading on the New York Stock Exchange. At the same time, the stock has risen a staggering 1,300 percent over a five-year period.

The revenue forecast of $65 billion in the fourth quarter is also a full ten times higher than the company's sales three years ago.

However, Maria Landeborn highlights that there are still question marks.

It's about the huge investments that American companies are making that span several years into the future. Then there's also talk about the lifespan of Nvidia's chip, how much depreciation will be made and how many updates to the chip are needed.

Another issue has also been the geopolitical challenges between the US and China and how it affects the company's sales.

The company's CFO Colette Kress admits that it did not have any meaningful business activity in China in the last quarter due to "geopolitical challenges and increased market competition."