Market concerns last year about a potential AI bubble have subsided somewhat. The fundamental issue right now is instead the enormous investments that companies are making in data centers, the infrastructure that AI services require, according to Landeborn.

"It's already a huge cost for them, and it will increase further in the future. The question is whether they will get enough profitability from it to be able to recoup the huge investments they are making," she says.

So far, companies have generally delivered above analysts' expectations in the AI sector - which has led to increased investment plans.

"I think it will be a question of evidence now, quarter by quarter. If it starts to appear as a general sign that the giants continue to plow money in but that growth is peaking, or that growth is not as high anymore, then we will see new concerns in big tech stocks."

$540 billion

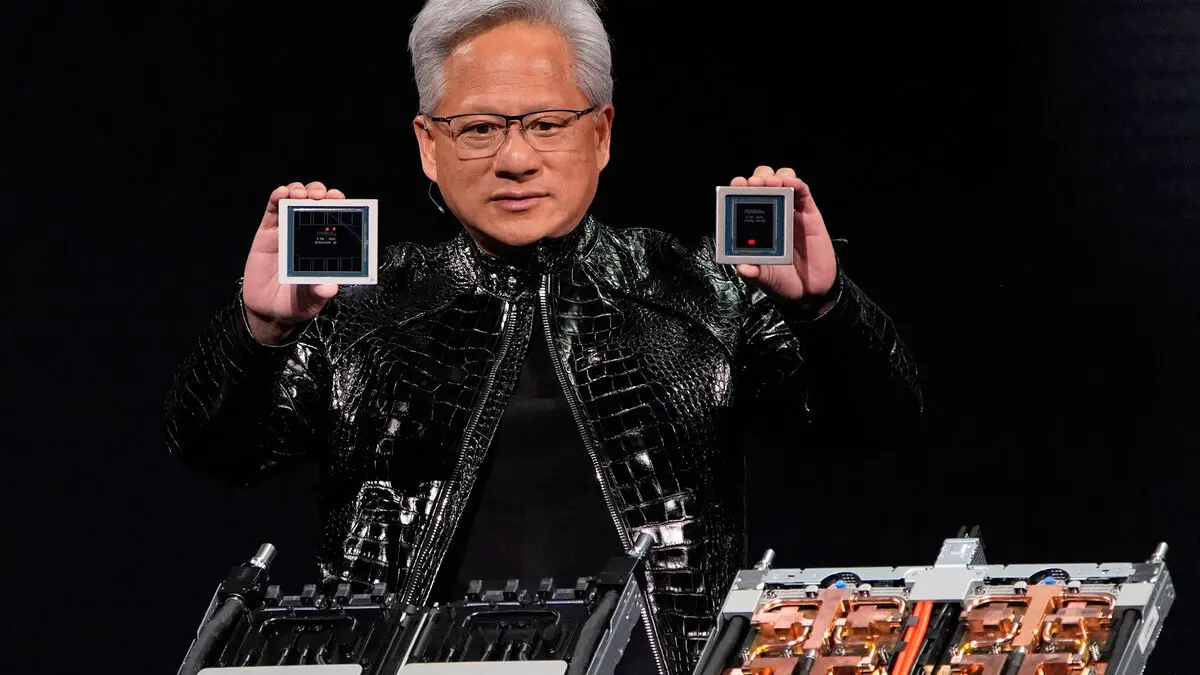

While Nvidia produces the advanced chips and processors needed for AI, other tech giants are building data centers en masse. Amazon, Meta, Apple, Alphabet and Microsoft are planning investments totaling $540 billion this year, according to a compilation by Danske Bank. This is on par with Germany's historic infrastructure investment, which spans twelve years.

But it's not all about the giants.

"Going forward, one can imagine that the biggest winners will not be the tech giants, but the companies that can use the services they offer to grow and create profitability," says Maria Landeborn.

A risk for companies is the rapid development of technology, meaning already-built data centers will need to be upgraded.

"You don't really know what the lifespan is and how quickly you will need to replace chips and components. Investments will be written off, and you will need to keep putting in new money."

Cross-investments

At the same time, everything is built on a circular economy, where tech companies directly or indirectly invest in each other. Maria Landeborn sees the cross-investments as a warning sign.

"This potentially helps to inflate the turnover and income of the companies. It also leads to interdependence. If one company does not live up to its commitments, it affects the next company in the chain."

Joakim Magnå/TT

Facts: When tech companies report

TT

Wednesday, January 28: ASML Holdings, Microsoft and Meta

Thursday, January 29: Apple

Wednesday, February 4: Alphabet

Thursday, February 5: Amazon

Wednesday, February 25: Nvidia