The weak pressure on prices in the Swedish economy, as confirmed by SCB's so-called quick-CPI for September, opens up for a so-called double rate cut by the Swedish Central Bank in a few weeks. This is something that most analysts also count on.

Inflation is not a concern for the Swedish Central Bank now, as I see it, we have an altogether too tight monetary policy, says Mattias Persson.

"Inflation under control"

He expects the Swedish Central Bank to continue cutting the interest rate in December and thereafter relatively quickly down to 2.00 percent in 2025. The interest rate is currently at 3.25 percent after three rate cuts earlier this year.

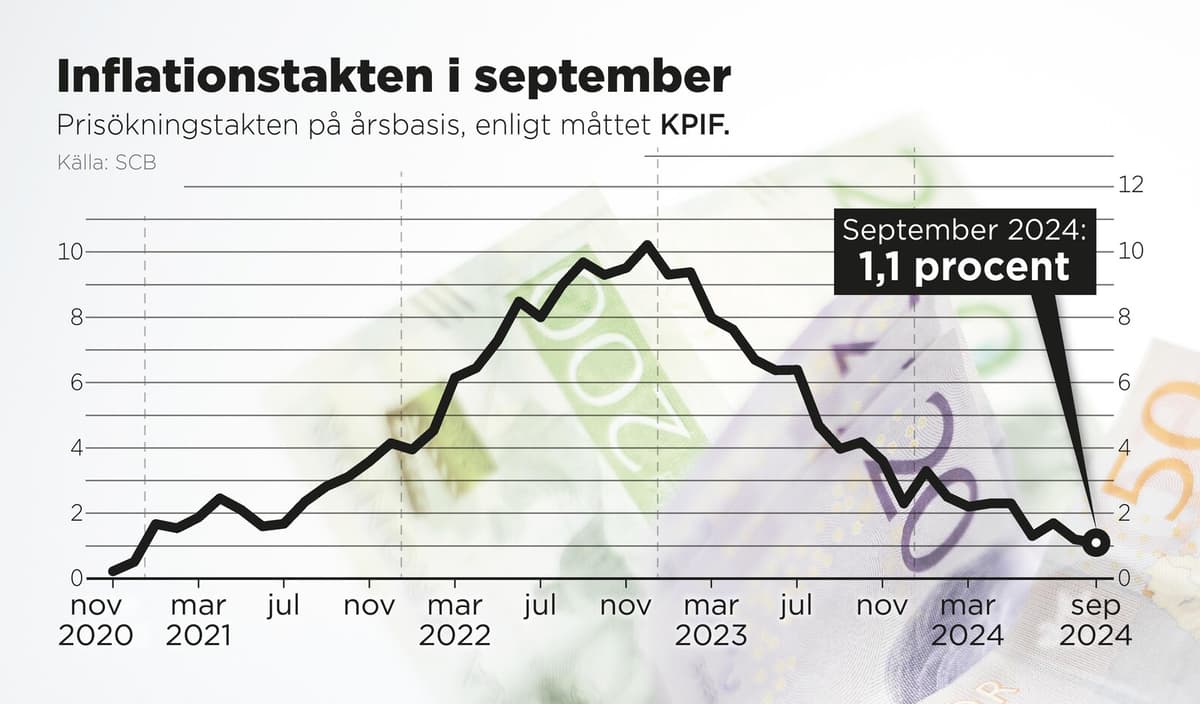

While the KPIF inflation for the fourth month in a row falls below the Swedish Central Bank's target of 2.0 percent – and is now at its lowest level since February 2020 – the underlying inflation, where energy prices are excluded, has also fallen back to 2.0 percent.

The CPI inflation, where SCB includes all price data – including mortgage rates – fell to 1.6 percent in September, down from 1.9 percent in August.

Torbjörn Isaksson, chief analyst at Nordea, says that Tuesday's inflation figures are roughly in line with the bank's forecasts.

The big picture is that inflation is under control. This does not change anything decisive for the Swedish Central Bank, he says.

"Domestic consumption is weak"

Nordea's assessment is that the Swedish Central Bank will cut the interest rate by 0.50 percentage points in November and 0.25 percentage points in December, so that the interest rate lands at 2.50 at the turn of the year.

The Swedish Central Bank is concerned that domestic consumption is weak and that the labor market is fragile. This is a reason for them to want to speed up to boost the mood among households and companies, he says.

Swedish market rates and the krona barely moved after SCB's inflation figures.

Corrected: An earlier version contained an incorrect KPIF figure.

The preliminary inflation figures for September from Statistics Sweden (SCB) come five working days before the regular inflation report on October 17. It is the first time SCB is presenting a so-called quick-CPI.

The quick-CPI lacks specific information on price developments for different commodity groups and sectors, which will be included as usual in the regular report in a week.

The tradition of presenting preliminary inflation figures reflects how it looks in the eurozone, where the statistical office Eurostat already presents a calculation of inflation for the month at the end of each month.