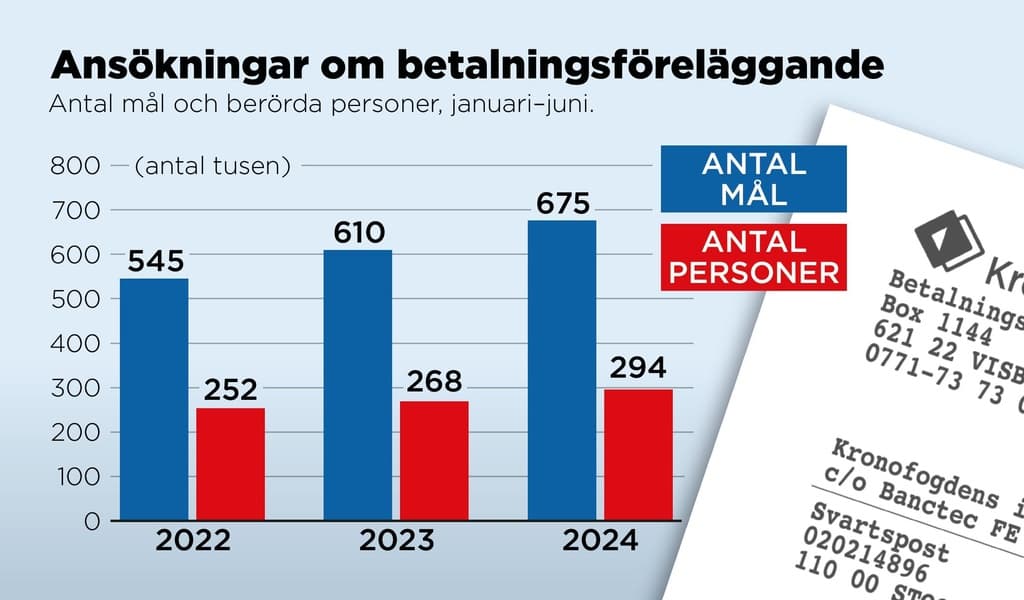

During the first half of 2024, the authority received more than 676,000 applications for payment orders – i.e. claims for unpaid invoices, bills, and loan instalments.

This is an increase of eleven percent compared to the same period last year. Over two years, the number has increased by 24 percent.

We have been warning about this for several years, both that the number of claims and the debt amount are increasing, says Davor Vuleta at the Enforcement Authority.

During the first six months of the year, the total amount of claims has risen to 18.4 billion kronor – an increase of 70 percent over two years.

The amounts have increased in all age groups, but most among those over 65.

Over two years, the amount has doubled, and there are explanations for this. They cannot increase their income, pensions have not developed as quickly as, for example, food prices, while inflation and interest rates have risen.

"A chain reaction"

According to Davor Vuleta, it is, on the other hand, gratifying that the total debt amount is holding steady at around the same level for the youngest, 18-25 years old.

We want to prevent people from starting their lives with a payment remark.

Besides affecting individuals, unpaid debts also hit companies that miss out on payments.

When more and more companies do not get paid, there is a risk of a negative chain reaction. There are small businesses that are dependent on these funds or a small landlord who is dependent on rents.

The entire chain means that there is less purchasing power in society, he adds.

"Will take time"

In recent years, tough economic conditions have led more people to live beyond their means, and it will take time before debt levels decrease.

Even if things get a little better in society, we at the Enforcement Authority will not see it yet. It takes time before it turns around for us. We will see a small increase until 2024 and then hope that it decreases again.

How can one then reverse this negative trend? Partly, the individual must take greater responsibility for their economy, and partly, companies that provide loans and credits must take their responsibility and conduct better credit checks.

We cannot continue as if we were not in an economic crisis, says Davor Vuleta.

Corrected: In an earlier version, there was an error regarding the total debt amount.