This is what he says despite the fact that inflation rose and was also higher than average expectations. His motivation for still increasing the likelihood of a rate cut is that the difference from the Swedish Central Bank's forecast has now decreased.

But inflation is still higher than the Swedish Central Bank's target and Nordea is still sticking to its assessment that the Swedish Central Bank will not cut interest rates.

Deputy Governor of the Swedish Central Bank Per Jansson says in a speech on Wednesday that there are signs that the summer's high inflation is temporary, writes Bloomberg.

"Some good news"

According to Jansson, the August figure for core inflation (KPIF-XE), i.e. KPIF inflation when energy prices are excluded, is "some good news".

According to this measure, inflation fell to 2.9 percent in August, compared to 3.2 percent in July. This is an important measure that the Swedish Central Bank also looks at.

Alexandra Stråberg, chief economist at Länsförsäkringar, says at the same time that today's figure now means that the rate cut will have to wait.

We have been weighing between September and November and now we believe in November. This is not a real cold shower, but it is still too high inflation, she says.

Swedbank's chief economist Mattias Persson is sticking to his previous assessment of two rate cuts in the autumn. Even if the direction is not crystal clear, the underlying inflation still indicates that the price increase rate is on its way down.

"The Swedish Central Bank should cut"

Our assessment is that it will continue down in September and that inflation is now on its way down towards the target. And then the Swedish Central Bank should cut in September and November, says Persson.

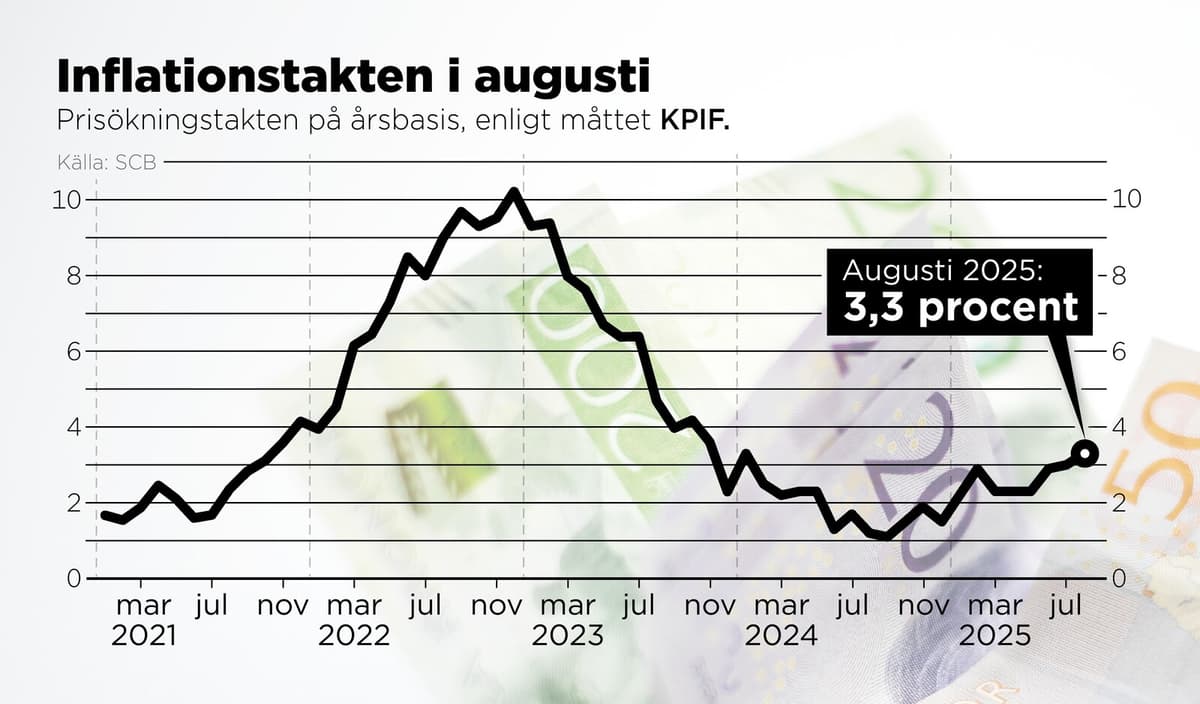

The average forecast among analysts was a KPIF inflation in August of 3.2 percent, according to a compilation of forecasts made by Bloomberg. In July, the KPIF inflation was 3.0 percent, according to SCB.

Far too high

For the Swedish Central Bank, it becomes a tricky situation.

Today's interest rate level is far too high, says Stråberg regarding the opportunities to get the Swedish economy going.

Despite today's inflation outcome, the Swedish Central Bank will need to cut before the turn of the year, she continues.

The Swedish Central Bank's target is a KPIF inflation - where mortgage interest rate effects have been excluded - of 2.0 percent.

Ordinary inflation figures will come in a week.